- Analyzed Investing

- Posts

- The Fog Thickens: Fed Flips, AI Cracks, and Why the Data Drought Changes Everything

The Fog Thickens: Fed Flips, AI Cracks, and Why the Data Drought Changes Everything

After 43 days of darkness, the government reopened—but the Fed just walked back rate cuts, tech bled $820B, and consumer confidence hit near-record lows. Welcome to the new normal.

We Built You A Radar: Analyzed Investing Is Live

The blog is up—and it’s built for people who don’t have time for fluff: https://analyzedinvesting.framer.website/

Think of it as our permanent, noise-canceling feed. The weekly letter is the take; the site is the archive, the methods, and the receipts. You’ll find compact explainers on the macro drivers we reference here, chartbooks you can skim in two minutes, and strategy deep dives you can return to when volatility turns your screen into a strobe light.

The lights are back on in Washington, but the damage is done. After 43 days, the longest government shutdown in American history finally ended Wednesday night when President Trump signed a funding package that kicks the can to January 30th. Federal workers return to mountains of backlogged work, air traffic controllers staff back up after mandated flight cuts, and economists scramble to piece together what actually happened to the economy during October. The White House confirmed Wednesday that some data may never be released—including critical October jobs and inflation reports. Chair Powell compared this to "driving in the fog," and now he's pumping the brakes.

