- Analyzed Investing

- Posts

- The Fed Just Told You To Stop Expecting Handouts

The Fed Just Told You To Stop Expecting Handouts

Powell's "hawkish cut" exposed the fantasy that easy money will save overvalued markets. Oracle's AI spending blowup was just the opening act.

We've upgraded our infrastructure: analyzedinvesting.framer.website is now home. Your Friday newsletter isn't going anywhere, but now you've got a proper archive of every contrarian call we've made.

The Year-End Moves No One’s Watching

Markets don’t wait — and year-end waits even less.

In the final stretch, money rotates, funds window-dress, tax-loss selling meets bottom-fishing, and “Santa Rally” chatter turns into real tape. Most people notice after the move.

Elite Trade Club is your morning shortcut: a curated selection of the setups that still matter this year — the headlines that move stocks, catalysts on deck, and where smart money is positioning before New Year’s. One read. Five minutes. Actionable clarity.

If you want to start 2026 from a stronger spot, finish 2025 prepared. Join 200K+ traders who open our premarket briefing, place their plan, and let the open come to them.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

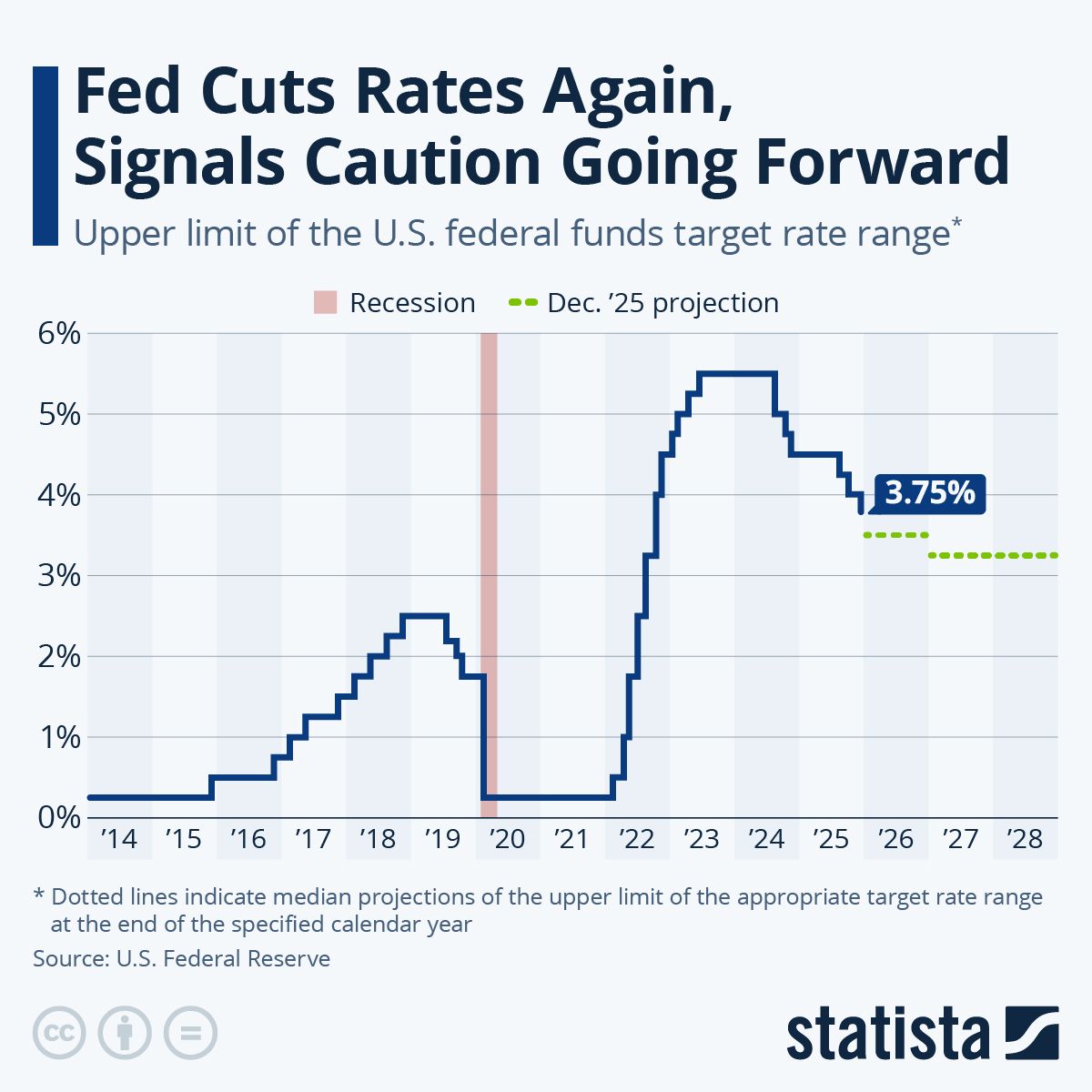

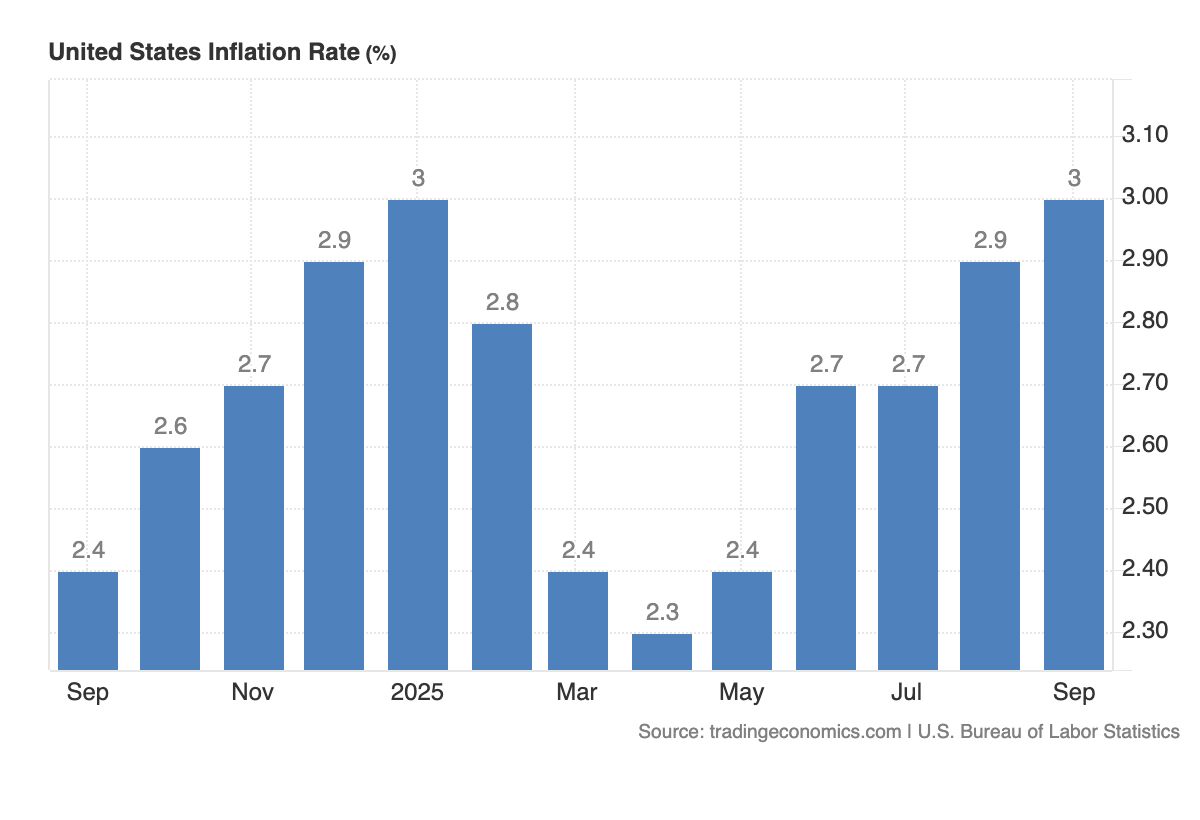

The Federal Reserve cut rates by 25 basis points on Wednesday, and the market initially cheered… Then Chair Jerome Powell opened his mouth and told everyone what they didn't want to hear: the party's over. With just one more cut projected for 2026 and inflation stubbornly stuck at 2.8%—well above the 2% target for the 55th consecutive month—Powell essentially admitted the Fed is out of ammunition and out of patience.

