- Analyzed Investing

- Posts

- The Powell Pivot, the AI Reckoning, and the Consumer Who Stopped Believing

The Powell Pivot, the AI Reckoning, and the Consumer Who Stopped Believing

Markets rally on rate-cut hopes while AI valuations crack and Americans sour on everything. Welcome to the final month of 2025's make-believe economy.

We've upgraded our infrastructure: analyzedinvesting.framer.website is now home. Your Friday newsletter isn't going anywhere, but now you've got a proper archive of every contrarian call we've made.

Invest in Renewable Energy Projects Across America

Across America, communities are being powered thanks to investors on Climatize who have committed to a brighter future.

Climatize lists vetted renewable energy investment offerings in different states.

As of November 2025, over $13.2 million has been invested across 28 projects on the platform, and over $3.6 million has already been returned to our growing community of thousands of members. Returns aren’t guaranteed, and past performance does not predict future results.

On Climatize, you can explore vetted clean energy offerings, including past projects like solar farms in Tennessee, grid-scale battery storage units in New York, and EV chargers in California. Each offering is reviewed for transparency and provides a clear view of how clean energy takes shape.

Investors can access clean energy projects from $10 through Climatize. Through Climatize, you can see and hear about the end impact of your money in our POWERED by Climatize stories.

Climatize is an SEC-registered & FINRA member funding portal. Crowdfunding carries risk, including loss.

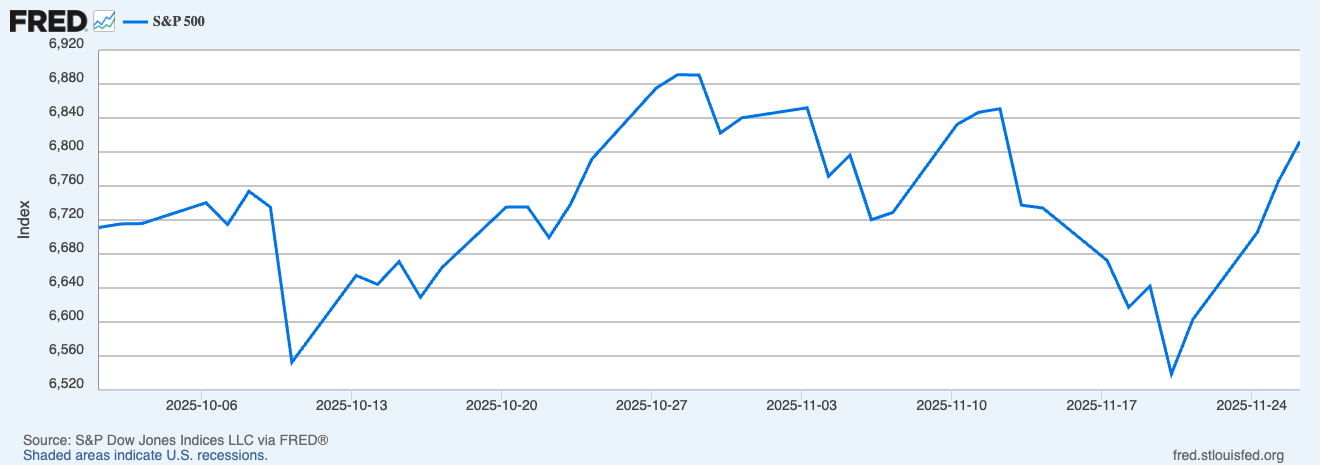

The Week the Market Remembered Fear Exists

Thanksgiving week gave us a three-day rally that felt less like conviction and more like muscle memory—markets bouncing because that's what they're supposed to do when Fed officials hint at easier money. The S&P 500 climbed back above 6,700 after testing its 100-day moving average earlier in the week, while the Nasdaq staged its best day since May. But strip away the holiday-thinned volume and you're left with a market that's essentially flat for November, nursing a 2% monthly loss while desperately clinging to the idea that the Fed will save it in December.

