- Analyzed Investing

- Posts

- Santa's Bailout: Markets Hit Records While the Fed Plays Scrooge

Santa's Bailout: Markets Hit Records While the Fed Plays Scrooge

The S&P just notched its 39th record close of 2025—but Powell's cutting only once in 2026. Here's what HENRYs need to know about the disconnect.

Santa's Bailout: Markets Hit Records While the Fed Plays Scrooge

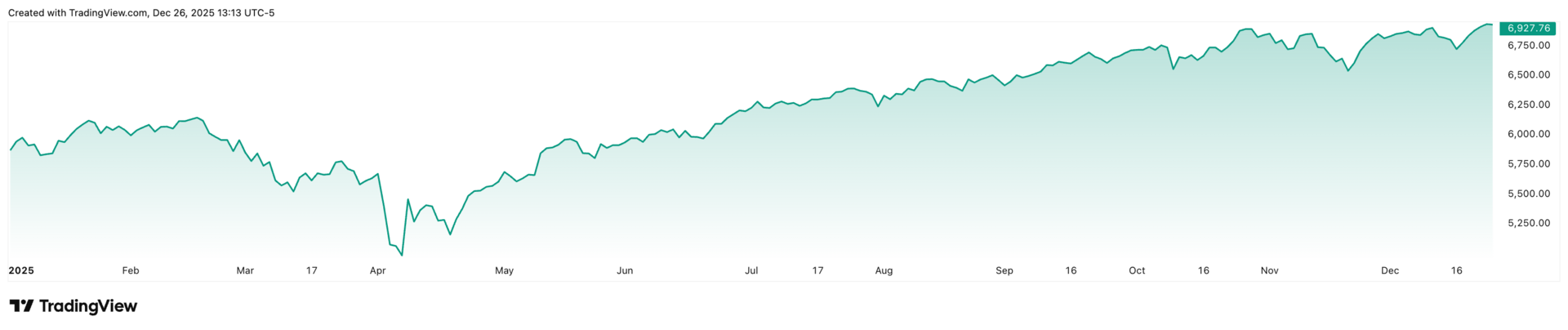

Hope everyone had a great Christmas. While you were unwrapping presents, Wall Street was wrapping up another record-breaking week. The S&P 500 closed Christmas Eve at 6,932, marking the index's 39th record of 2025—its fifth consecutive day in the green. The Dow hit 48,731, also a fresh milestone.

Markets took Thursday off for the holiday, and Friday's trade is light as everyone nurses their eggnog hangovers. But underneath the festive cheer, there's a story worth unwrapping: markets are pricing in perpetual gains while the Fed is signaling restraint, tariffs are reshaping trade flows, and AI infrastructure spending is hitting nosebleed levels.

For investors navigating 2026, this disconnect matters more than you think.

What investment is rudimentary for billionaires but ‘revolutionary’ for 70,571+ investors entering 2026?

Imagine this. You open your phone to an alert. It says, “you spent $236,000,000 more this month than you did last month.”

If you were the top bidder at Sotheby’s fall auctions, it could be reality.

Sounds crazy, right? But when the ultra-wealthy spend staggering amounts on blue-chip art, it’s not just for decoration.

The scarcity of these treasured artworks has helped drive their prices, in exceptional cases, to thin-air heights, without moving in lockstep with other asset classes.

The contemporary and post war segments have even outpaced the S&P 500 overall since 1995.*

Now, over 70,000 people have invested $1.2 billion+ across 500 iconic artworks featuring Banksy, Basquiat, Picasso, and more.

How? You don’t need Medici money to invest in multimillion dollar artworks with Masterworks.

Thousands of members have gotten annualized net returns like 14.6%, 17.6%, and 17.8% from 26 sales to date.

*Based on Masterworks data. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

The Fed's Hawkish Cut: One and Done?

The Federal Reserve delivered its third rate cut of 2025 earlier this month, bringing the federal funds rate to a range of 3.50%–3.75%. But here's where Santa turned into Scrooge:

What the Fed signaled:

The updated dot plot now projects just one cut in 2026 and another in 2027

That's a drastic slowdown from the three cuts markets were pricing in just months ago

Fed Chair Jerome Powell said the central bank is "well positioned to wait and see" (translation: we're not in a rush)

Why the Fed is pumping the brakes:

Core inflation remains stuck at 2.8%, well above the Fed's 2% target

GDP growth for Q3 came in at a surprisingly strong 4.3%, beating estimates handily

Unemployment sits at 4.6%—not alarming, but trending higher throughout the year

The internal drama:

Three members dissented from the decision—the most since 2019

This signals deep divisions within the committee about the path forward

Some officials want to keep cutting to support jobs; others are laser-focused on inflation

What it means for you:

Don't count on relief for mortgage rates or borrowing costs anytime soon

CME FedWatch now shows just 13.3% odds of a January cut, down from 24% a week ago

