- Analyzed Investing

- Posts

- Inflation Surprises, Oil Crashes, AI Implodes — Reality Bites Back

Inflation Surprises, Oil Crashes, AI Implodes — Reality Bites Back

The dollar weakens. Inflation cools suspiciously. Broadcom triggers an AI selloff. Nobody's buying the soft landing anymore.

Reality's Overdue Invoice

The last full trading week of 2025 delivered a masterclass in narrative destruction. While the Fed cut rates amid deep internal division, four separate pressure points cracked open: inflation came in cooler than expected at 2.7% (economists forecast 3.1%), oil collapsed toward $55—the lowest since 2021—the dollar retreated despite rate cuts elsewhere, and Broadcom's margin compression triggered an 11% wipeout that dragged the entire AI trade down with it.

Welcome to December's reality check. The year-end Santa Rally is looking more like a horror show.

The Year-End Moves No One’s Watching

Markets don’t wait — and year-end waits even less.

In the final stretch, money rotates, funds window-dress, tax-loss selling meets bottom-fishing, and “Santa Rally” chatter turns into real tape. Most people notice after the move.

Elite Trade Club is your morning shortcut: a curated selection of the setups that still matter this year — the headlines that move stocks, catalysts on deck, and where smart money is positioning before New Year’s. One read. Five minutes. Actionable clarity.

If you want to start 2026 from a stronger spot, finish 2025 prepared. Join 200K+ traders who open our premarket briefing, place their plan, and let the open come to them.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

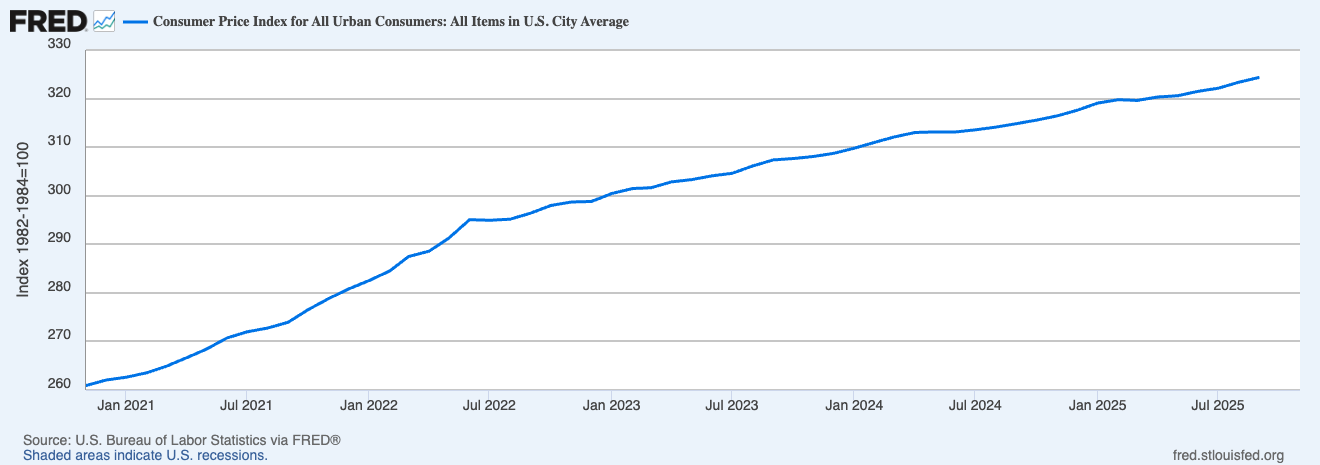

Inflation's Suspicious Cooldown

Thursday's CPI report was supposed to confirm sticky inflation. Instead, it delivered a head-scratcher:

The Numbers:

Headline CPI: 2.7% YoY (vs. 3.1% expected)

Core CPI: 2.6% YoY (slowest since March 2021)

Shelter inflation: 3.0% (finally moderating from years of strength)

Energy: +4.2%, food: +2.6%

Source: FRED St Louis.

The Problem:

This data is dirty. The government shutdown disrupted October collection entirely, and November's figures required "additional processing time"—BLS code for "we're not confident." Capital Economics' Paul Ashworth called the sudden drop "very unusual outside of a recession."

Why It Matters:

Markets now price 27% odds of a January cut, up from near-zero before the report. But if December's CPI—released before the January FOMC—reverts higher, the whipsaw will be brutal. This isn't a trend; it's a single data point wrapped in uncertainty.