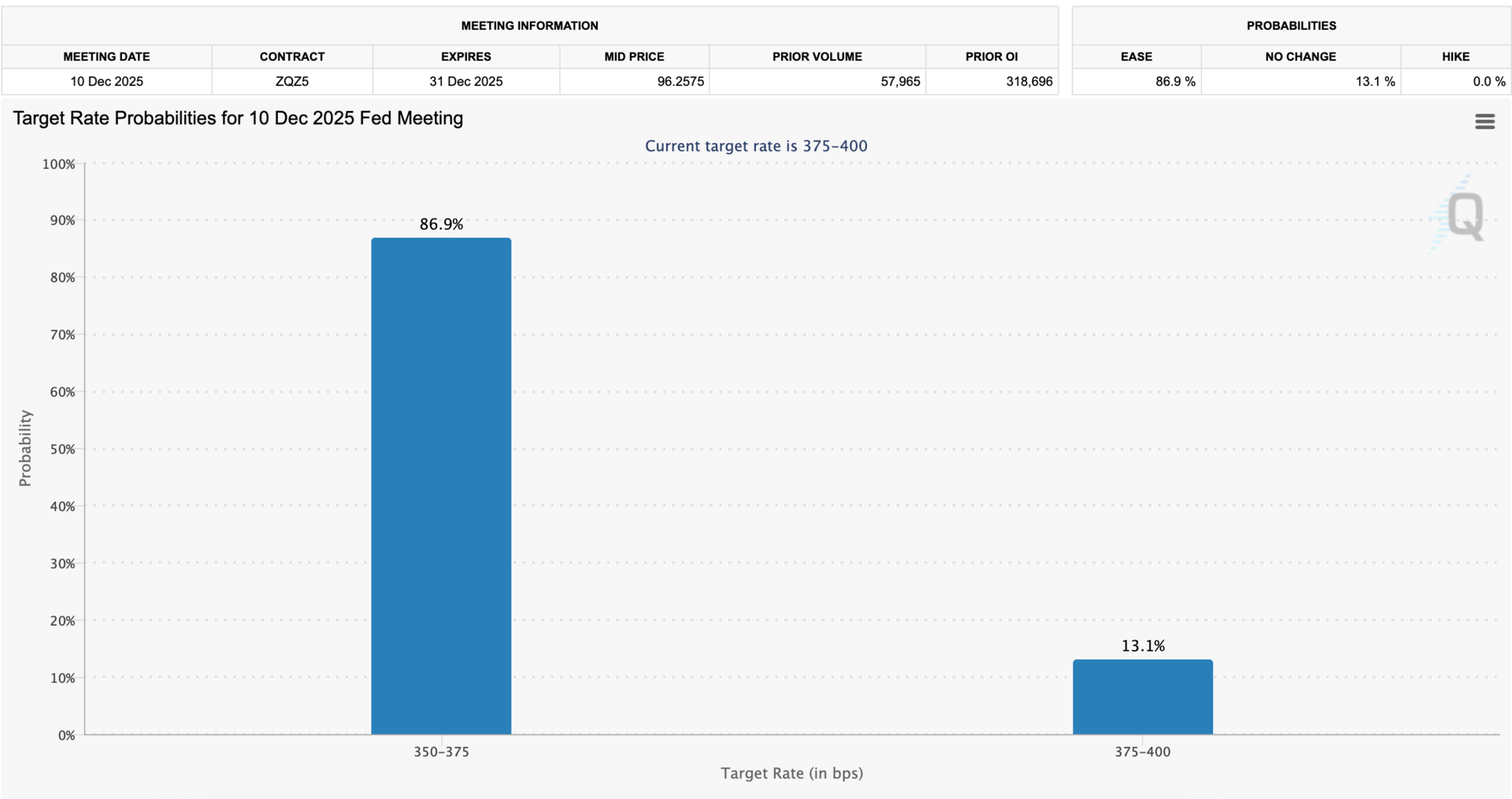

New York Fed President John Williams gave the market what it wanted on Friday, suggesting there's still "room for further adjustment" to rates. Translation: we're cutting in December, probably. Markets responded like Pavlov's dogs, with odds of a 25-basis-point cut jumping from 42% to over 80% in a matter of days. The CME FedWatch tool now prices in an 82% probability of a cut at the December 9-10 meeting.

