- Analyzed Investing

- Posts

- Shutdown, Soft Jobs, and the AI Hangover: Markets Are Flying Partly Blind

Shutdown, Soft Jobs, and the AI Hangover: Markets Are Flying Partly Blind

With Washington frozen and official data dark, investors are leaning on patchwork indicators. Tech’s halo slipped, gold won’t go away, and oil’s slump is whispering “disinflation.” Here’s what actually mattered.

We Built You A Radar: Analyzed Investing Is Live

The blog is up—and it’s built for people who don’t have time for fluff: https://analyzedinvesting.framer.website/

Think of it as our permanent, noise-canceling feed. The weekly letter is the take; the site is the archive, the methods, and the receipts. You’ll find compact explainers on the macro drivers we reference here, chartbooks you can skim in two minutes, and strategy deep dives you can return to when volatility turns your screen into a strobe light.

The week in one line

When a government as large as America’s stops publishing numbers, price becomes the only truth. This week, that truth said: the labor market is cooling at the margins, the AI trade isn’t bulletproof, safe-haven demand still breathes, and energy is quietly loosening the inflation vise. The narrative machine says “soft landing.” Markets traded like “softening and squinting.”

1) Data blackout economics: investors jury-rig the dashboard

The longest U.S. government shutdown on record rolled into November, taking core economic releases with it. That forced investors to triangulate the jobs picture from private proxies and alt-data—hardly ideal when the Federal Reserve itself just cut rates and is debating whether that was the last move of 2025. Reuters’ tick-tock on the standoff sums up the scale of the disruption and the growing economic hit.

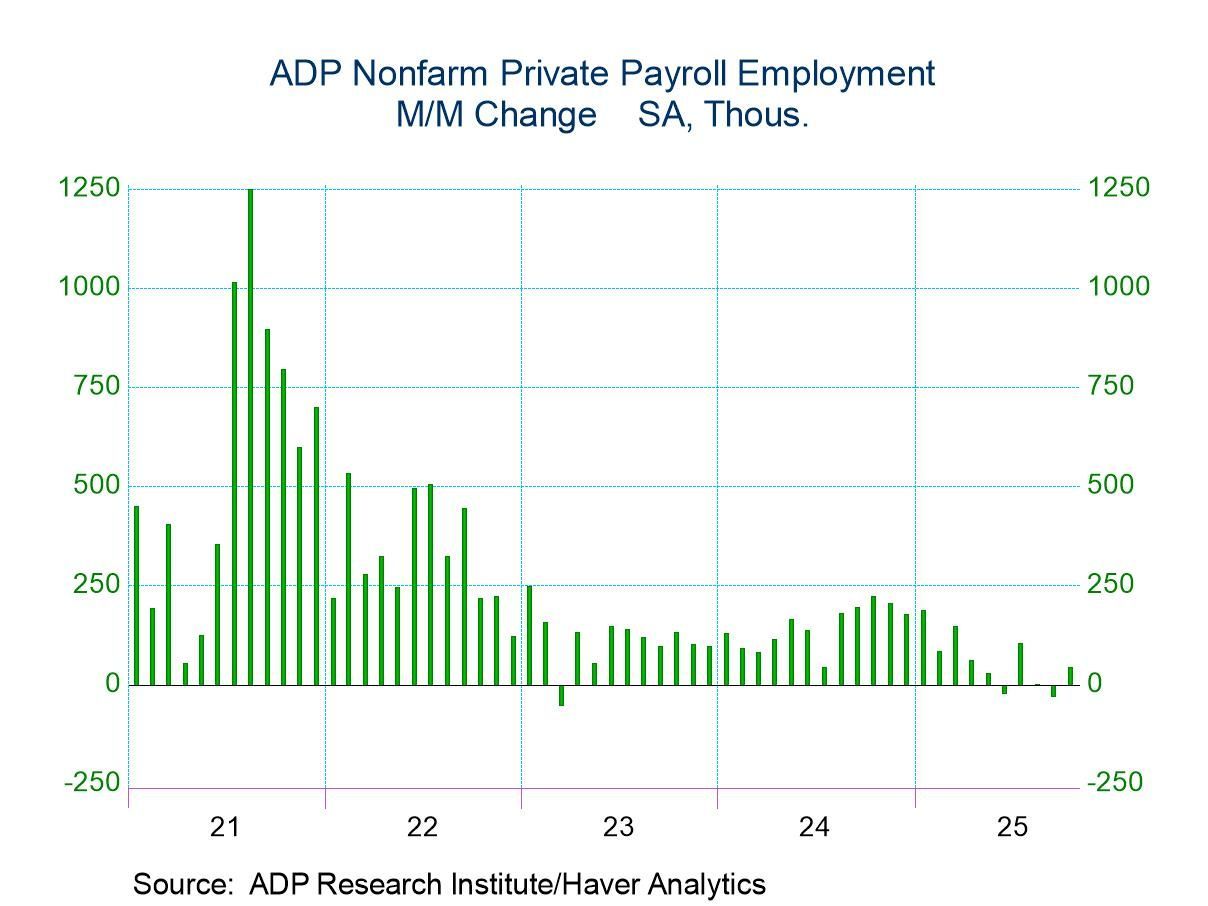

So we read what we can. ADP’s payroll report showed the private sector added 42,000 jobs in October, a tepid rebound that confirms cooling rather than collapse. The ISM Services PMI popped back to 52.4, signaling modest expansion while the employment sub-components remained muddled.