The "higher for longer" narrative is back

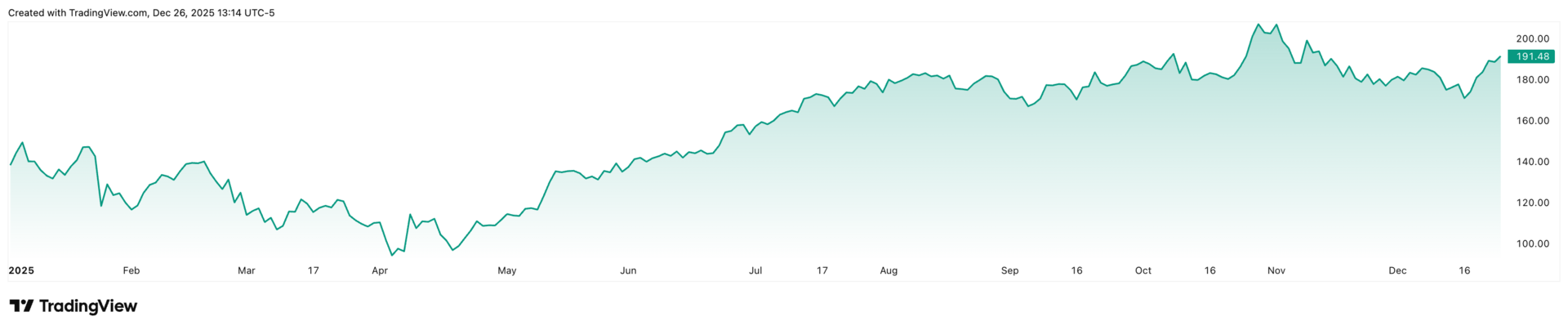

AI Infrastructure: $3 Trillion or Bust

While the Fed plays Scrooge, big tech is channeling Santa. Nvidia just posted $57 billion in revenue for Q3, up 62% year-over-year. CEO Jensen Huang is crowing that cloud GPUs are "sold out" and Blackwell chip sales are "off the charts."

The jaw-dropper:

Nvidia executives are forecasting $3 trillion to $4 trillion in annual AI infrastructure spending industry-wide by the end of the decade

The company has $500 billion in orders for Blackwell and Rubin chips through 2026

Who's spending:

Hyperscalers like Microsoft, Google, Amazon, and Oracle are in a full-blown arms race to build data centers

OpenAI alone is deploying at least 10 gigawatts of Nvidia systems for next-gen infrastructure

Foundation model builders like Anthropic and Mistral are also spending aggressively

The bubble question:

This is an extraordinary bet that AI workloads will justify the capex blowout

Data centers are speculative assets that could face a reckoning in 2-3 years when the world reaches full capacity, as analysts have warned

OpenAI and other model developers are spending like drunken sailors while revenues lag way behind

The question isn't whether AI is real—it obviously is—but whether the investment timeline matches reality

For now, Nvidia is printing money. But if the AI hype cycle peaks before tangible ROI materializes, late-stage investors could be left holding very expensive hardware.

