- Analyzed Investing

- Posts

- The Fed Just Got Criminally Investigated While Markets Partied Like Nothing Happened

The Fed Just Got Criminally Investigated While Markets Partied Like Nothing Happened

Powell faces grand jury subpoenas. Netflix guides down while hitting 325M subs. Small caps surge as Mag 7 stumble. Here's what Wall Street is pretending not to notice.

January 16, 2026

Wall Street spent this week celebrating a rotation into small caps and real estate—the kind of breadth expansion everyone's been praying for since 2023. The S&P 500 inched higher, Netflix topped 325 million subscribers, and regional banks rallied on hopes of steepening yield curves.

Meanwhile, the Department of Justice served the Federal Reserve with criminal grand jury subpoenas threatening to indict Chair Jerome Powell. The Dow dropped 400 points on Monday before recovering. By Tuesday, markets were back to pricing in soft landings and rate cuts.

Here's what nobody's saying out loud: when the executive branch starts criminalizing monetary policy decisions, you don't get to pretend it's business as usual.

Stop Drowning In AI Information Overload

Your inbox is flooded with newsletters. Your feed is chaos. Somewhere in that noise are the insights that could transform your work—but who has time to find them?

The Deep View solves this. We read everything, analyze what matters, and deliver only the intelligence you need. No duplicate stories, no filler content, no wasted time. Just the essential AI developments that impact your industry, explained clearly and concisely.

Replace hours of scattered reading with five focused minutes. While others scramble to keep up, you'll stay ahead of developments that matter. 600,000+ professionals at top companies have already made this switch.

When "Independent" Central Banking Meets Political Weaponization

Jerome Powell released an extraordinary video statement Sunday night confirming the DOJ investigation stems from his Senate testimony about Fed building renovations—a $2.5 billion project Trump has repeatedly attacked. Powell was unequivocal: this isn't about construction overruns. It's about the Fed refusing to cut rates on Trump's timeline.

Powell's exact words:

"The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President."

The market's response?

Monday morning: Dow drops 400 points

Tuesday: Recovery complete, soft landing narrative resumes

Powell's exit odds: Initially 85% chance of leaving before August, now reversed to just 55%

DJI - 1M

The DOJ investigation may have backfired. Powell now looks more likely to stay through January 2028 as a Fed Governor, ensuring a powerful voice for independence remains even after Trump names a new Chair.

Political fallout:

Senator Thom Tillis immediately pledged to oppose any Fed nominee until this is resolved

Treasury Secretary Scott Bessent reportedly told people he's unhappy with the decision

Trump denied knowledge of the probe while simultaneously calling Powell "not very good at the Fed"

The question markets are studiously ignoring: If the Fed can be criminally investigated for policy decisions the White House doesn't like, what exactly are you pricing?