Two takeaways: first, the “no landing” crowd just lost a little altitude; second, the absence of BLS data raises the odds of policy error. Even Fed officials are admitting they’re steering with less visibility—New York Fed’s John Williams floated that the Fed may soon need to grow its balance sheet for liquidity reasons, a jaw-tightening line in any other year. And yes, in this shutdown, journalists at Pew had to explain to the public why the country simply… doesn’t have official jobs data right now.

Bond markets read all this as “less heat, more uncertainty.” The dollar ended the week roughly flat after Thursday’s swoon on softer labor gauges, while Treasury yields held steady after a shutdown-induced rally.

“Buy the dip” has turned from strategy into superstition; right now, the only dip buyers with conviction are central bankers keeping pipes unclogged.

2) The AI trade meets gravity

The week’s other tell came from tech. After months of narrative oxygen, the AI complex felt thinner air. Global headlines highlighted a rotation out of richly priced chip and AI-adjacent names as investors questioned how fast capex can translate into cash flow. It wasn’t a collapse; it was worse: fatigue. When investors stop bidding every wobble, you find out who’s leveraged to the story instead of the cash cycle.

Yields didn’t give tech the usual excuse. With the data drought muting macro catalysts, the 10-year mostly marked time, and poll-based forecasts continue to anchor around the low-4s over the next few quarters—an unfriendly but not fatal backdrop for duration-sensitive growth. Meanwhile, the Fed itself is split after last week’s quarter-point cut; Powell all but admitted there are “strongly differing views” about December.Translation: don’t expect policy to save your multiple.

If the AI basket keeps chopping while the macro fog persists, leadership narrows and liquidity gets pickier. That’s not a bear case; it’s a selectivity case. In that regime, systematic re-balancers and relative-value frameworks tend to outperform storytellers.