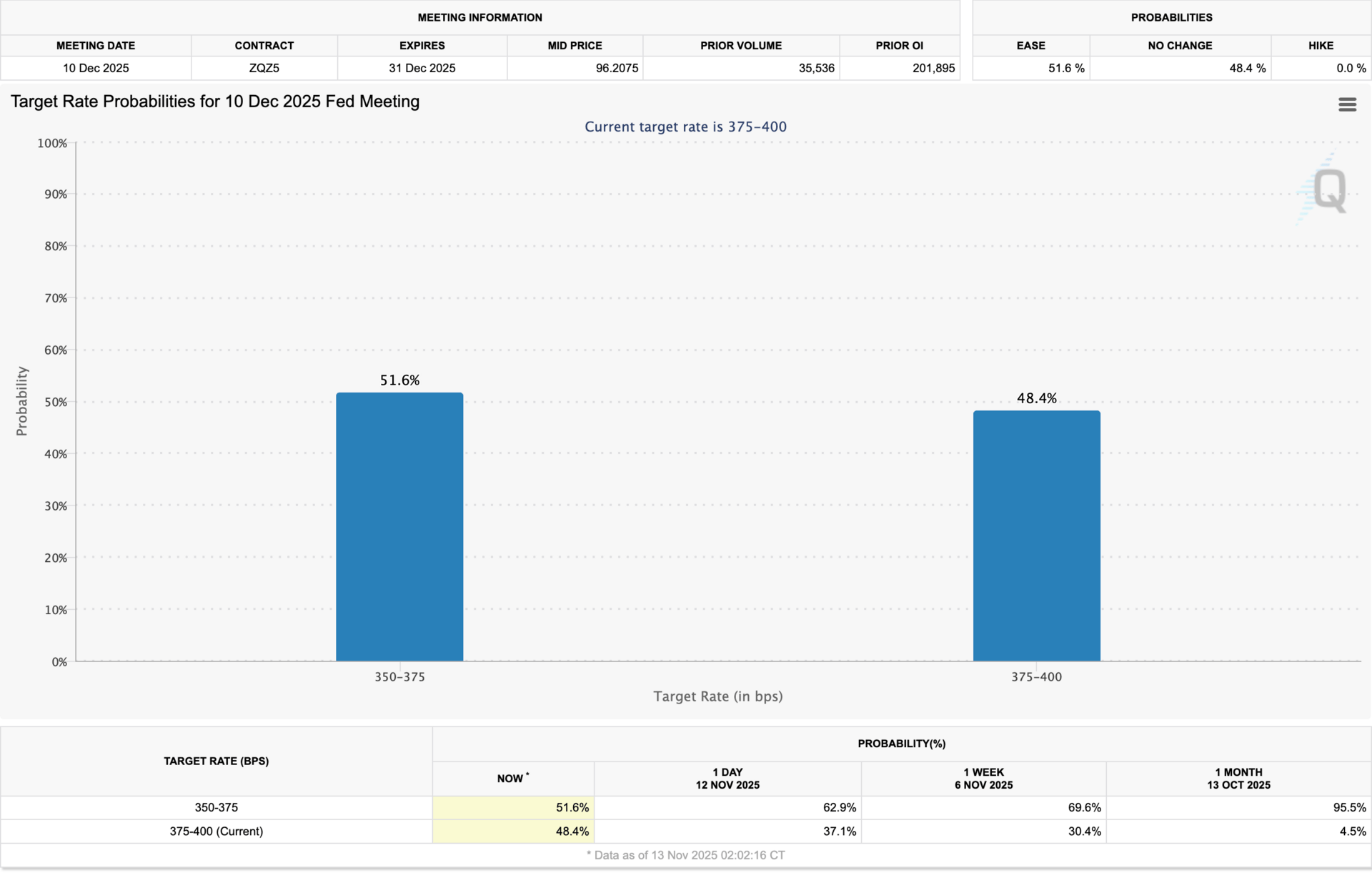

The Fed's Sudden Cold Feet

Two weeks ago, markets were pricing in a 90% probability of a December rate cut. Today? That's flipped to a coin toss—just 49.4% as of Thursday afternoon.

Boston Fed President Susan Collins, a centrist voice who previously supported further easing, dropped the hammer Wednesday:

"Absent evidence of a notable labor market deterioration, I would be hesitant to ease policy further"

Cited "limited information on inflation due to the government shutdown" as a key concern

Shifted from supporting cuts in October to advocating a pause now

Atlanta Fed President Raphael Bostic echoed her concerns:

Businesses plan to raise prices next year

Inflation may not cool anytime soon

"We cannot breezily assume inflationary pressures will quickly dissipate"

Powell finds himself managing deep divisions within the FOMC, caught between hawks demanding a pause and doves who want to keep cutting. The problem? He's flying blind. Without October data, the Fed is guessing. And when central banks guess, markets get nervous.

