- Analyzed Investing

- Posts

- The Fed Just Blinked. Again. What Comes Next Will Hurt.

The Fed Just Blinked. Again. What Comes Next Will Hurt.

Powell's latest pivot, Nvidia's stumble, and why the bond market is pricing in a recession nobody wants to admit is coming.

We've officially launched our new home at analyzedinvesting.framer.website. Same sharp analysis, cleaner layout, zero BS. Bookmark it.

$1K Could’ve Made $2.5M

In 1999, $1K in Nvidia’s IPO would be worth $2.5M today. Now another early-stage AI tech startup is breaking through—and it’s still early.

RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend.

The company’s valuation has surged 4900% in four years* with over $50M raised.

Already trusted by a who’s-who roster of Fortune 1000 brands and leading global agencies. Recurring seven-figure partnerships in place and their Nasdaq ticker is reserved: $RADI.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

The Week That Was

Another week, another reminder that the market doesn't care about your feelings. The S&P closed the week down, tech stocks got hammered, and Jerome Powell delivered yet another masterclass in saying nothing while markets heard everything. If you're still clinging to the idea that 2025 will be smooth sailing, this week was your wake-up call.

The narrative is shifting, and it's happening faster than most realize. The Fed is trapped between inflation that won't die and an economy that's starting to crack. Tech earnings showed the AI trade might have finally run out of road. And meanwhile, Treasury yields are doing things that should make anyone with a mortgage very, very nervous.

Let's break it down.

Powell's Pivot That Wasn't (But Actually Was)

The Federal Reserve held rates steady this week, as expected. But Powell's press conference was the real story. He spent thirty minutes threading a needle: admitting inflation remains "elevated" while simultaneously suggesting the Fed is in no rush to cut rates further. Translation: they're out of moves, and they know it.

Here's the problem:

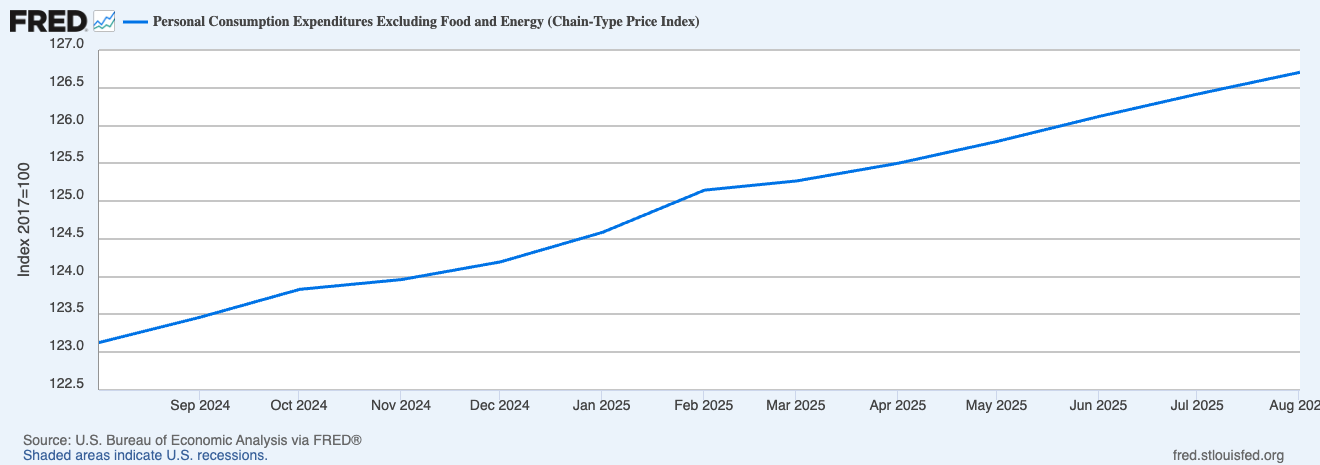

Core PCE inflation—the Fed's preferred measure—is still running at 2.8% year-over-year, well above the 2% target

Consumer spending growth slowed in October, and jobless claims are ticking higher

The Fed is now stuck: cutting rates risks reigniting inflation, but keeping them elevated risks tipping the economy into contraction