Netflix Hits 325 Million Subs, Guides to Slower Growth—Stock Craters Anyway

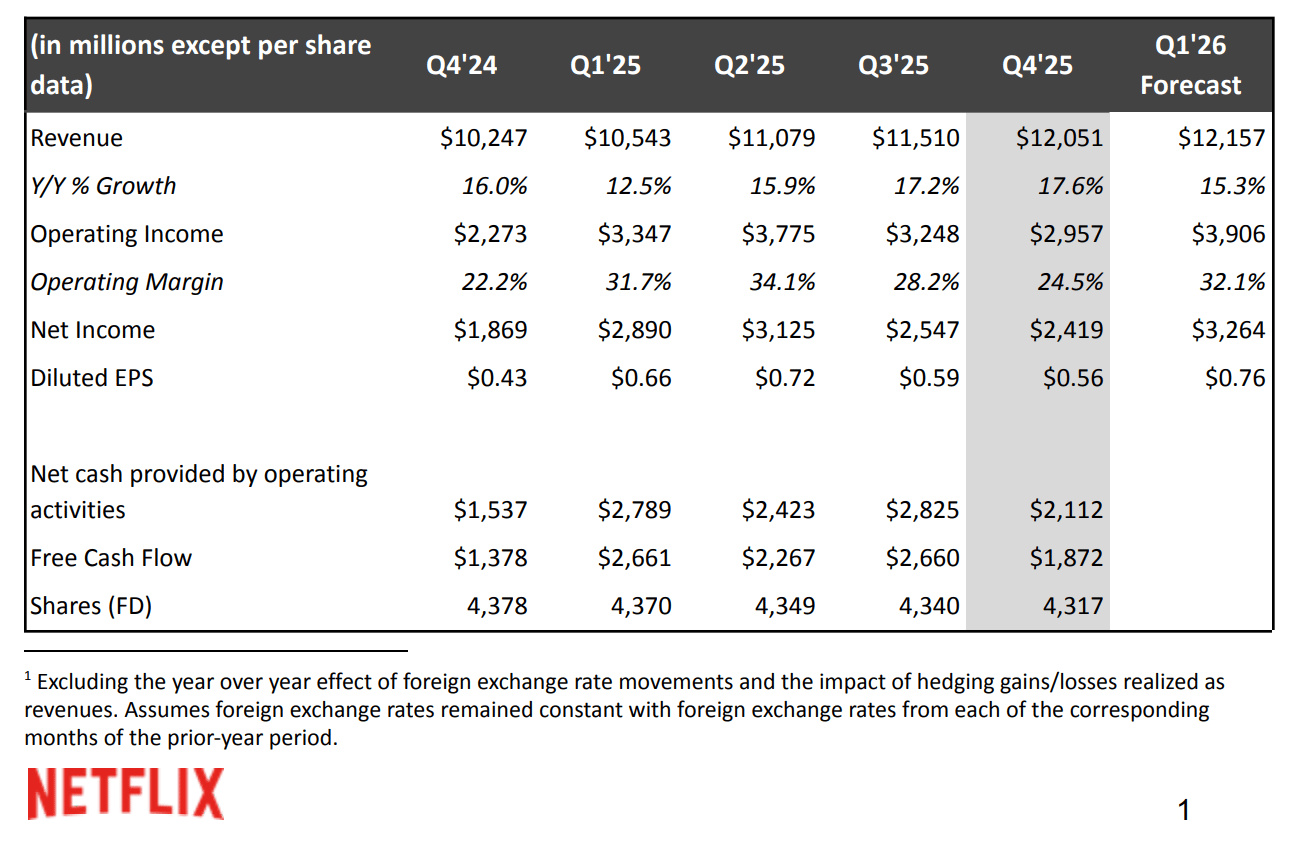

Netflix reported earnings Tuesday that beat on every line—until management opened their mouths about 2026.

The numbers that looked good:

Crossed 325 million paid subscribers in Q4 2025

Revenue grew 18% year-over-year to $12.05 billion

Operating margins hit nearly 30%

Ad revenue grew 2.5x in 2025 to over $1.5 billion

Warner Bros. Discovery acquisition closed for $27.75 per share all-cash

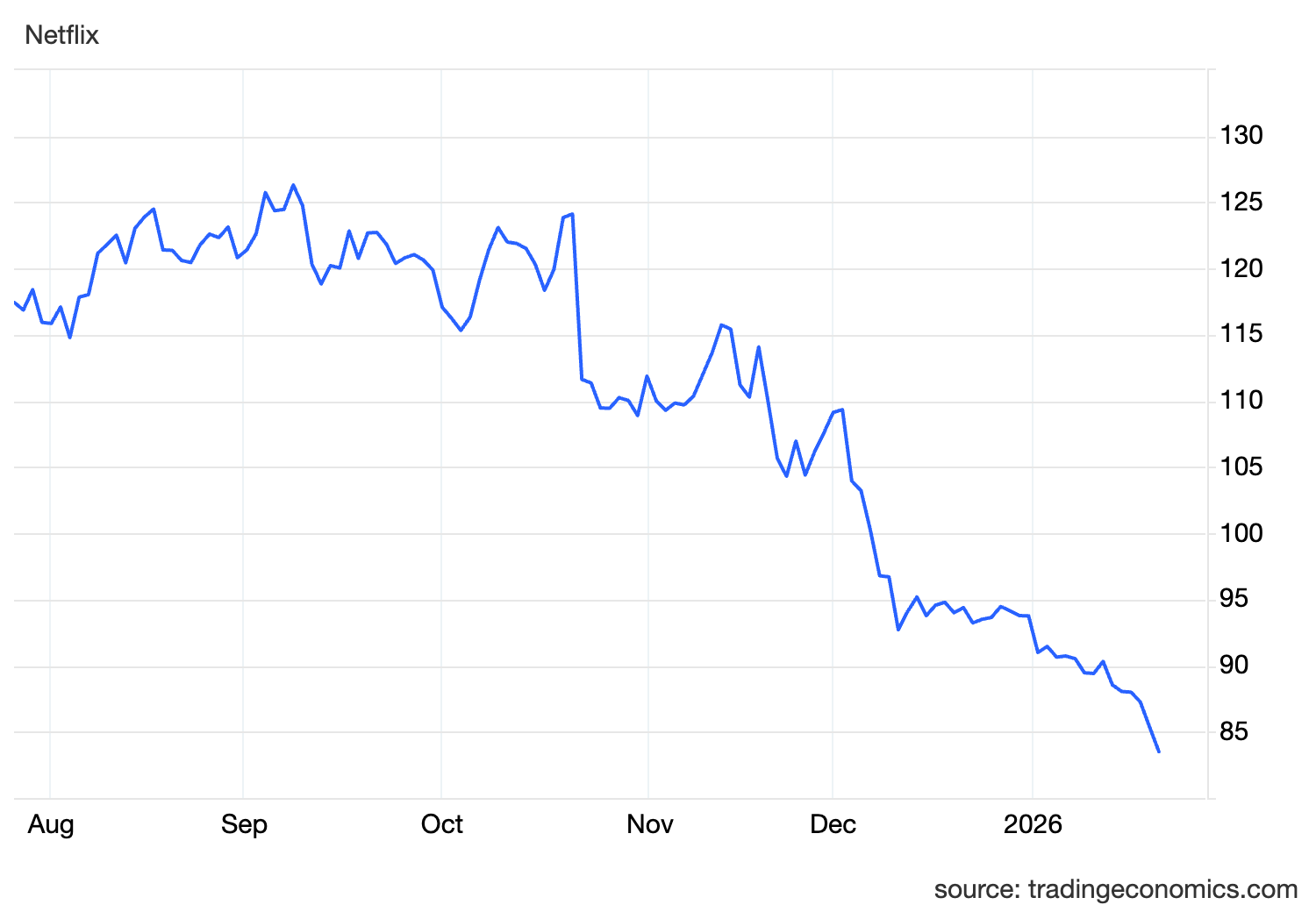

Markets weren't impressed. Netflix shares dropped 6-7% in the sessions following the report.

The problem? 2026 guidance projects:

Revenue growth of 12-14% (down from 17% in 2025)

Share buybacks paused to fund Warner acquisition

Content spending up 11.5% to $20 billion

Operating income growth "higher in the second half than the first half" (translation: lumpy margins)

Netflix (USD) - 6M

The tell everyone's missing:

Netflix is moving aggressively into live sports—NFL Christmas games, MLB Opening Night, World Baseball Classic—mimicking the linear TV model it spent a decade disrupting.

When the disruptor starts looking like the incumbent, maturity isn't a bug, it's the feature.

The bull case:

Ad revenue projected to double again to $3 billion in 2026

Operating margins targeting 31.5% (up from 29.5%)

Warner integration drives new subscription wave

"Premium Plus" pricing tiers with HBO unlock ARPU growth

The bear case:

$72 billion in combined debt

Rising sports licensing costs

Amazon/YouTube competing for ad dollars

Just spent $27.75/share to acquire declining linear TV assets

Netflix now trades at valuations that assume subscriber growth peters out and margins stop expanding. With refinancing pressures and sports costs spiraling, that might not be wrong.

