- Analyzed Investing

- Posts

- When Bad News Became Good News: Markets Celebrate the Worst Hiring Year Since 2020

When Bad News Became Good News: Markets Celebrate the Worst Hiring Year Since 2020

Wall Street just hit all-time highs after learning December added only 50,000 jobs—capping the weakest labor market in five years. Welcome to 2026, where economic weakness is the new bull thesis.

January 16, 2026

Wall Street started 2026 by doing what it does best: celebrating disaster with champagne.

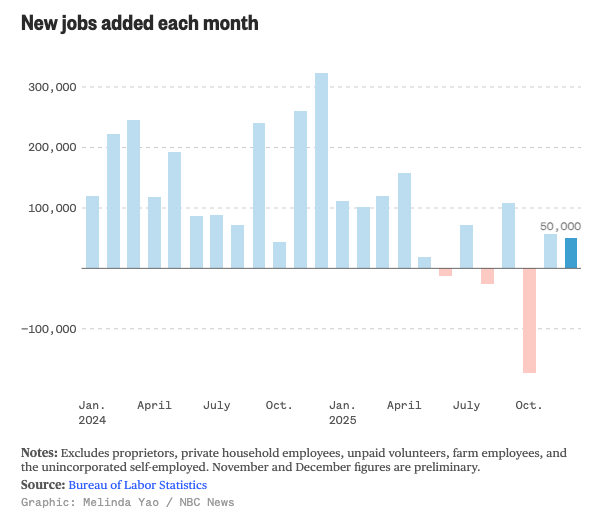

December's jobs report delivered a paltry 50,000 new positions—less than expected, capping off the worst year for hiring since 2020. The Fed quietly admitted it thinks the monthly data has been systematically overstated by 60,000 jobs, meaning payrolls have actually been shrinking by 20,000 per month since April.

The damage in detail:

Manufacturing shed 68,000 positions for the year

Retail cut 25,000 in December alone as companies froze hiring

Just 584,000 jobs created in all of 2025—far below 2+ million in both 2024 and 2023

October and November revised down by 76,000 combined

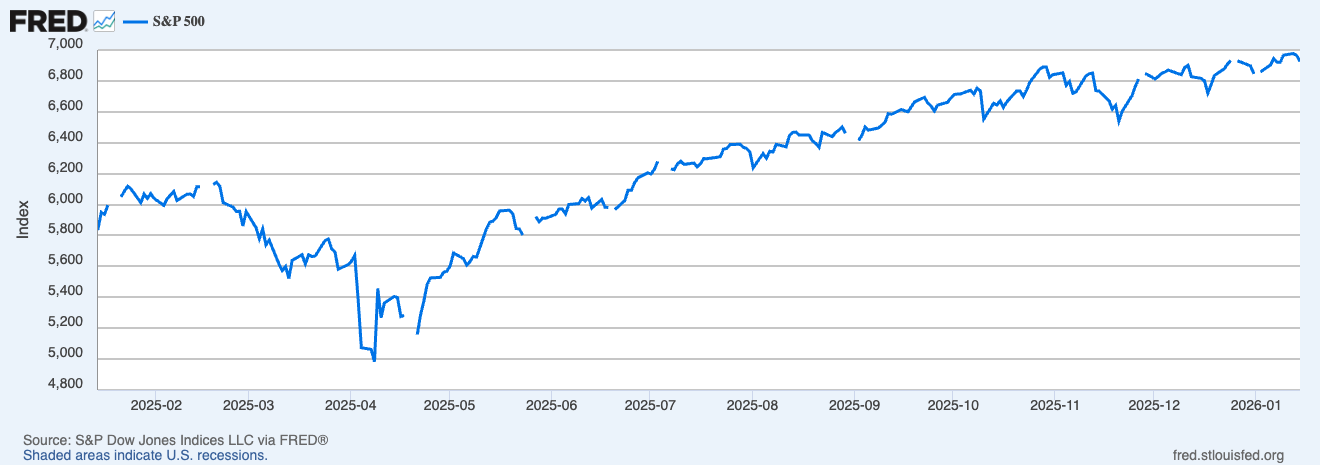

The S&P 500's response? Record highs. The Nasdaq? Up 1%.

Apparently, a labor market in virtual stall mode is exactly what investors wanted to hear. Three years into this rally, we've officially reached peak absurdity: bad news is definitively good news, and everyone's pretending this makes perfect sense.

The "Goldilocks" logic:

Weak jobs mean more Fed cuts

More cuts mean cheaper money

Cheaper money means stocks go up

Not too hot (no hiring surge to spark inflation)

Not too cold (unemployment only ticked to 4.4%)

Just right for risk assets

But here's what nobody wants to discuss: The market's betting the Fed will rescue growth with rate cuts while simultaneously assuming corporate earnings will accelerate 15% this year. Both can't be true—and yet here we are at all-time highs, pricing in perfection.