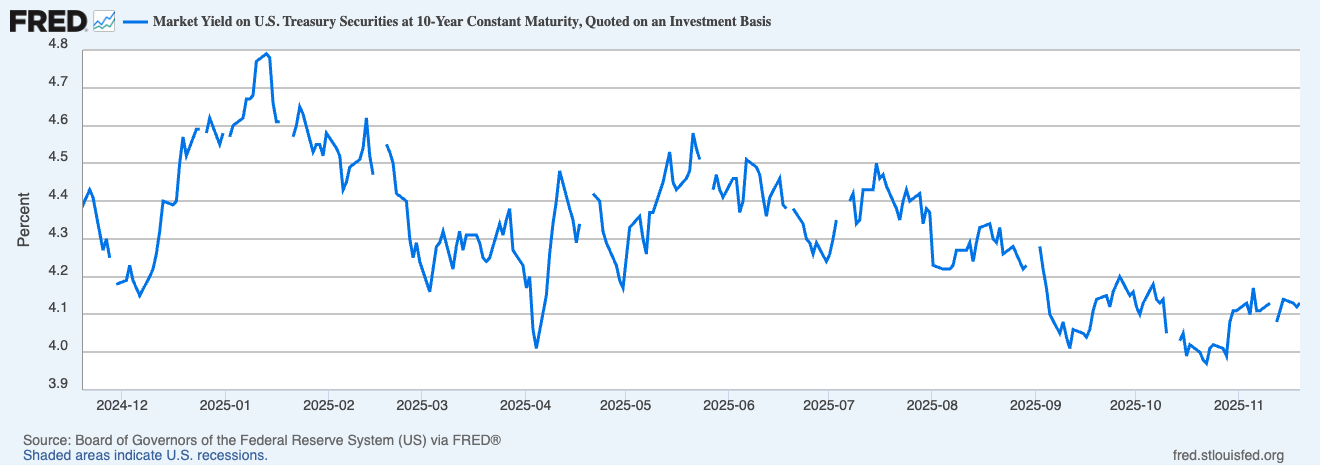

Bond markets are already pricing this in. The 10-year Treasury yield spiked to 4.45% mid-week before settling slightly lower, but the trend is unmistakable: investors are demanding higher compensation for long-term risk. That's not bullish. That's bond vigilantes waking up from a decade-long nap.

For HENRYs, this matters:

Mortgage rates are effectively anchored to the 10-year, and if yields keep climbing, forget about that refinance you were hoping for

Housing affordability is already at multi-decade lows

Rising rates will only make it worse—if you're sitting on cash waiting for "the right time" to buy, that time might never come at prices that make sense

Nvidia's Stumble and the AI Reality Check

Nvidia reported earnings this week, and while the headline numbers beat expectations, guidance disappointed and the stock got crushed in after-hours trading. The AI darling that carried the Nasdaq for two years straight suddenly looks mortal.

Here's what Wall Street isn't telling you:

Nvidia's growth is slowing because the easy money has already been made

Data center buildouts are decelerating, and the hyperscalers—Amazon, Microsoft, Google—are all signaling they're getting more disciplined about AI capex

The gold rush phase is over; now comes the hard part: proving AI actually generates returns

This isn't just about Nvidia. The entire AI trade—from semiconductors to cloud infrastructure—is built on the assumption that companies will keep spending billions on infrastructure that hasn't yet proven it can turn a profit. At some point, CFOs will demand ROI, and when they do, a lot of these valuations will look absurd in hindsight.

The lesson: Just because a technology is transformative doesn't mean every stock touching it is a buy. The internet was transformative too, and most dot-com stocks still went to zero.