3) Energy deflates, gold refuses to

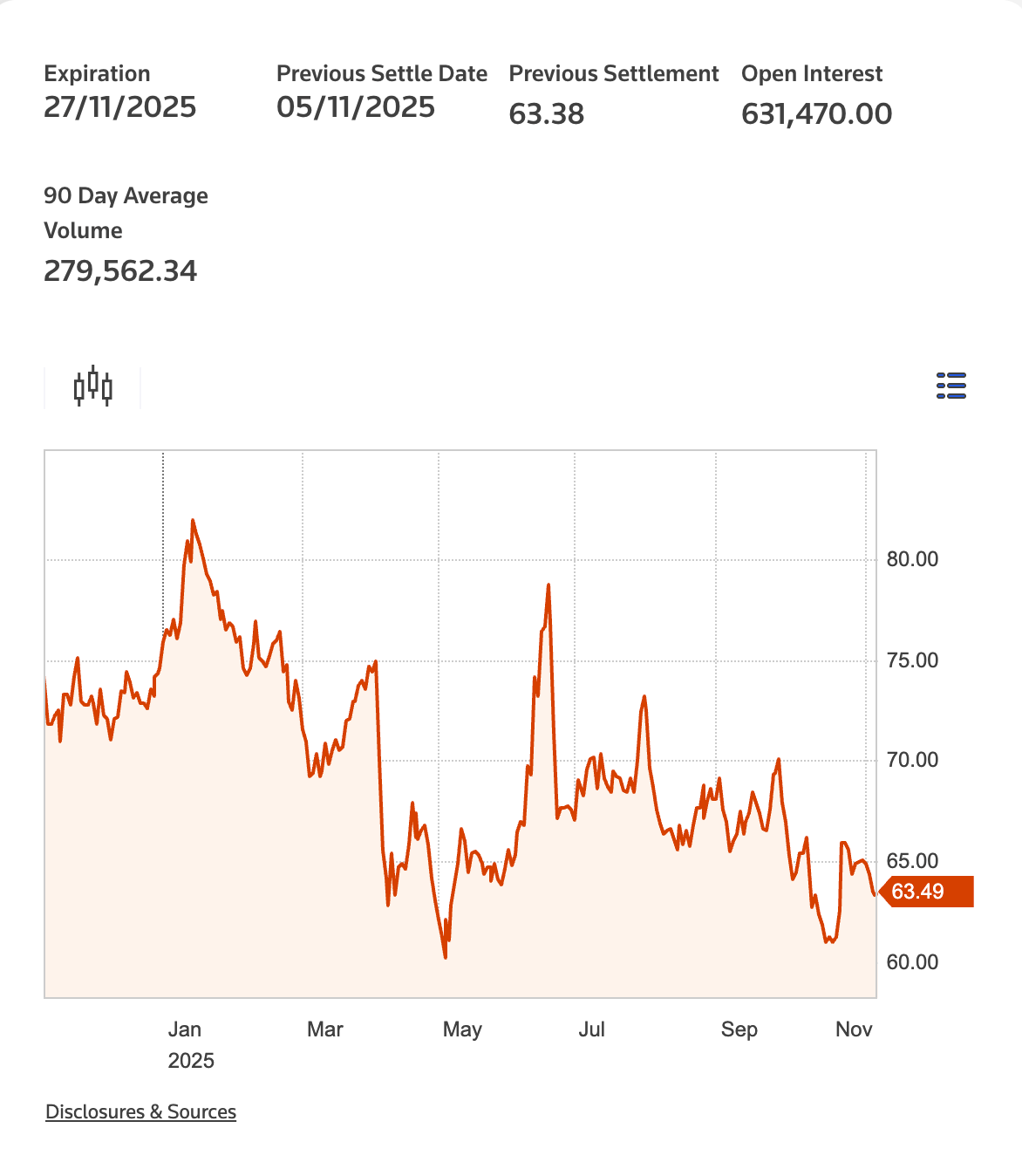

Quietly, oil is doing the Fed’s job. Brent hovered in the low-$60s and WTI in the high-$50s, on track for a second straight weekly loss as oversupply fears and softer U.S. demand outweighed OPEC+ choreography. A cheaper energy input bleeds into freight, plastics, and headline inflation—one reason bond markets didn’t panic when services activity perked up.

Gold told a complementary story. After printing records in recent months, the metal is holding near eye-watering levels as a hedge against political risk, legal fights over tariffs, and the simple reality that no one trusts the data stream right now. And the industry’s own crowd—traders and refiners—sees a wide cone of uncertainty from $3,000 to $5,000 on a 12-month view. Call it the “credibility premium.” When institutions wobble, hard assets get a bid.

Oil is whispering “disinflation,” gold is shouting “institutional risk.”

Strategy Spotlight: GLD-Tech Rotation

This week’s setup—tech froth fatigue, gold’s resilience, and a macro tape craving discipline—fits a structured barbell between growth beta and a crisis hedge. The GLD-Tech Rotation strategy systematically tilts between leveraged Nasdaq exposure and gold based on recent relative performance, with volatility guards (Bollinger-band constraints) to avoid chasing blow-off moves. It’s not a promise of returns; it’s a rule-set that acknowledges two truths: tech drives upside in “risk-on,” and gold preserves optionality when the system itself is the risk factor. In a market flying partly blind, rules beat narratives—and this strategy is explicitly rules-based and rebalanced daily by design.

If you’ve been whipsawed trying to time AI headlines and shutdown rumors, a disciplined rotation between GLD and tech can keep you exposed to what’s working without marrying the story. Past performance isn’t a guarantee, but process is a choice.

Big Picture: What to do with this mess

The shutdown isn’t just politics; it’s price action. It removes the referee’s whistle from the game, so players set the tempo. In that vacuum, liquidity (not logic) decides daily moves. The dollar drifts with sentiment. Yields stall because the bond market won’t front-run policy without data. Oil keeps bleeding—quietly easing the inflation narrative. Gold refuses to look away.

Three forward-looking points:

Policy fog is a factor, not a headline. If the Fed extends its balance-sheet conversation beyond plumbing, the market will read it as “implicit put.” That’s supportive for risk assets—until it isn’t.

Watch breadth, not just the index. If AI-adjacent megacaps chop while cyclicals and cash-flow compounders gain share, the S&P can mask a leadership change. Rotations can be profitable if you systematize them; they’re lethal if you chase them.

Energy is a shock absorber. If Brent holds low-$60s, headline inflation relief continues into year-end. That doesn’t force Fed cuts, but it lowers the hurdle for them—provided the data blackout ends before the Fed flies on instruments alone.

Disclaimer: This newsletter is provided for informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or any other sort of advice. The content herein represents the opinions and analysis of the authors and should not be considered a recommendation to purchase or sell any security. Surmount and its affiliates are not registered investment advisors. All investments involve risk, including the possible loss of principal. Past performance does not guarantee future results. Before making any investment decisions, you should consult with your own professional advisors and consider your individual financial situation, investment objectives, and risk tolerance. The strategies mentioned are not suitable for all investors.