- Analyzed Investing

- Posts

- Markets Price in Salvation While Legends Bet Against the Bubble

Markets Price in Salvation While Legends Bet Against the Bubble

Rate cuts won't save you from what's coming. While Wall Street cheers the Fed's expected pivot, Burry and Chanos are shorting the AI trade—and the math says they might be right.

We've upgraded our infrastructure: analyzedinvesting.framer.website is now home. Your Friday newsletter isn't going anywhere, but now you've got a proper archive of every contrarian call we've made.

Learn how to make every AI investment count.

Successful AI transformation starts with deeply understanding your organization’s most critical use cases. We recommend this practical guide from You.com that walks through a proven framework to identify, prioritize, and document high-value AI opportunities.

In this AI Use Case Discovery Guide, you’ll learn how to:

Map internal workflows and customer journeys to pinpoint where AI can drive measurable ROI

Ask the right questions when it comes to AI use cases

Align cross-functional teams and stakeholders for a unified, scalable approach

The Week That Broke the AI Narrative

Welcome to December, where market expectations of a Fed rate cut have climbed to 87% and everyone's convinced the cavalry is coming. The S&P 500 finished the week near 6,850, just shy of record highs, fueled by five consecutive days of gains heading into month's end. Bitcoin crashed below $86,000—down 30% from October's peak—taking crypto proxies like Strategy and Coinbase down with it. And while traders dream of Santa rallies, the ghosts of market crashes past are making their voices heard.

The legends are circling. Michael Burry, the man who bet against the housing bubble, published a scathing takedown of Tesla, calling it "ridiculously overvalued" and warning that Musk's $1 trillion pay package will dilute shareholders by another 3.6% annually. Jim Chanos—the Enron killer himself—is now targeting Nvidia, warning that the $20+ billion in GPU-backed debt secured by loss-making "neocloud" companies like CoreWeave is a house of cards waiting to collapse.

When the two most successful short sellers of the past two decades start circling the same trade, high earners should pay attention.

The AI Bubble's Dirty Secret: It's Built on Borrowed Time (and Borrowed Money)

Here's what Wall Street doesn't want you to know: the entire AI infrastructure boom is being financed by chips as collateral. Emerging cloud operators have taken out massive loans backed by Nvidia GPUs, betting they can generate enough revenue before the hardware depreciates into worthlessness. Chanos points out the fatal flaw: most cloud firms assume their chips will generate revenue for six years, but Nvidia releases new generations every 18 months. If the actual useful life is closer to three years, "the whole economics of a lot of these deals kind of falls apart."

CoreWeave alone posted $770 million in losses so far this year. The company is unprofitable, burning cash, and using rapidly-depreciating GPUs as loan collateral. Sound familiar? It should—it's the same playbook Lucent used before implosion in the dot-com crash.

Meanwhile, Tesla trades at 294 times trailing earnings on a $1.43 trillion market cap, despite revenue growth cooling to 12% and operating margins compressing from 9.2% to 7.2%. Burry's criticism cuts deep: Tesla dilutes shareholders without buybacks, and the narrative has shifted from "EV company" to "robotaxi/humanoid robot moonshot" precisely because the core auto business is weakening. The pivot is the tell.

The Fed's December Dilemma: Data Fog and Political Pressure

Here's where it gets interesting. The Fed is flying blind. The 43-day government shutdown—the longest in U.S. history—delayed or canceled critical economic releases. No November jobs report. The September PCE data, the Fed's preferred inflation gauge, won't be released until tomorrow (December 5). Core PCE has been creeping back toward 2.9%—nearly a full percentage point above target—while the labor market shows confusing signals.