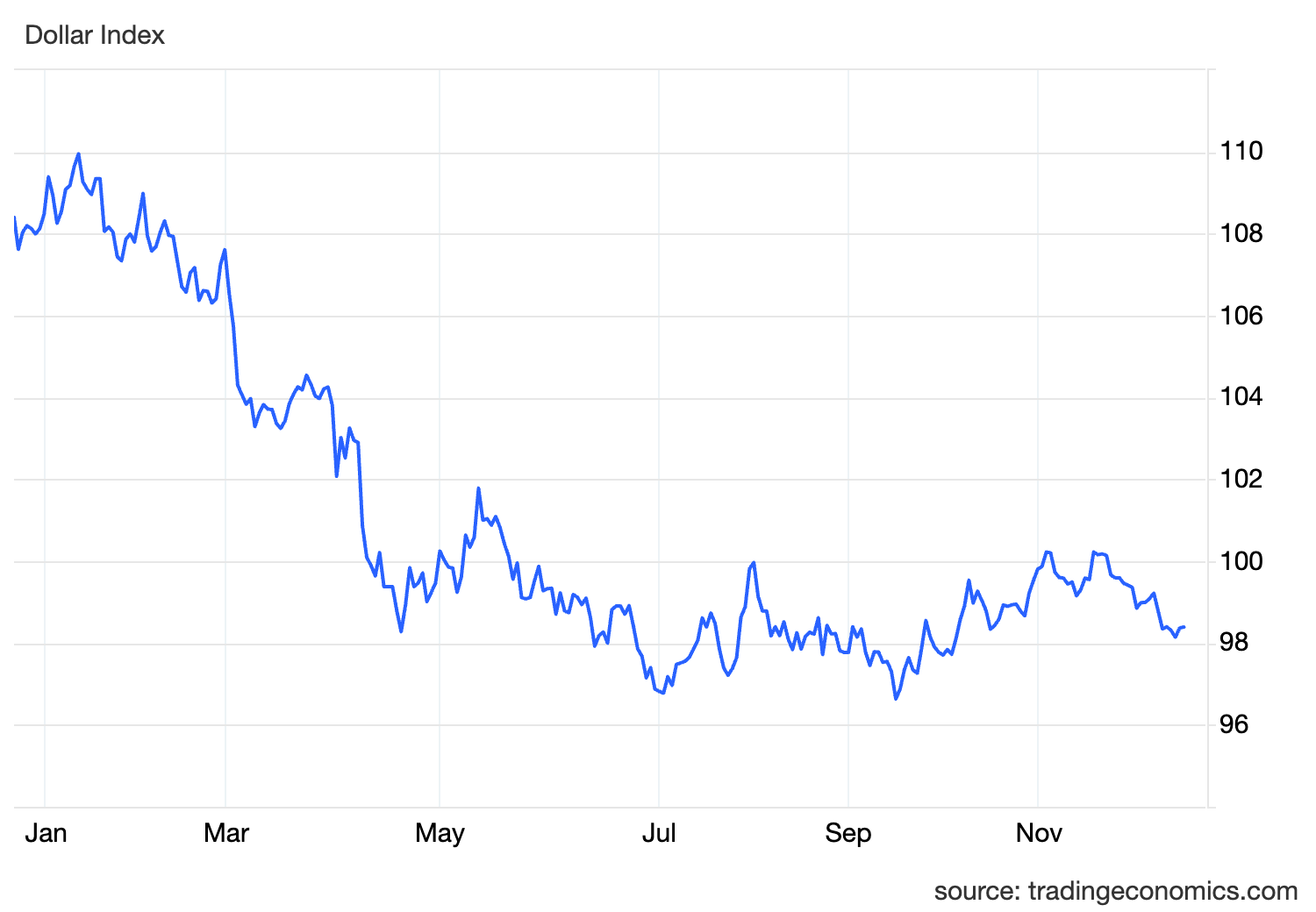

The Dollar's Quiet Retreat

While everyone obsesses over the Fed, the dollar index (DXY) slipped to 98.4—near two-month lows—despite Europe and the UK cutting rates faster than the U.S.

What's Driving It:

Policy uncertainty: Markets remain rattled by headlines around Fed independence and Trump's tariff threats

Capital reallocation: European equity flows hit $42B YTD as investors rotate away from U.S. assets

Weakening carry: With the Fed cutting, the dollar's yield advantage is evaporating

DXY fell 10.7% in H1 2025—the worst first-half performance in over 50 years. A weaker dollar typically boosts international equities and commodities, but it also signals eroding confidence in U.S. exceptionalism. If you're betting on American dominance, the currency market is calling your bluff.