Here's what's fascinating: just two weeks ago, markets had written off a December cut entirely after delayed September jobs data showed 119,000 positions added—more than double expectations. But unemployment ticked up to 4.2%, and that was enough for the Fed's dovish wing to override the hawkish holdouts worried about tariff-driven inflation that's already adding 0.4-0.5 percentage points to core PCE.

The Powell Put is back, baby. Whether the economy needs it or deserves it is apparently beside the point.

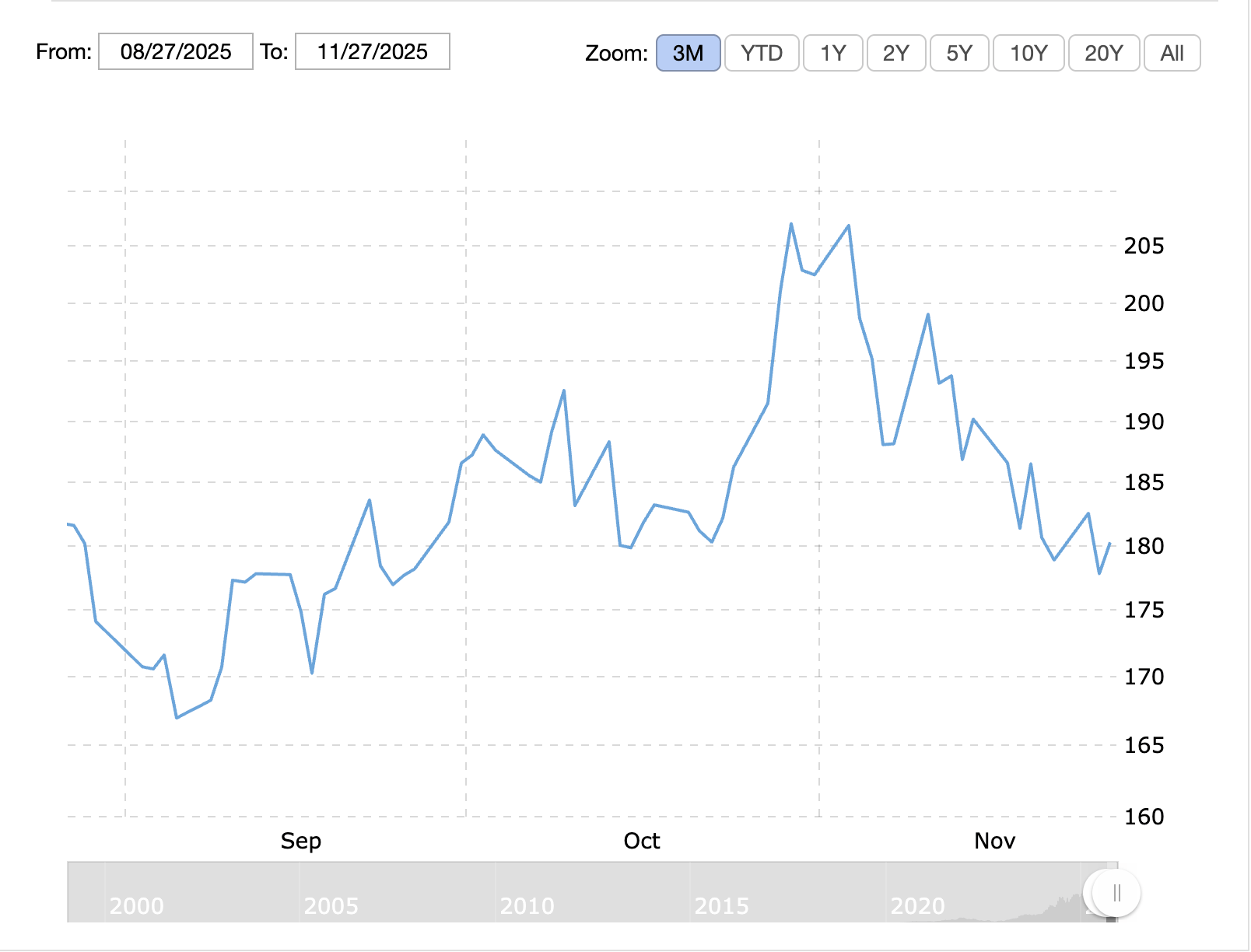

AI's Reality Check: When $5 Trillion Meets $0 Earnings

While the market was busy front-running the Fed, artificial intelligence stocks spent the week getting reacquainted with gravity. Nvidia—the poster child for this entire AI infrastructure boom—closed down nearly 3% on Thursday despite beating earnings and guiding higher for Q4. The chip giant reported 62% revenue growth to $57 billion and promised another strong quarter ahead, but markets yawned. Worse, they sold.

The problem? Reports that Meta is considering Google's TPU chips for 2027 data center needs sent Nvidia tumbling 4% in a single day, while Alphabet rallied. It's not that Nvidia is losing its dominance—it's that markets are finally waking up to the fact that customer concentration and circular financing don't exactly scream "sustainable moat."

The broader AI complex is showing cracks everywhere you look. Bank of America's latest fund manager survey found 45% of asset allocators now identify an "AI bubble" as the biggest tail risk, up from 33% just a month ago. Meanwhile, 53% believe AI stocks are already in bubble territory. When Peter Thiel's hedge fund dumps its entire $100 million Nvidia stake and Michael Burry goes short, maybe it's time to check the exits.