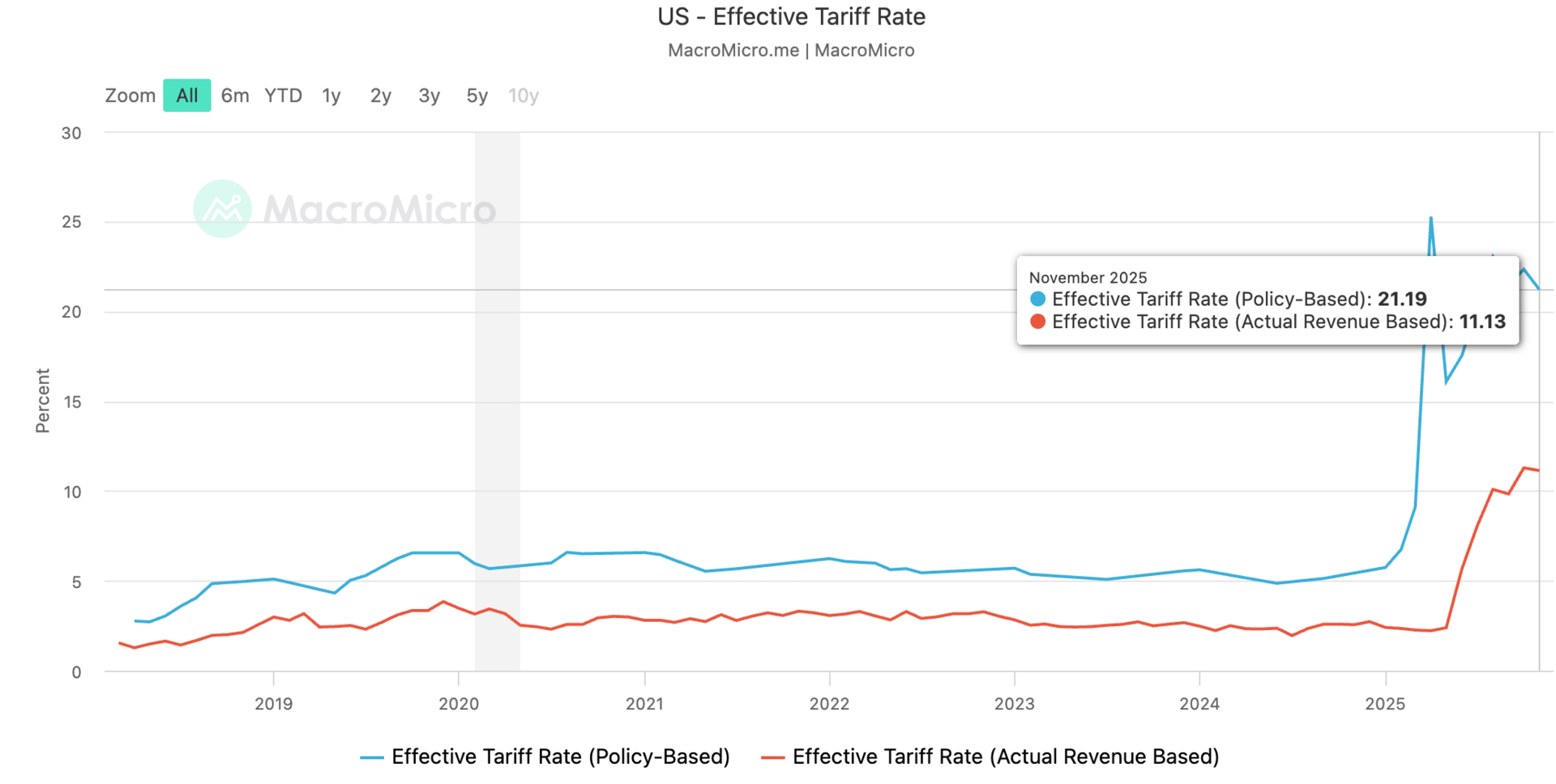

Tariffs: The Year-End Gift Nobody Asked For

Trump's trade war defined 2025 in ways few expected. The tariffs have become a permanent feature of the economic landscape, and they're not going away.

The numbers:

The effective U.S. tariff rate hit nearly 17% in November—the highest since 1935

That's seven times greater than January's average

The tariffs have raised over $236 billion through November

The impact:

Chinese imports fell nearly 25% in the first three quarters of the year

Imports from Mexico, Vietnam, and Taiwan surged as companies scrambled to reroute production

The tariffs amount to an average tax increase of $1,200 per U.S. household in 2025

Job growth has actually slowed, and the promised surge in manufacturing jobs hasn't materialized

What you need to know:

Expect higher prices on everything from electronics to apparel

Don't bet on meaningful tariff rollbacks in 2026

Supply chain disruptions will continue to create volatility

Strategy Spotlight: GLD-Tech Rotation

Markets are playing tug-of-war between AI euphoria and Fed hawkishness, and the GLD-Tech Rotation strategy is built for exactly this kind of whipsaw environment.

The approach is elegantly simple: algorithmically alternate between ProShares UltraPro QQQ (TQQQ) and SPDR Gold Trust (GLD) based on which is outperforming. The strategy rebalances daily, increasing holdings in the relative winner while using Bollinger bands as a safety net. When prices move more than 1.5 standard deviations from their 20-day average, it automatically pulls back to 50% capital deployment—protecting against the kind of tail risks that come with record valuations.

This week perfectly illustrates why this matters. Tech exposure captures the AI infrastructure rally pushing Nvidia and mega-caps to fresh records, while gold provides the hedge when Fed policy uncertainty spikes or tariffs rattle sentiment. You're not making a binary bet on growth or safety—you're following momentum while the algorithm handles the risk management.

In a market where Powell can turn hawkish overnight and Nvidia can add $100 billion in market cap on a single earnings call, having a system that adapts daily beats trying to time every twist yourself. It's a disciplined, structured approach to playing both sides of the risk-on/risk-off trade—not a guarantee of returns, but a systematic response to the volatility HENRYs will face in 2026.

Big Picture: Don't Confuse Momentum with Inevitability

Markets are riding a Santa Claus rally—historically defined as gains during the last five trading days of December and the first two of January. Since 1950, the S&P has averaged a 1.3% gain during this period, occurring about 80% of the time.

The historical pattern:

Successful Santa rallies have preceded three months of market outperformance

Failed rallies tend to signal three months of underperformance

The last strong Santa rally was in 2018, when the S&P jumped 4.1%

This year's setup:

Sentiment is buoyant, GDP is strong, and earnings have been solid

But valuations are stretched, the Fed is tapping the brakes, and AI spending is starting to look like the ultimate bet-the-farm trade

Markets are priced for perfection in an environment where perfection is unlikely

What to watch heading into 2026:

The same forces driving records today—loose financial conditions, AI euphoria, retail FOMO—can reverse quickly

The Fed isn't coming to the rescue with aggressive rate cuts

Tariffs are a permanent tax until policy changes

AI infrastructure is a multi-trillion-dollar gamble with an uncertain payoff timeline

Momentum is real until it isn't. Stay tactical, stay disciplined, and don't assume the rally lasts forever just because it's lasted this long. Markets have a way of humbling those who confuse a good year with a permanent trend.

Enjoy the rest of the holiday week—and we'll see you in 2026.

Until next week,

Analyzed Investing