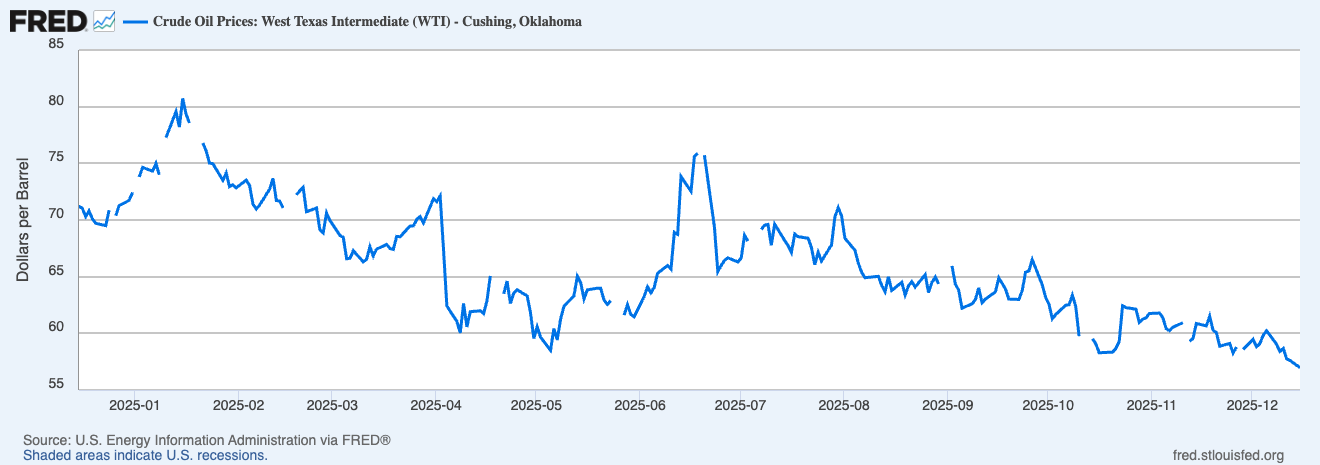

Oil's Deflationary Death Spiral

WTI crude hit $56.09 this week, the lowest since early 2021, with Brent falling below $60. The drop accelerated despite Trump's blockade on Venezuelan sanctioned tankers.

Supply Glut Reality:

OPEC+ restored shut-in capacity while non-OPEC producers ramped up

Russia-Ukraine peace progress raises prospect of easing restrictions on Russian flows

Global oil stocks surged 424 million barrels from January-November

Oil on water jumped 213 million barrels since August—sanctioned barrels can't find buyers

Demand Weakness:

China showing persistent consumption softness

U.S. and Middle East demand cooling

Sub-$55 oil is either deflation's early warning or a gift to consumers. The market can't decide which. Energy stocks bled alongside crude—Exxon and Chevron both down ~2% on Tuesday. If oil stays here, it kills the inflation narrative—but it also signals serious demand destruction.

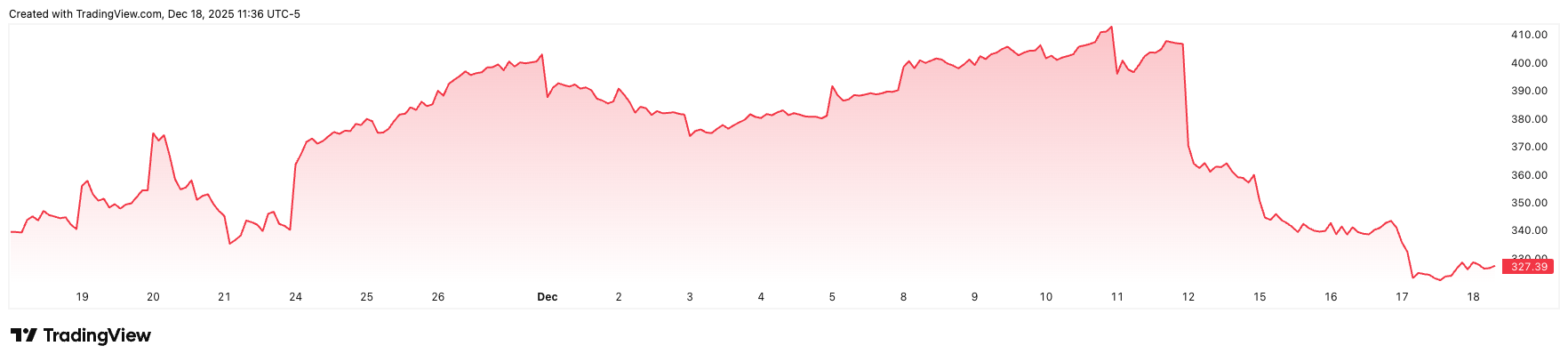

Broadcom's AI Margin Reveal

Thursday night's Broadcom earnings call was the AI trade's watershed moment. CEO Hock Tan revealed what bulls didn't want to hear:

The Selloff Trigger:

Gross margin guidance: 76.9% for Q1 (down from 79% last year)

AI systems sales (full server racks) carry lower margins than traditional software

$73 billion backlog sounds impressive—until you realize it's less profitable per dollar

The Cascade:

Broadcom: -11% Friday, $200B market cap erased

Oracle: -2.3% (after disappointing its own forecast)

Semiconductor index: Down significantly

AI stock angst spreads to Nvidia, AMD

Here’s the real issue; AI margins are compressing toward commodity economics. As hyperscalers build in-house chips and competition floods the market, the 70%+ gross margins justifying trillion-dollar valuations are eroding. Bernstein's Stacy Rasgon called it "AI stock angst," but the translation is simpler: investors are finally asking if the math works.

The Fed's Pyrrhic Victory

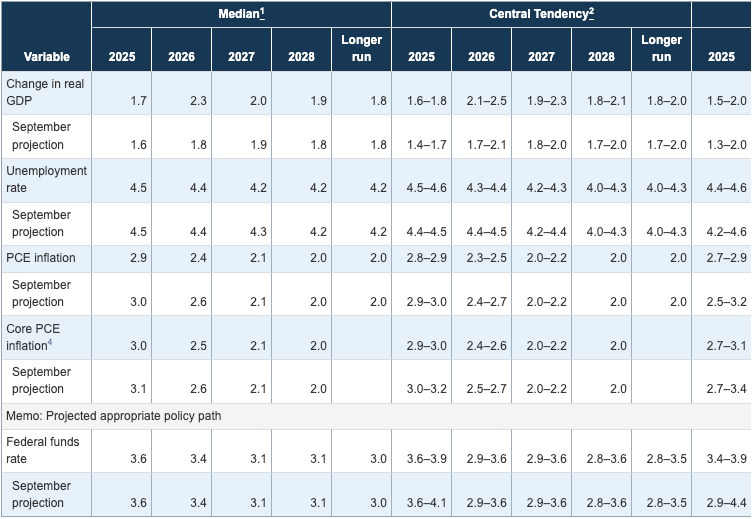

Buried under all of this is last week's 9-3 Fed decision—the most divided vote since 2019. Powell cut rates to 3.5%-3.75%, but three dissents (two wanted no cut, one wanted double) and seven members penciling in zero cuts for 2026 exposed the chaos.

Key Takeaways:

Unemployment hit 4.6%—highest in four years

October lost 105K jobs, November added just 64K

Black unemployment: 8.3% (surged from 7.5%)

700,000 more Americans unemployed than last year

Powell prioritized the labor market over price stability—a gamble that looks increasingly reckless as data uncertainty mounts.

Strategy Spotlight: AlphaFactory Protective

In environments like this—where volatility spikes, narratives collapse, and correlations break—tactical risk management beats hero trades every time. That's where AlphaFactory Protective comes in.

How It Works:

The strategy holds a basket of high-quality, large-cap stocks alongside gold (GLD) as a hedge. It dynamically adjusts allocations based on market volatility:

Low volatility: Full allocation to stocks (momentum and value scored)

Moderate volatility: Mixed stocks and gold

High volatility: Defensive positioning—reduce equity exposure, increase gold

Why It Fits Now:

Value orientation: Combines momentum signals with valuation metrics (PEG ratios) to avoid overpaying

Volatility protection: Automatically scales back when SPY realized volatility spikes

Gold hedge: Provides ballast when growth narratives crack

This isn't a get-rich-quick scheme. It's a disciplined framework for navigating uncertainty—exactly what markets need as we head into 2026.

The Big Picture: Four Cracks, One Conclusion

December handed us clarity wrapped in chaos:

Inflation data is unreliable due to shutdown distortions, yet markets are pricing dovish Fed moves

Oil's collapse signals either deflation or demand destruction—neither is bullish

Dollar weakness despite U.S. rate advantage suggests capital is fleeing American exceptionalism

AI margins compressing faster than bulls anticipated, threatening the one sector that carried 2025

What This Means for 2026:

The soft-landing narrative is dead. We're either heading into a shallow recession (jobs deteriorating, oil collapsing, growth slowing) or a stagflationary grind (tariffs boost prices, unemployment rises, Fed stays stuck). Neither scenario supports today's valuations.

Action items:

Stress-test your portfolio against 5%+ unemployment

Don't assume AI keeps working—Broadcom just told you margins are mortal

Watch December CPI like a hawk—if it reverts to 3%, the rally dies

Consider defensive positioning before everyone else does

The emperor isn't just naked—he's hypothermic. And the market's about to notice.

Stay sharp.

Until next week,

Analyzed Investing