The math is getting harder to defend. Analysts estimate 15-25% of the S&P 500's value can be attributed to AI expectations—that's 800 to 1,300 index points betting on a future that hasn't arrived yet. Companies are issuing $141 billion in AI-related debt this year, eclipsing 2024's full-year total. And underneath it all sits a web of circular investments where Nvidia funds OpenAI to buy Nvidia chips, while Meta uses special purpose vehicles to keep $27 billion in data center debt off its balance sheet.

Sound familiar? It should. We've been here before, with fiber optics in 2000 and mortgage-backed securities in 2007. The difference is that this time, the AI bulls insist "it's different" because the technology actually works. Sure. The railroads worked too—that didn't stop most railroad investors from getting wiped out.

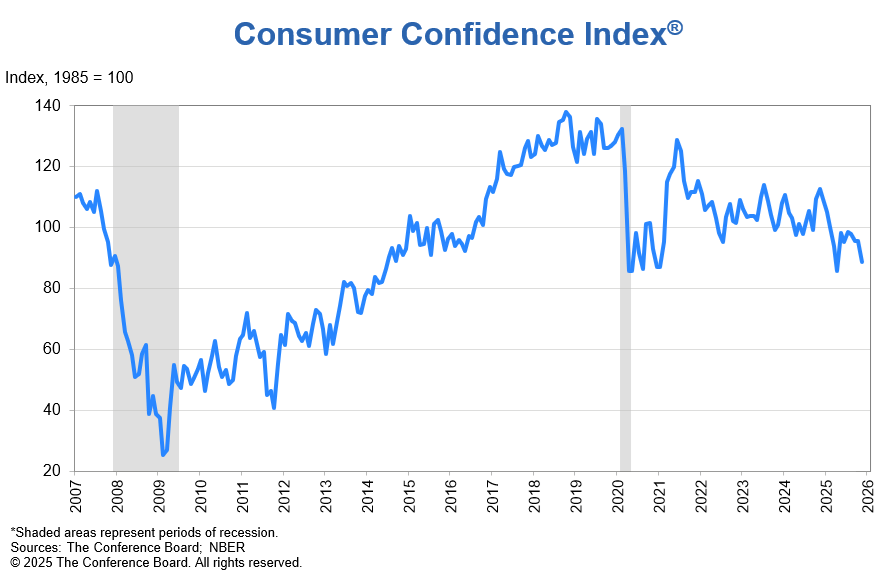

The Consumer Capitulation: When America Stops Believing

And then there's the consumer, who after two years of being told the economy is fine, has finally decided to stop pretending. Consumer confidence crashed in November, with the Conference Board's index plunging 6.8 points to 88.7—the lowest reading since April when tariff fears first spooked markets. The expectations component, which asks Americans about the next six months, dropped to 63.2. That's below 80 for ten consecutive months, a level that historically signals recession within a year.