This wasn't a normal rate cut. This was what the bond market calls a "hawkish cut"—a reduction accompanied by language so restrictive it might as well have been a hike. The vote itself was a trainwreck: 9-3 with dissents from opposite directions, marking the most divided Fed since 2019. Two officials wanted no cut at all. One wanted 50 basis points. Four non-voting members registered "soft dissents." This is what desperation looks like when you're trying to hold together a consensus that doesn't exist.

Meanwhile, Oracle's earnings miss on Thursday morning wasn't just a disappointing quarter—it was a reckoning. The cloud giant's revenue disappointed and AI spending surged, sending the stock down 13% and triggering a broader tech selloff. The message? All those billions poured into AI infrastructure might not generate returns anytime soon. And investors are finally starting to ask uncomfortable questions.

Let's cut through the noise and examine what really happened this week.

Powell's Uncomfortable Truth: Inflation Is Tariff-Driven and He Can't Fix It

Here's what Powell actually said during Wednesday's press conference that should terrify anyone paying attention: "It's really tariffs that's causing most of the inflation overshoot."

Read that again. The Fed Chair just admitted that the primary driver of inflation—the thing destroying purchasing power for everyday Americans—is policy-driven, not market-driven. And there's absolutely nothing monetary policy can do about it.

The Data Tells the Ugly Story:

Core inflation stuck at 2.8% for the 55th straight month above the Fed's 2% target

Unemployment hit 4.4%, highest since October 2021

November ADP showed sharpest job decline (32,000 lost) in over two years

Labor market stuck in "low hire, low fire" mode—a slow bleed that doesn't show up in headlines until it's too late

President Trump's broad tariffs have jacked up prices across the board, and Powell can't cut rates fast enough to offset that without risking a complete loss of credibility on the inflation mandate. So what does he do? He cuts once more for optics, projects hawkishness to keep bond vigilantes at bay, and hopes the data magically improves.

The Fed is trapped. Cut rates to support jobs, and you risk stoking inflation that's already running hot. Hold rates steady to fight inflation, and you risk a deeper labor market downturn. Powell chose the former this week, but he made it clear there won't be many more bailouts. The market heard him loud and clear: Treasury yields barely moved lower after the announcement, and the dollar strengthened. That's not what happens when markets expect aggressive easing ahead.

Oracle's AI Reality Check: The Emperor Has No Clothes

Thursday morning, Oracle reported earnings that missed revenue expectations while simultaneously raising AI infrastructure spending forecasts. The stock cratered 13%, and the entire AI trade shuddered.

This wasn't just about Oracle. This was about a market finally waking up to the uncomfortable reality that spending billions on AI infrastructure doesn't automatically translate to revenue growth.

The Fallout Was Swift:

Oracle down 13% on disappointing revenue and increased AI capex

Microsoft, Nvidia, and Meta declined as AI spending sustainability questioned

Dow Jones hit new record highs, surging 1.1% as money rotated to value

Bank of America upgraded Visa; Amazon announced $35B India investment

Traditional industrials, financials, and consumer names led the charge

Oracle is far from alone here—Microsoft, Google, Meta, and Amazon have all massively ramped up capex for AI data centers, chips, and compute. The pitch has been simple: spend now, dominate later. Except "later" keeps getting pushed further out, and investors are getting impatient.

This is what a sector rotation looks like when hype meets reality. The Magnificent 7 tech stocks have carried the S&P 500 for two years straight, accounting for a disproportionate share of gains. But concentration cuts both ways. When Oracle stumbles and the AI narrative cracks, the entire house of cards wobbles.

The S&P 500 closed Wednesday at 6,886—just 0.7% below its October all-time high. But market breadth tells a different story:

Fewer stocks participating in the rally

Russell 2000 small-caps briefly hit record highs before pulling back

Concentration risk at historic levels

That's not the sign of a healthy, broad-based bull market. That's a sign of investors desperately searching for anything that isn't wildly overvalued tech.