Become the go-to AI expert in 30 days

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

AI's Achilles Heel: The Memory Crisis Nobody's Pricing

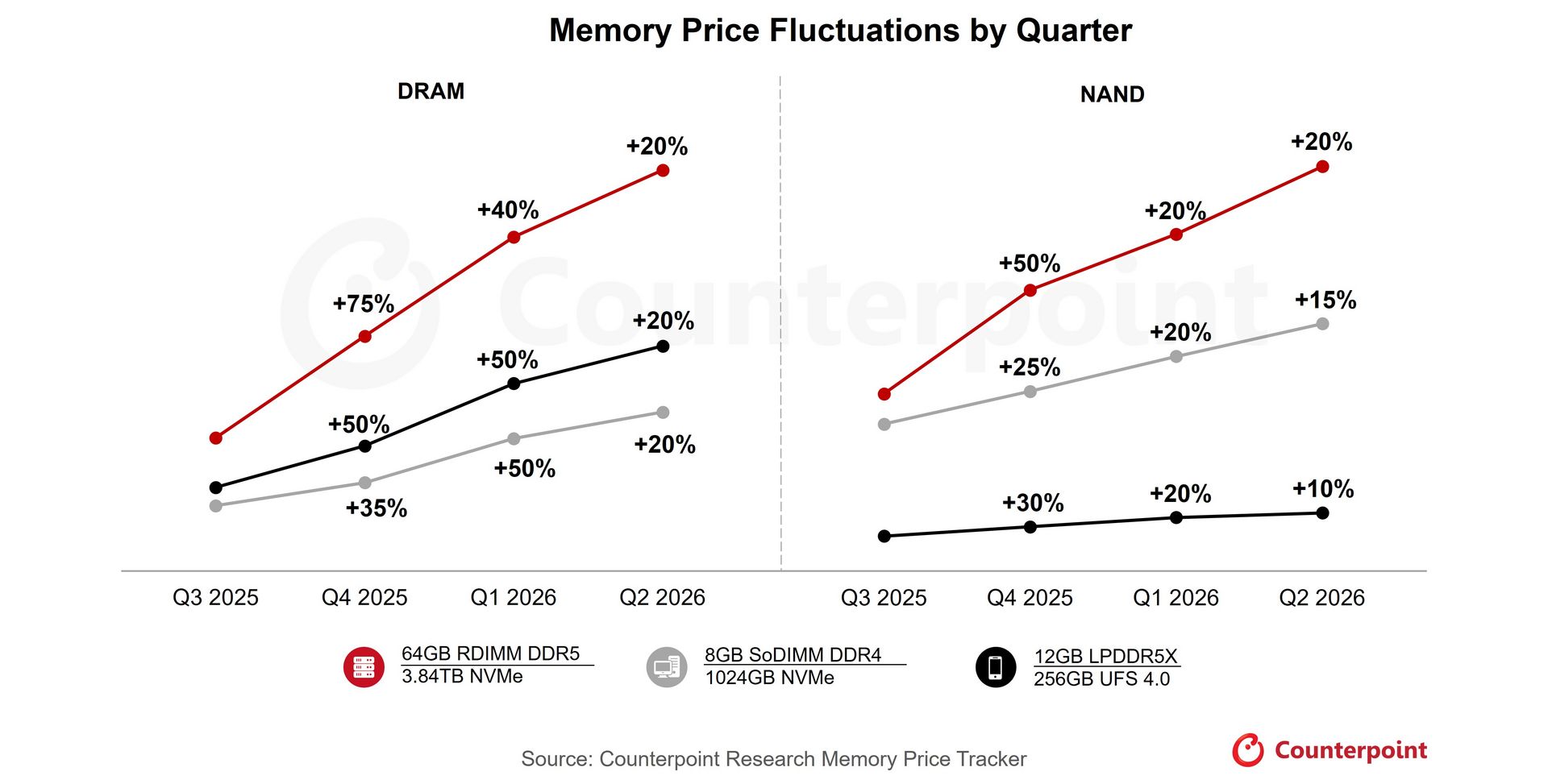

While Wall Street obsesses over whether the Fed cuts once or twice in 2026, a structural supply crisis is quietly threatening the entire AI infrastructure buildout—and it's got nothing to do with GPUs.

High-bandwidth memory (HBM) is completely sold out through 2026. Not "tight"—gone. Micron, SK Hynix, and Samsung have zero capacity left. Every wafer, every package, every chip has been claimed by hyperscalers desperate to feed AI data centers.