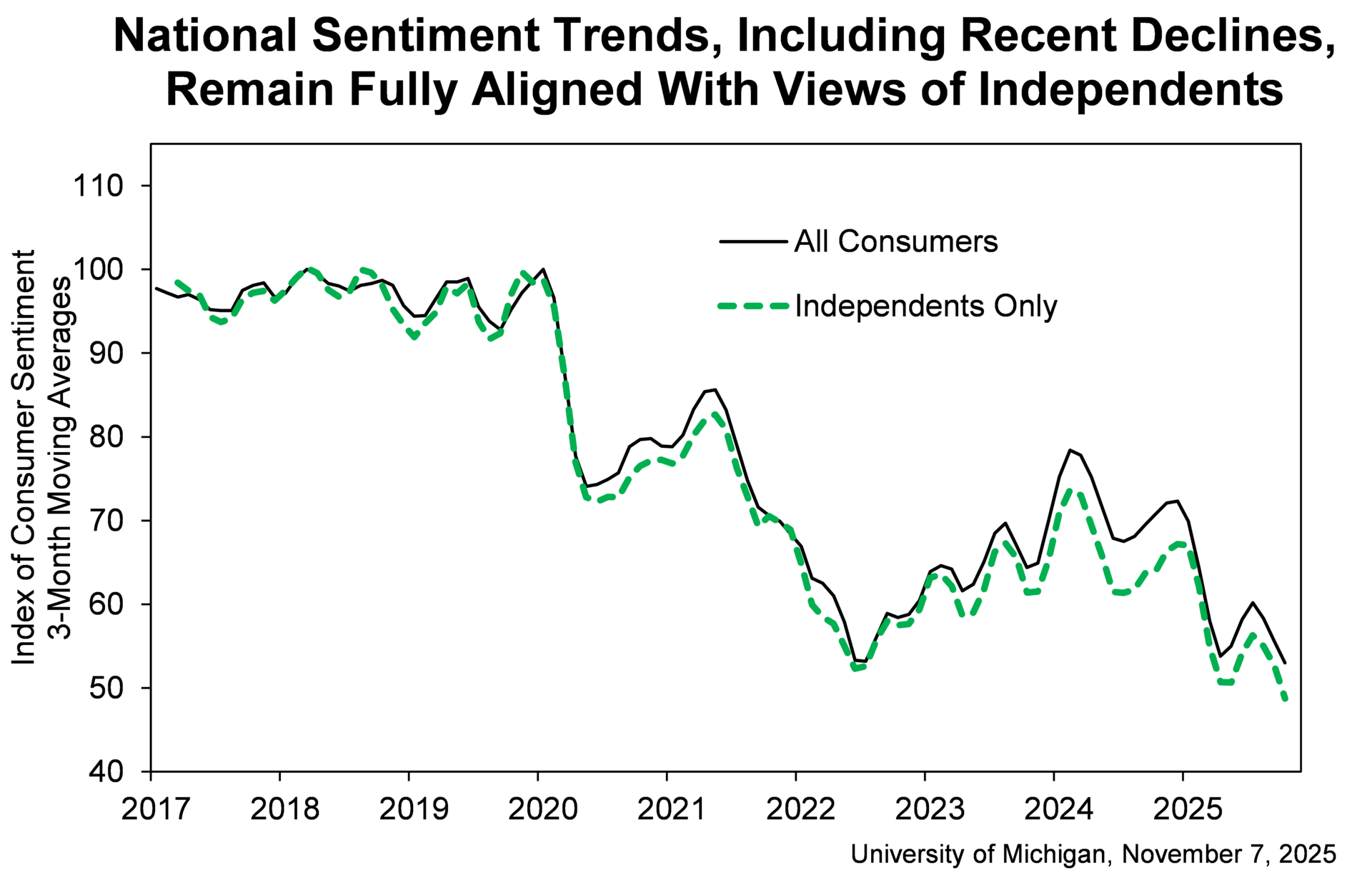

Consumer Confidence Craters

While the Fed debates its next move, American consumers have made their position clear: they're terrified. The University of Michigan's consumer sentiment index plunged to 50.3 in November—the second-lowest reading ever, trailing only June 2022's record low of 50.0.

The damage:

30% collapse from last year

6.2% drop from October alone

Current economic conditions fell to 52.3—the lowest in the index's history

The numbers reveal a K-shaped reality:

Consumers with large stock holdings: sentiment jumped 11% this month, buoyed by equity strength

Everyone else: a net 62% predict higher unemployment ahead—up from 52% last month

Year-ahead inflation expectations: ticked up to 4.7%

Concerns about shutdown consequences: swept across all demographics

This isn't sentiment—it's a warning signal. And it's being ignored.

AI's $820 Billion Reality Check

The tech sector didn't wait for consumer confidence to crater—it got there first. Last week marked the worst weekly decline for tech stocks since April's "Liberation Day" tariff sell-off.

The carnage was brutal:

Microsoft, Nvidia, AMD, Palantir, Oracle, and Meta: collectively wiped out over $820 billion in market value

Nvidia: dropped 7% for the week

Oracle: fell 8.8%

AMD: matched Oracle's decline

Super Micro Computer: plummeted 23%—the week's worst S&P 500 performer

Microsoft: snapped an eight-day losing streak—its longest since 2011

The catalyst? A reality check on "sky-high valuations." After months of euphoric AI-driven gains, investors suddenly remembered that multiples matter. Palantir's strong earnings report triggered a sharp decline anyway, sparking fears of a sector-wide repricing.

What spooked the market:

Nvidia's CEO told the Financial Times that China would likely "win the AI race"

Trump's response—"No, I love AI"—didn't help

His administration stated there would be "no federal bailout for AI"

Buy the dip has turned from strategy into superstition.

Strategy Spotlight: Recession Resistant

In times like these, when sentiment collapses, the Fed hesitates, and high-flying tech gets repriced, defensive positioning matters. The Recession Resistant strategy from Surmount AI offers a disciplined, rules-based approach to navigating economic uncertainty.

What it does:

Focuses on companies offering essential products and services

Targets defensive sectors: consumer staples, healthcare, utilities, essential retail

Rebalances monthly to maintain diversified exposure

Emphasizes companies with strong fundamentals and reliable cash flows

The thesis is straightforward: during recessions, consumers prioritize essentials over discretionary spending. By systematically tilting toward businesses that historically demonstrate resilience during downturns, this approach aims to reduce downside risk and provide stability when economic conditions deteriorate.

This isn't a guarantee—it's a framework. And frameworks matter when the fog rolls in.

The Big Picture

Three months. That's how long Congress bought with Wednesday night's deal. January 30th will bring another funding cliff, meaning federal workers face renewed uncertainty in less than 90 days.

Here's what we know:

The October data we needed may never arrive

The Fed's cutting cycle is suddenly in doubt—odds flipped from 90% to 49% in two weeks

The AI trade that powered markets all year is cracking under its own weight

Consumer confidence sits at near-record lows

The wealth gap is widening—only those with large stock portfolios feel confident

The shutdown revealed uncomfortable truths: consumer confidence is brittle, policy certainty is fiction, and markets are more fragile than anyone wants to admit. The government reopened, but nothing feels resolved. Rate cuts aren't guaranteed. Tech isn't invincible. And the economic data blackout means we're all guessing.

Welcome to the new normal: fog, everywhere.

Disclaimer: This newsletter is provided for informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or any other sort of advice. The content herein represents the opinions and analysis of the authors and should not be considered a recommendation to purchase or sell any security. Surmount and its affiliates are not registered investment advisors. All investments involve risk, including the possible loss of principal. Past performance does not guarantee future results. Before making any investment decisions, you should consult with your own professional advisors and consider your individual financial situation, investment objectives, and risk tolerance. The strategies mentioned are not suitable for all investors.