Netflix's $72 Billion Hail Mary and the Streaming Endgame

While tech imploded and the Fed fumbled, Netflix dropped a bombshell: a $72 billion deal to acquire Warner Bros. Discovery's HBO Max streaming service and film studio.

Market Reaction Says It All:

Netflix stock fell 4% (not what you want when you're the buyer)

Warner Bros. Discovery rose 4% (sellers getting premium valuation)

Deal won't close for 12-18 months, faces antitrust scrutiny

Paramount immediately launched hostile bid for Warner Bros., triggering potential bidding war

Why the negative reaction for Netflix? Because investors are finally questioning whether empire-building through debt-fueled M&A makes sense in a higher-for-longer rate environment. Netflix is already burning cash on content. Now it's taking on $72 billion in additional obligations to acquire assets that Warner Bros. couldn't monetize profitably.

The bull case: Scale and content library dominance.

The bear case: Overleveraged in a streaming market with razor-thin margins and subscriber churn.

The streaming wars are entering their final, desperate phase. Consolidation is inevitable. But the winners won't necessarily be the biggest—they'll be the ones with the cleanest balance sheets and the most sustainable business models. Right now, that's not Netflix.

Small Caps and Retail: The Only Bright Spots

While mega-cap tech stumbled and the Fed delivered bad news disguised as a rate cut, a few corners of the market actually delivered.