DDR4 memory prices surge globally

The supply crunch in numbers:

Producing 1GB of HBM requires 4x the wafer capacity of standard DDR5 memory

By 2026, AI will consume nearly 20% of global DRAM production (equivalent wafer usage basis)

Memory manufacturers aren't expanding capacity fast enough—they're just reallocating everything toward AI

Price explosion:

Contract prices for DRAM jumped 170% year-over-year in Q3 2025

TrendForce projects another 50-55% price surge this quarter

Lead analyst called pace "unprecedented"

Real-world consequences:

NVIDIA is cutting gaming GPU production by 30-40% in H1 2026

Micron discontinued its entire Crucial consumer brand to free up capacity for "strategic accounts" (read: AI)

Dell plans price hikes of hundreds of dollars

IDC expects PC shipments to decline 4.9% in 2026 as memory costs balloon

Xiaomi warned prices for smartphones could rise 25% just from DRAM expense per device

The timeline problem:

Samsung and SK Hynix's new fabs won't come online until 2027-2028

OpenAI and Microsoft's Project Stargate committed to 900,000 DRAM wafer starts per month—roughly 35-40% of global capacity

These are multi-year contracts with fixed volumes

No "surge production" coming to save consumer markets

Wall Street keeps cheering every AI infrastructure announcement—more data centers! More CapEx! More growth!—without asking the obvious question: what happens when the physical constraints actually bite?

The memory shortage isn't a speed bump. It's a structural reallocation that could last into 2027 or 2028, and it's already forcing cuts to consumer tech production while AI companies hoard supply at any cost.

JPMorgan's "Expense Shock" Reveals the Real Cost of the AI Arms Race

Speaking of costs, JPMorgan just gave Wall Street a preview of what happens when the AI spending spree collides with reality.