Oil, OPEC, and the Geopolitical Wildcard

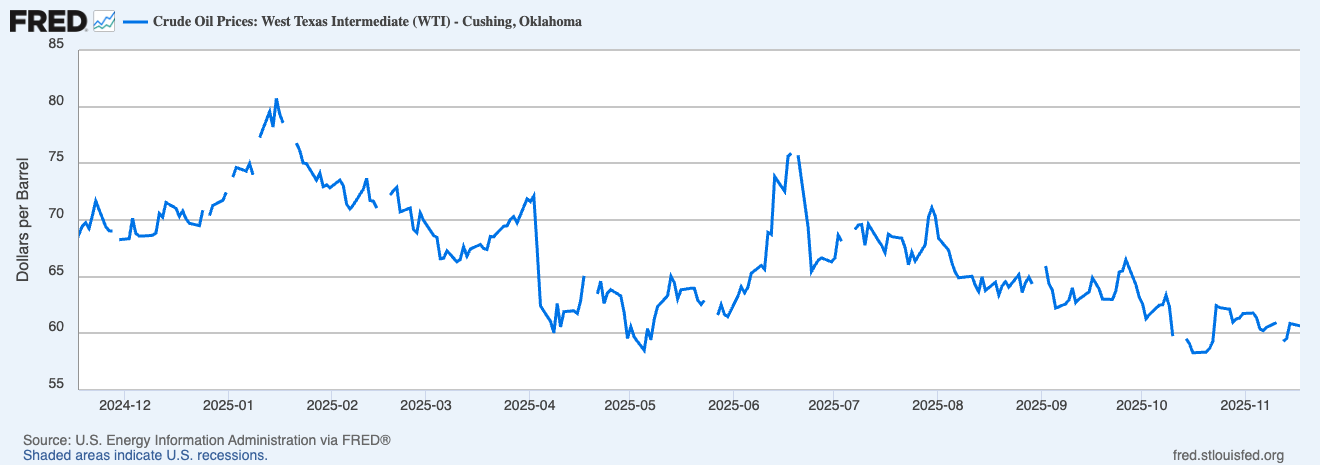

Oil prices dropped below $70 per barrel this week, the lowest level since early 2024. OPEC+ extended production cuts again, but the market isn't buying it.

Why oil is tanking:

Demand from China remains weak

U.S. production is at record highs

The cartel's leverage is evaporating

Lower oil prices should be good news for consumers, right? Maybe. But here's the catch: energy stocks have been propping up portfolios all year. If crude stays below $70, expect Energy sector returns to reverse sharply. And if you're overweight oil as an inflation hedge, you might want to rethink that position.

The geopolitical angle: Cheap oil also changes the calculus for Russia, Iran, and Saudi Arabia—all of whom rely on high prices to fund their governments. Watch for instability in regions where budgets were built on $90 oil. Markets hate surprises, and geopolitical shocks tend to arrive when everyone's looking the other way.

Strategy Spotlight: AlphaFactory Protective

Given this week's themes—rising yields, Fed uncertainty, and market volatility—it's worth highlighting the AlphaFactory Protective strategy.

How it works:

Combines momentum and value signals across a basket of high-cap stocks

Incorporates dynamic allocation to gold based on realized volatility in the S&P 500

Allocates fully to equities during low volatility regimes

Shifts partially into gold during moderate volatility

Moves defensively during high volatility periods

It's a disciplined, rules-based framework designed to adapt to changing market conditions without relying on subjective forecasts. This isn't a silver bullet, and past performance doesn't guarantee future results. But for investors looking for a structured way to navigate uncertainty, it's worth exploring.

The Big Picture

Markets are entering a phase where nothing is easy. The Fed has lost the plot, inflation is sticky, growth is slowing, and valuations remain elevated in key sectors. The "buy the dip" reflex that worked for fifteen years is starting to look less like strategy and more like superstition.

For HENRYs, the playbook is changing:

You can't just set it and forget it anymore

Diversification matters again

Risk management matters again

If you're still 100% long tech and crypto, you're not "bullish"—you're just gambling

The next six months will separate the disciplined from the delusional. Position accordingly.

Analyzed Investing – Skeptical. Sharp. Disciplined.

Visit us at analyzedinvesting.framer.website

Disclaimer: This newsletter is provided for informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or any other sort of advice. The content herein represents the opinions and analysis of the authors and should not be considered a recommendation to purchase or sell any security. Surmount and its affiliates are not registered investment advisors. All investments involve risk, including the possible loss of principal. Past performance does not guarantee future results. Before making any investment decisions, you should consult with your own professional advisors and consider your individual financial situation, investment objectives, and risk tolerance. The strategies mentioned are not suitable for all investors.