- Analyzed Investing

- Posts

- When "Historic" Collapses Become Routine: Silver's Second 30% Wipeout in Five Days

When "Historic" Collapses Become Routine: Silver's Second 30% Wipeout in Five Days

Wall Street's celebrating rotation into "boring" sectors while precious metals implode again, software gets a death sentence, and the Fed chair pick everyone said wouldn't rattle markets just triggered the biggest precious metals crash since 1980. Twice.

February 6, 2025

When Markets Break Twice in the Same Week

Another Friday, another historic crash. Another Tuesday, another "positioning reset." By Thursday? Silver was down another 18%, erasing its two-day "recovery."

Welcome to the new normal, where silver collapses 31% in a single session, bounces 10% the next day while analysts proclaim "the investment case remains intact," then plunges 18% again three days later because apparently nobody found the floor the first time.

The official narrative? Kevin Warsh's Fed chair nomination was a non-event. "Markets won't care," they said. "He's credible," they said. The reality? Gold fell 11.37% on January 30th—its worst day since 1980. Silver cratered 31.35%—its worst closing decline since March 1980.

But here's what Wall Street isn't telling you: this wasn't just about Warsh. This was about a market so grotesquely overleveraged, so crowded with bullish options, so juiced on gamma squeeze mechanics that it took exactly one headline to trigger a liquidation cascade that wiped out months of gains in hours.

Deutsche Bank tried to spin it: "Investor intentions haven't changed for the worse." Tell that to the iShares Silver Trust, which posted over $40 billion in trading volume on Friday—more than Apple and Amazon combined. That's not "positioning reset." That's panic.

And then it happened again. By Thursday, spot silver plunged another 18% to below $73. Turns out the "floor" everyone found on Tuesday was just another trapdoor.

Gold's down 21% from its all-time high. Silver's off 41%. And the same analysts who said "this is the buying opportunity" on Monday are now saying "brace for continued roller-coaster action."

Translation: Nobody knows where this ends.

Software's Slow-Motion Extinction Event

While precious metals were busy imploding twice, software stocks entered their own death spiral—only this one's playing out in slow motion, and somehow that makes it worse.

ServiceNow crashed to $109, down from $239 at its peak. Adobe? Back to April 2020 levels, erasing every penny of pandemic gains. Microsoft shed $360 billion in market cap in a single day. The iShares Software ETF (IGV) is down 22% from its highs, officially in bear market territory.

The narrative? "AI agents will kill SaaS." Anthropic just rolled out legal tools. The market's pricing in total obsolescence.

But here's the actual story nobody's saying out loud: AI isn't killing software. Budget reallocation is. Meta's spending $135 billion on AI capex this year. Microsoft's dropping $75 billion. Hyperscalers will burn through $470+ billion on AI infrastructure in 2026.

That money's coming from somewhere. And "somewhere" is every Salesforce seat expansion, every ServiceNow module add-on, every software renewal that's getting delayed while CIOs figure out if they can replace it with Claude or cut headcount to fund their AI transformation.

Hedge funds made $24 billion shorting software stocks in January alone. And they're increasing their bets, targeting companies offering "basic automation services" that could be replicated by AI.

The thing is… Earnings haven't collapsed yet. Wall Street's just paying less for them. That's not disruption. That's a valuation reset pricing in future disruption that may or may not happen.

The Rotation Everyone's Celebrating (While Missing the Point)