What's crushing confidence? Take your pick. Write-in responses mentioned "prices and inflation, tariffs and trade, and politics" as top concerns. The share of consumers saying jobs are "plentiful" fell to 27.6%, down from 37% a year ago. Meanwhile, 81% of holiday shoppers expect prices to be higher due to tariffs, and 63% say food and grocery costs will force them to change their shopping behavior.

This isn't just vibes. Retail sales slowed in September, and major retailers are slashing guidance. Walmart cut its profit forecast. Target warned of "meaningful pressure" from tariffs. Even Macy's and Best Buy are getting cautious. When the companies that sell stuff to Americans say Americans aren't buying stuff, maybe we should listen.

Yet the White House insists there's no correlation between confidence data and actual consumer spending. "People are going about their lives, getting their paychecks, spending their paychecks," one official told CNBC. Right. Because that worked out so well in 2008 when we ignored warning signs until it was too late.

Strategy Spotlight: Protection When Markets Stop Making Sense

In markets where the Fed's next move drives more price action than fundamentals, and where AI valuations swing wildly on a single headline, static portfolios become sitting ducks. That's where Surmount's AlphaFactory Protective strategy offers a disciplined framework designed for exactly these conditions.

The strategy combines momentum and value signals across a basket of high-quality large-cap stocks while incorporating a defensive mechanism that responds to volatility. The approach tracks SPY's realized volatility to adjust allocations dynamically: full allocation to stocks in calm markets, a balanced mix of equities and gold (GLD) when volatility picks up, and defensive positioning when market stress intensifies.

This isn't about predicting whether the December Fed cut materializes or guessing when AI stocks finally crater. It's about adapting to what markets are actually doing—riding strength when conditions support it, rotating to safety when volatility spikes above historical norms. With the VIX having touched 28 earlier this month and correlation rising across asset classes (everything moving in lockstep with rate expectations), active volatility-based allocation helps navigate regime changes that catch buy-and-hold investors off guard.

The strategy's combination of momentum scoring (12-month returns) and value metrics (PEG ratios) across NASDAQ/NYSE leaders provides exposure to market upside while the gold allocation mechanism acts as built-in protection. It's the kind of systematic risk management that matters when "buy the dip" has morphed from strategy into superstition.

The Big Picture: December's High-Wire Act

So where does this leave us heading into December? With a market that's priced for perfection expecting the Fed to deliver salvation, AI companies burning through capital like it's 1999, and consumers who've stopped believing the "everything is fine" narrative.

The setup is precarious. If the Fed delivers that December cut, markets might rally through year-end on autopilot. But that's a low bar—the real question is what happens in 2026 when economic data either confirms the soft landing or reveals it was always a fantasy. Goldman Sachs and other strategists are already forecasting 10-20% corrections within the next 12-24 months, with AI valuations and slowing growth as the likely catalysts.

Here's the uncomfortable truth: markets are trading on hope, not fundamentals. Hope that the Fed cuts enough to keep things afloat. Hope that AI eventually justifies its trillion-dollar valuations. Hope that consumers keep spending even as they tell everyone they won't.

Hope is not a strategy. December will test whether markets can sustain their make-believe rally, or whether reality finally demands its due. Position accordingly.

— Analyzed Investing

Visit us at analyzedinvesting.framer.website

Disclaimer: This newsletter is provided for informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or any other sort of advice. The content herein represents the opinions and analysis of the authors and should not be considered a recommendation to purchase or sell any security. Surmount and its affiliates are not registered investment advisors. All investments involve risk, including the possible loss of principal. Past performance does not guarantee future results. Before making any investment decisions, you should consult with your own professional advisors and consider your individual financial situation, investment objectives, and risk tolerance. The strategies mentioned are not suitable for all investors.