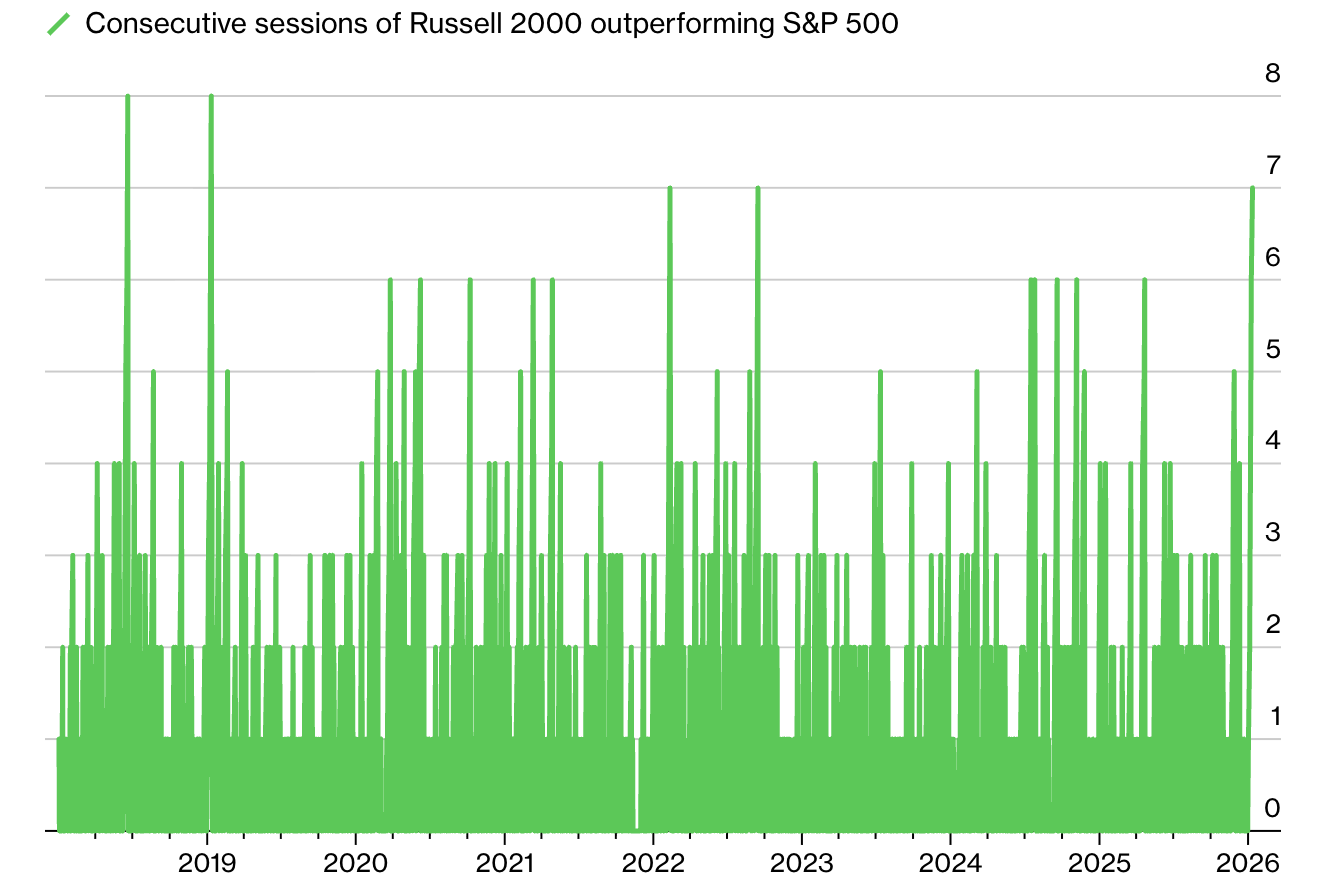

The Great Rotation Finally Arrives (Or Does It?)