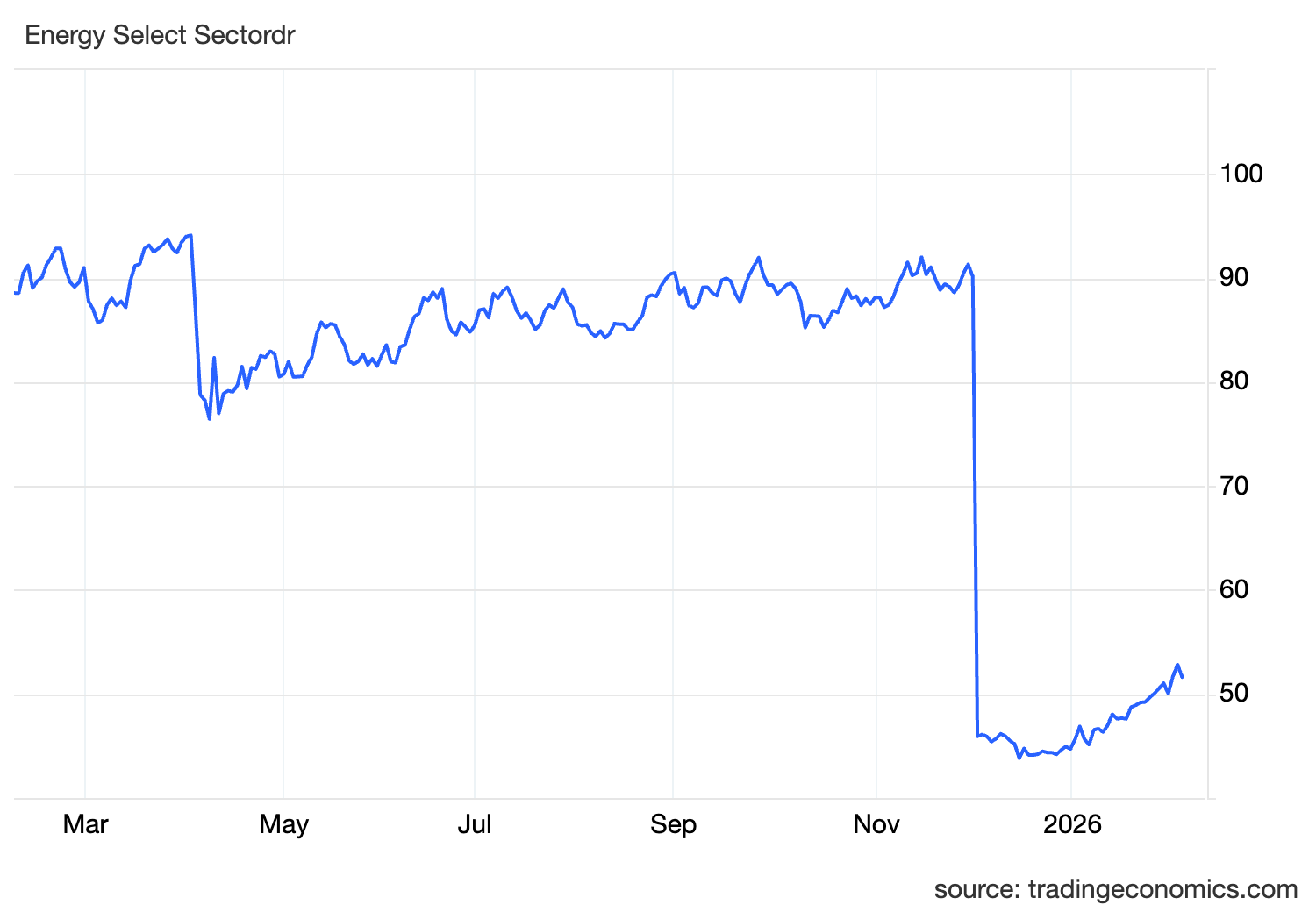

Here's what's quietly happening while everyone panics about precious metals and software: Energy just hit all-time highs for the first time since the Great Financial Crisis.

Let that sink in. XLE has gone nowhere for 16 years. Now it's at record levels while tech hemorrhages.

The narrative: "Healthy rotation! Market's broadening!"

The reality: Money's not leaving equities—it's fleeing growth narratives that depended on endless rate cuts and AI hype cycles. Energy led January with healthcare right behind it, while tech, software, and financials all closed lower.

This isn't rotation. It's re-pricing.

The steepening yield curve everyone said would favor value stocks? It's happening. But it's also exposing how fragile the growth trade became. When ServiceNow beats earnings for the ninth straight quarter and drops 10% anyway, that's not about fundamentals. That's about investors realizing the multiple they paid assumed infinite growth in a zero-rate world.

Strategy Spotlight: Quiver Analyst Buys

In a market where consensus is wrong twice before breakfast and Wall Street's paying for yesterday's narratives with tomorrow's valuations, filtering signal from noise matters more than ever. Surmount's Quiver Analyst Buys strategy approaches this problem differently: instead of treating all analyst opinions equally, it weights forecasts based on each analyst's actual track record.

Here's how it works: Quiver's proprietary scoring method rates Wall Street analysts based on the historical accuracy of their price targets. Analysts with proven forecasting success get higher weights. Analysts with poor track records? Lower weights—or in some cases, negative weights that actively fade their recommendations.

The strategy then aggregates all analyst forecasts made over the past year, calculates weighted average price targets for every ticker, identifies the top 100 scores, and narrows to the 10 largest by market cap to avoid stocks with sparse coverage. These 10 positions are held equal-weighted and rebalanced monthly.

This isn't about blindly following Wall Street. It's about systematically identifying which analysts have actually been right when it mattered, then following those voices while tuning out the perennially wrong. In an environment where software analysts were still bullish while valuations collapsed 50% and precious metals bulls failed to spot two historic crashes in five days, separating skill from noise has real value.

Of course, even the best analysts get things wrong, and past accuracy doesn't guarantee future performance. But when everyone's got an opinion and most of them are garbage, a systematic approach to identifying who's been consistently less wrong can provide an edge that matters.

What's Actually Happening

Strip away the headlines, and this week's telling you three things:

First: Leverage kills. When silver can drop 31%, bounce 10%, then drop 18% again—all in five days—that's not fundamentals. That's forced liquidation in a market with no natural buyers left.

Second: Narratives are repricing faster than earnings. Software's getting destroyed not because profits collapsed, but because Wall Street decided the future profits aren't worth today's multiples. That's a sentiment shift, not a business collapse. And sentiment shifts can reverse. Or accelerate.

Third: The Fed chair pick everyone said wouldn't matter? It mattered. Not because Warsh is hawkish or dovish, but because it forced everyone to reevaluate what "haven" even means when the central bank's independence is explicitly in question.

Watch credit markets. Watch whether commodities breadth is actually broadening beyond energy, or if this is just another narrow leadership trade. And watch whether earnings season confirms or contradicts the AI-kills-software thesis. Because right now, the market's pricing in a future that hasn't shown up in the numbers yet.

When "historic" becomes routine, you're not in a healthy correction. You're in a regime change.

Until next week,

Analyzed Investing