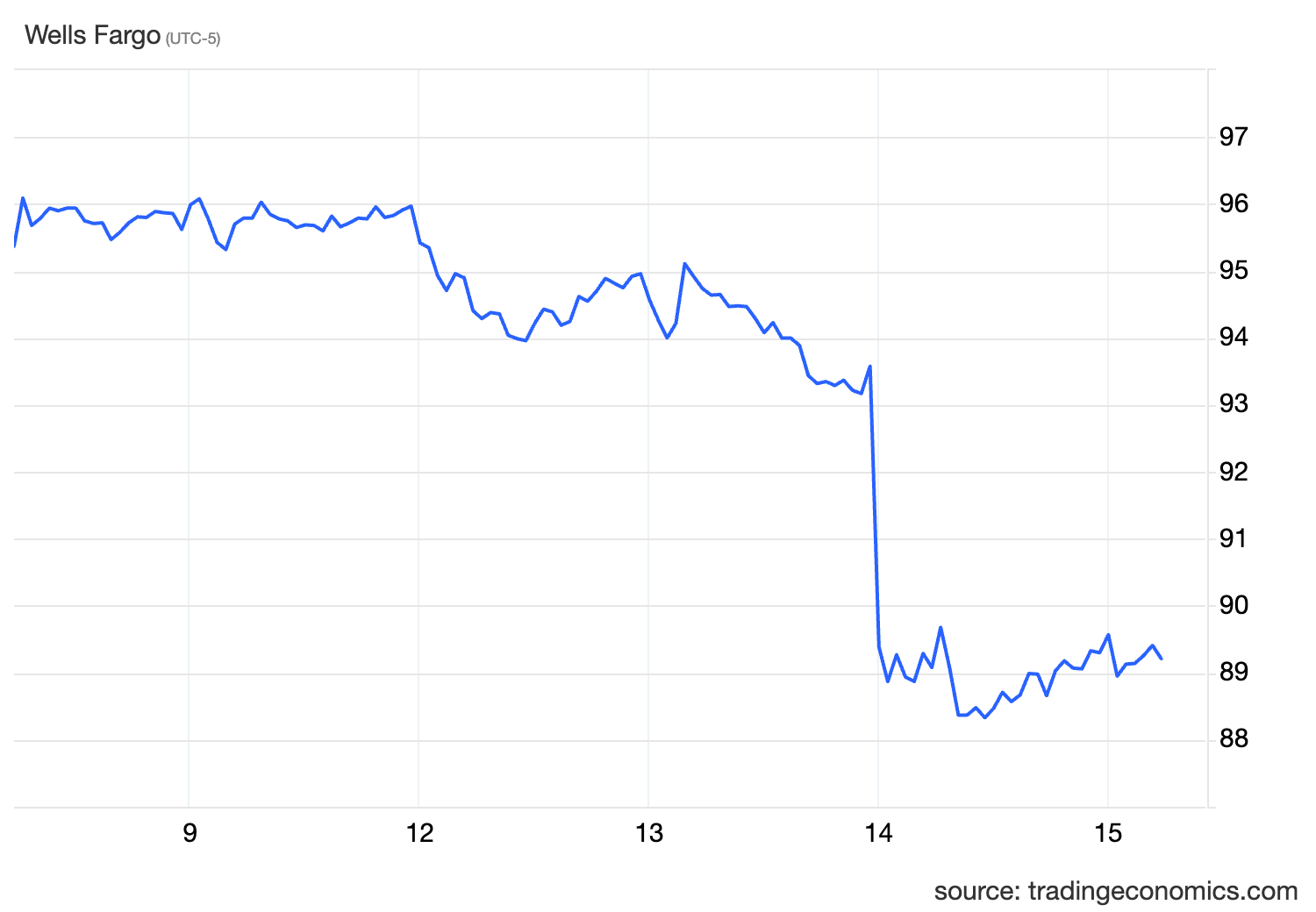

Despite beating Q4 earnings estimates, the stock dropped 4% intraday after management issued:

Conservative 2026 guidance

"Surprisingly high expense budget"

Projected $95 billion in expenses for 2026

J.P. Morgan Chase (USD) - 1W

The culprit: Massive spending on AI infrastructure and technology, even if it hammers near-term margins.

What this means:

The era of easy earnings growth driven by high interest rates is over

As the Fed cuts deeper, banks face shrinking net interest income and exploding technology costs

Jamie Dimon is sacrificing profitability today to win the AI infrastructure war tomorrow

Every major bank will face the same choice: spend aggressively or fall behind permanently

Collateral damage:

Wells Fargo tumbled 4% on its earnings miss, looking increasingly vulnerable

The banking sector is now in a profitability squeeze

Rates are falling, but the technology arms race demands billions in CapEx

That's not the backdrop for multiple expansion

Wells Fargo (USD) - 1W

What Happens When the "Soft Landing" Is Actually Stagflation Lite?

Let's recap where we actually are:

The labor market reality:

Manufacturing shed 68,000 jobs in 2025

The Fed admitted job creation overstated by 60,000 per month

Wage growth for job changers accelerated to 6.6%, keeping inflation sticky

The cost pressure reality:

Memory prices surging 50%+ per quarter

Corporate expenses exploding (JPMorgan signals this)

AI infrastructure spending accelerating despite physical constraints

The valuation reality:

Markets hit record highs because... the Fed might cut rates twice?

S&P 500 trading at 22x forward earnings

Bank of America's sentiment gauge flashing "excessive bullishness"

Leveraged fund positioning in small caps at 94th percentile

The logical impossibility:

The "soft landing" narrative requires you to believe:

Weakening economic activity will coincide with 15% earnings growth

Sustained AI infrastructure spending can continue despite memory crisis

No credit stress despite rates staying higher for longer

Collapsing labor market is bullish and corporate profits will accelerate

Rising input costs + slowing demand = margin expansion

More likely? We're entering a phase where growth disappoints while costs stay elevated—a kind of stagflation lite that breaks the "bad news is good news" logic the market's been riding since 2023.

Strategy Spotlight: Recession Resistant

For investors who aren't buying the "Goldilocks" narrative—who see a labor market in serious deterioration, sticky inflation, and elevated valuations colliding with slowing growth—Recession Resistant offers a disciplined alternative.

Rather than chasing momentum into increasingly crowded cyclical trades, this strategy systematically allocates to defensive stocks that have historically demonstrated resilience during economic downturns:

Consumer staples

Healthcare

Utilities

Essential retail

The approach:

Recognizes that when consumers pull back and businesses freeze hiring, spending shifts toward necessities

Rebalances approximately every 30 days

Maintains diversification across sectors less sensitive to economic fluctuations

Designed for environments where growth disappoints while the Fed's ability to rescue markets remains constrained by persistent inflation

Closing Notes

Markets are priced for perfection at exactly the moment when cracks are appearing everywhere:

The contradictions:

Worst labor market in five years gets cheered because it might produce Fed cuts

AI infrastructure spending accelerates into a memory supply crisis that won't resolve for two years

Banks warn about exploding expenses just as rate cuts threaten their margins

Everyone's positioned for a "reacceleration" in growth that the actual economic data refuses to confirm

The problem with "bad news is good news":

It only works until bad news actually becomes bad news. Watch what happens when:

Q1 earnings guidance comes in cautious

Memory shortage starts forcing AI infrastructure delays

Credit stress emerges from a labor market that's been deteriorating for nine straight months

The market's celebrating job losses because it assumes the Fed will save everything. That's not a bull case—it's a prayer.

Until next week,

Analyzed Investing