Small caps and real estate surged this week while mega-cap tech sputtered—the market breadth expansion everyone's been forecasting since 2023.

The headline numbers:

Russell 2000: Up ~7% year-to-date

Magnificent Seven: Down 1.4%

Real Estate sector (worst performer in 2025): Rallied 4.09% last week, with 30 of 31 constituents posting gains

Basic materials sector: Up 9.05% year-to-date

The clean narrative:

Lower rates benefit rate-sensitive sectors

One Big Beautiful Bill Act's tax cuts favor small businesses

Earnings growth finally broadening beyond AI infrastructure

Mid-caps trade at 16.5x forward earnings vs. 22x+ for large-cap tech—a 25-year valuation gap

What's missing from the celebration:

Credit spreads are still historically tight. Corporate debt refinancing costs remain elevated despite Fed cuts. 85% of maturing debt in 2026-2027 will need to be refinanced at 200+ basis point increases versus when originally issued.

Small caps and regionals are more exposed to those refinancing pressures, not less.

Trump proposed capping credit card rates at 10% for one year—a populist move that would:

Save consumers $100 billion annually

Decimate bank profitability

Cut off credit access for millions

JPMorgan CFO Jeremy Barnum warned it would be "devastating" for the economy. Bank stocks rallied on the news, pricing in that Congress won't pass it.

Maybe they're right. Or maybe they're just betting Trump can't accomplish what he says he'll do—which is a hell of a way to run a portfolio.

Strategy Spotlight: SP500? No. SP10.

Wall Street's celebrating small-cap outperformance and declaring mega-cap dominance dead. But here's the thing: the fundamentals driving the largest companies haven't changed in two weeks.

Surmount's SP 10 Strategy cuts through the noise by investing exclusively in the ten largest S&P 500 companies—the actual market leaders with fortress balance sheets, dominant market share, and pricing power that smaller competitors can't match.

Think about what's still happening beneath the rotation headlines: AI infrastructure spending accelerating, cloud revenue growing, data center buildouts expanding. The Magnificent Seven keep beating earnings expectations while maintaining margin expansion. Meanwhile, Russell 2000 aggregate earnings are barely positive.

When credit conditions tighten and refinancing costs spike 200+ basis points, who's better positioned—a regional bank or Microsoft sitting on $100B in cash?

This strategy rebalances quarterly to stay concentrated in the top 10, accepting higher risk in exchange for direct exposure to the companies actually driving market returns. If this rotation fades like the previous ones, you're not scrambling to get back in.

The risk? If small-cap value genuinely outperforms for years, concentrated mega-cap exposure underperforms by design. But that's a bet on regime change, not just sector rotation.

What Actually Matters Going Forward

Wall Street is pricing in broadening earnings growth, dovish Fed policy, and smooth rotations from growth to value.

What it's not pricing:

Institutional breakdowns that make monetary policy unpredictable

Credit stress that emerges when overleveraged companies refinance at 200+ bps increases

Regulatory chaos when the executive branch declares war on financial regulators

Three things to watch that consensus is ignoring:

1. Fed nominations: Trump needs Senate approval for Powell's replacement. If Tillis holds his line and other Republicans join, Trump's pick might not get confirmed—leaving Powell on the board through 2028 as the lone voice against political interference.

2. Credit availability compression: If banks actually comply with a 10% rate cap—or even get pressured into voluntary reductions—consumer credit dries up just as refinancing pressures hit corporates. That's not bullish for small caps.

3. Netflix's Warner integration: Wall Street is treating this like Netflix bought growth. They actually bought declining linear TV assets and $72B in combined debt. If subscriber growth stalls or sports costs spiral, this could be the deal that broke streaming's economics.

Markets are behaving like everything's fine because the alternative is confronting uncomfortable questions about rule of law, institutional independence, and whether the monetary policy framework that's anchored asset prices for 40 years still functions.

Maybe they're right. Or maybe denial just sounds better than the alternative.

Until next week,

Analyzed Investing