Five Below: Crushed earnings with $0.68 per share vs. $0.22 expected

Same-store sales up 6.3%

E-commerce surged 15%

Stock up 65% year-to-date

The lesson: Sell products people need at prices they can afford

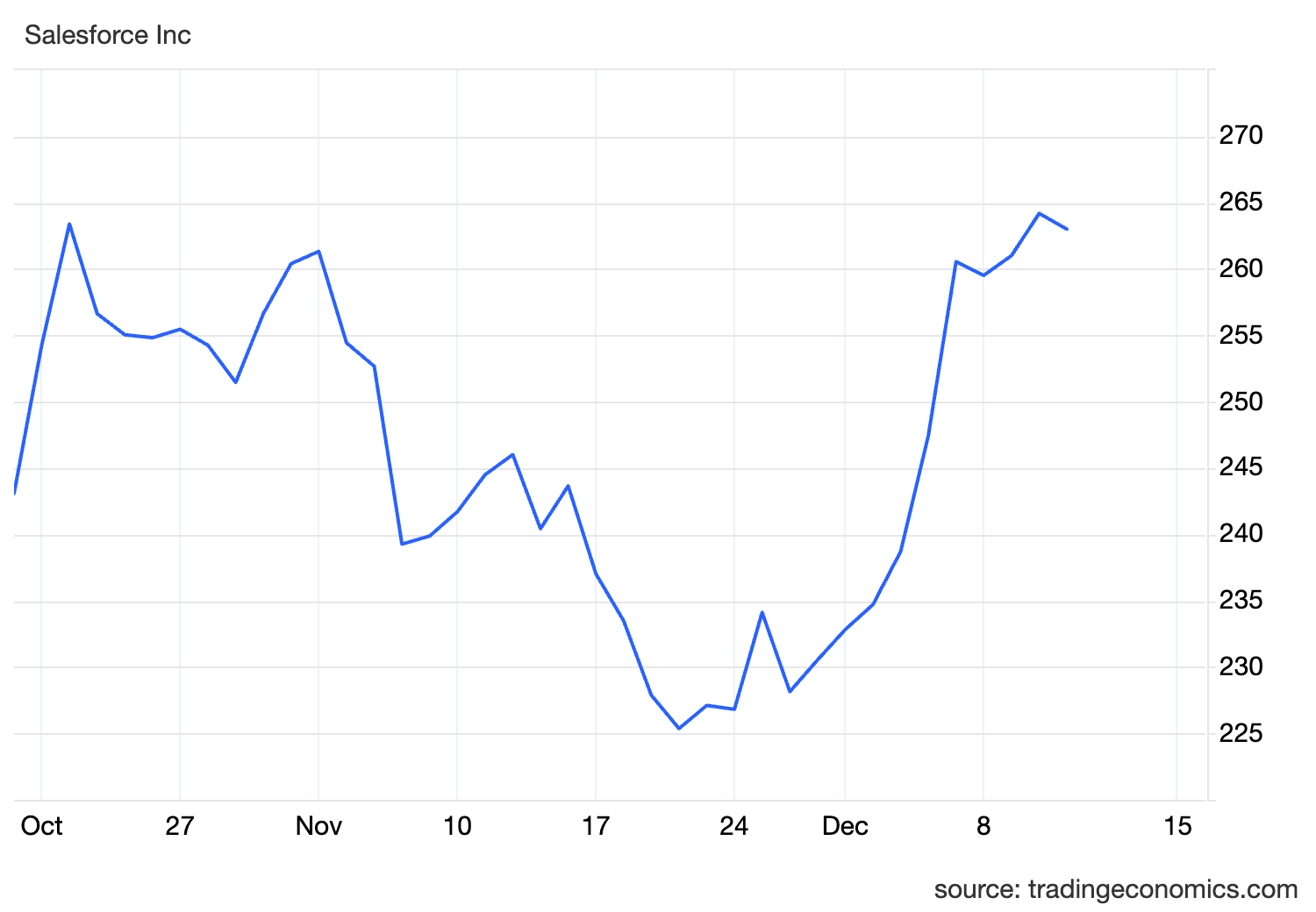

Salesforce: Demolished expectations with $3.25 vs. $2.85 estimated

Shares jumped 24% on the news

Proved enterprise software spending isn't dead

Quality tech with real ROI still works

The pattern? Quality companies with real earnings, reasonable valuations, and actual products are being rewarded. Speculation is out. Profitability is in. And investors are finally waking up to the idea that maybe, just maybe, fundamentals matter again.

Strategy Spotlight: Bitcoin and Ethereum Momentum Followers

Given this week's themes—Fed hawkishness, inflation driven by policy not markets, tech speculation unraveling, and investors searching for alternatives—it's worth examining systematic approaches to assets outside traditional equities.

We've just launched two new momentum-following strategies designed for investors who want disciplined exposure to crypto without the emotional rollercoaster of 24/7 trading: the Bitcoin Momentum Follower and Ethereum Momentum Follower.

Here's the Current Setup:

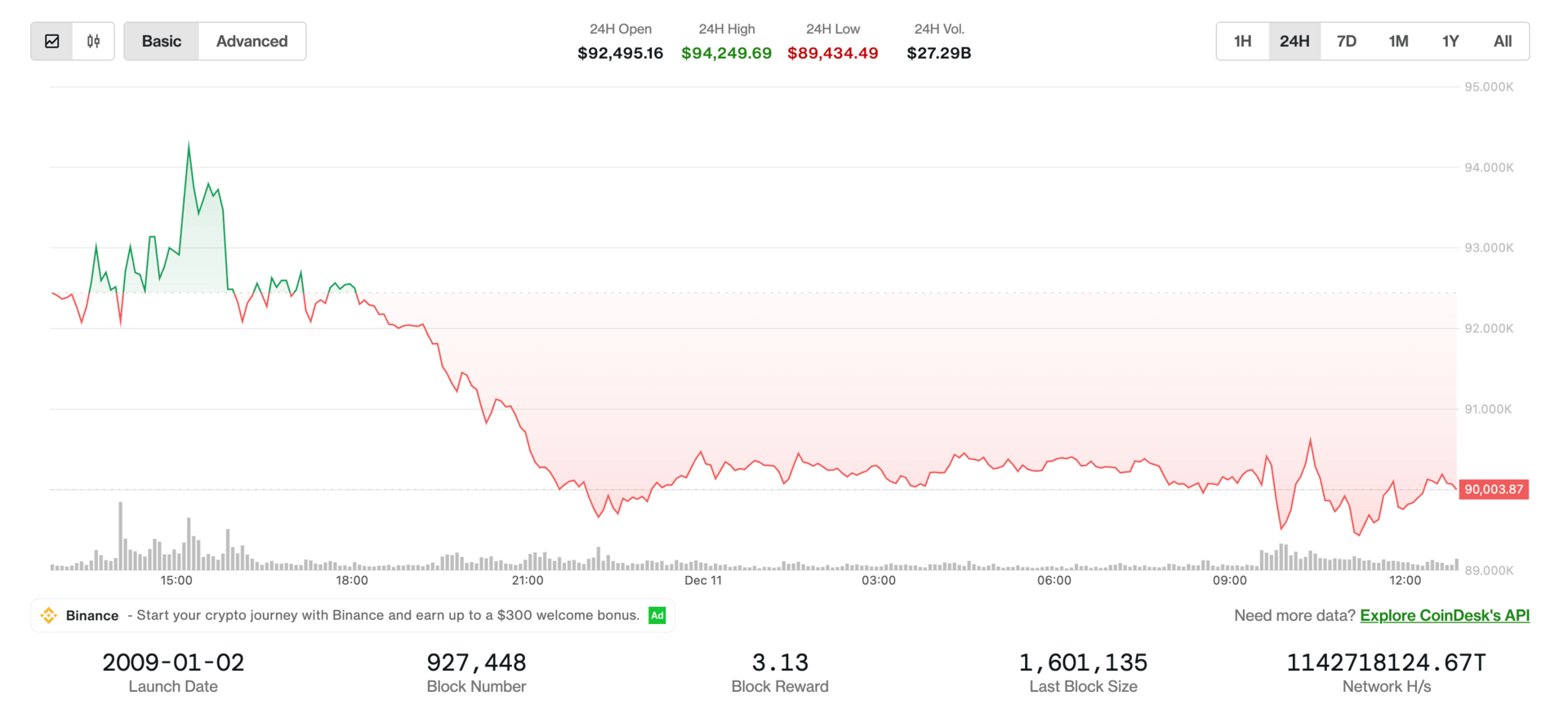

Bitcoin trading around $86,000-$90,000, down ~30% from 2025 highs

Ethereum hovering around $3,100-$3,200

Both experienced sharp selloffs from ETF outflows and leverage flushing

Volatility compressed but still elevated relative to traditional assets

Crypto markets exhibit strong serial correlation and trending behavior. When Bitcoin and Ethereum establish sustained upward momentum, they tend to run hard. When momentum deteriorates, they tend to fall harder. The problem? Most investors buy the top out of FOMO and sell the bottom out of panic.

How Momentum Strategies Work:

Systematically adjust exposure based on quantitative trend signals

Moving average relationships, rate-of-change metrics, breakout patterns

Increase allocation when momentum strengthens

Reduce exposure or move to cash when momentum deteriorates

Remove emotion from a 24/7 market that never sleeps

Why This Matters Now:

Fed admitting it can't fix policy-driven inflation

Traditional markets facing concentration risk and valuation concerns

Alternative assets becoming more interesting as diversifiers

But crypto's volatility makes buy-and-hold stomach-churning for most

A rules-based momentum approach captures sustained trends while limiting downside during inevitable drawdowns.

For investors who believe digital assets deserve a place in a diversified portfolio yet want discipline rather than speculation, momentum-following offers a middle path between reckless gambling and fearful avoidance.

The Big Picture: Buy the Dip Has Turned Into Superstition

Let's be brutally honest about where we are.

What Just Happened:

The Fed told you it's done being your bailout

Powell explicitly said "well positioned to wait and see"—central banker speak for "don't expect help unless things break badly"

Inflation still running hot, driven by tariffs the Fed can't control

Labor market softening in ways that don't show up in headlines until too late

Tech's AI spending binge facing its first real skepticism

Mega-cap concentration risk unwinding

Netflix betting $72B that bigger is better in an industry where profitability remains elusive

This Is Not the Setup for a Melt-Up Rally:

This is the setup for volatility, rotation, and a market that punishes complacency. The investors who thrive in this environment won't be the ones chasing momentum in overvalued tech or blindly buying every dip. Because in a market where the Fed is stepping back, AI hype is cracking, and concentration risk is real, the only edge left is process.

Buy the dip worked when the Fed had your back. Now? It's just superstition.

Quick Links: This Week from Analyzed Investing

Disclaimer: The information provided in this newsletter is for educational and informational purposes only and should not be construed as financial, investment, tax, or legal advice. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities, investments, or financial products.