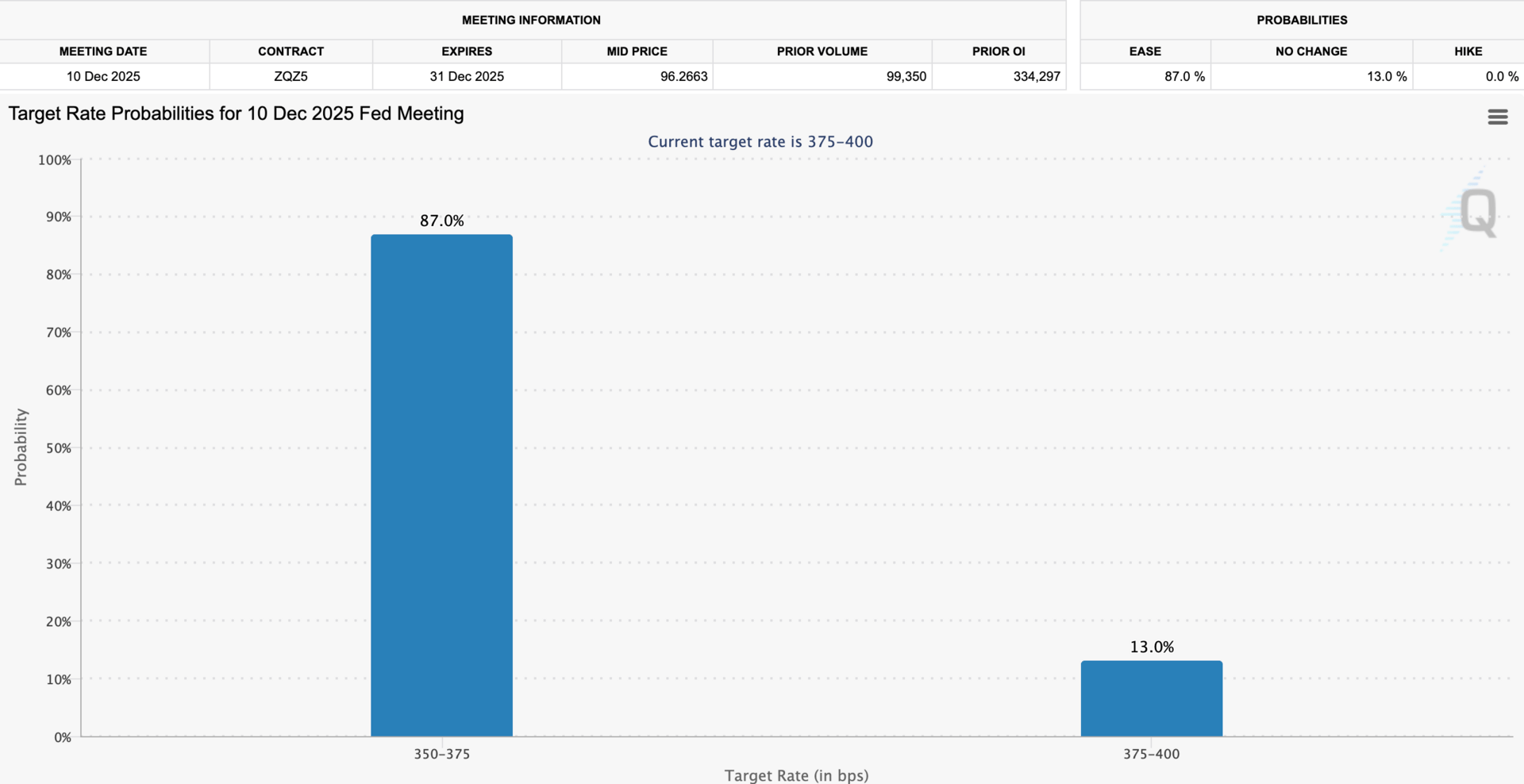

The Cleveland Fed's "nowcast" suggests inflation remains stubbornly elevated. Yet 86.9% of traders are pricing in a December 10 rate cut. The disconnect is staggering. Markets want cuts. The Fed needs data. Powell has already warned that a December cut is "not a foregone conclusion", yet Wall Street keeps frontrunning the trade.

What happens when expectations meet reality? Historically, not well.

The other wildcard: Trump has already picked Powell's replacement, and the announcement is expected soon. Political pressure on Fed independence is intensifying. When central banks lose credibility, inflation expectations become unanchored. This is the risk no one's pricing in.

AlphaFactory Protective—The Volatility Ejection Seat

Here's the problem with going full bear: what if you're early? What if December brings the Santa rally everyone's pricing in, the Fed cuts rates, and the market rips another 10% before reality sets in? You'll watch from the sidelines, kicking yourself.

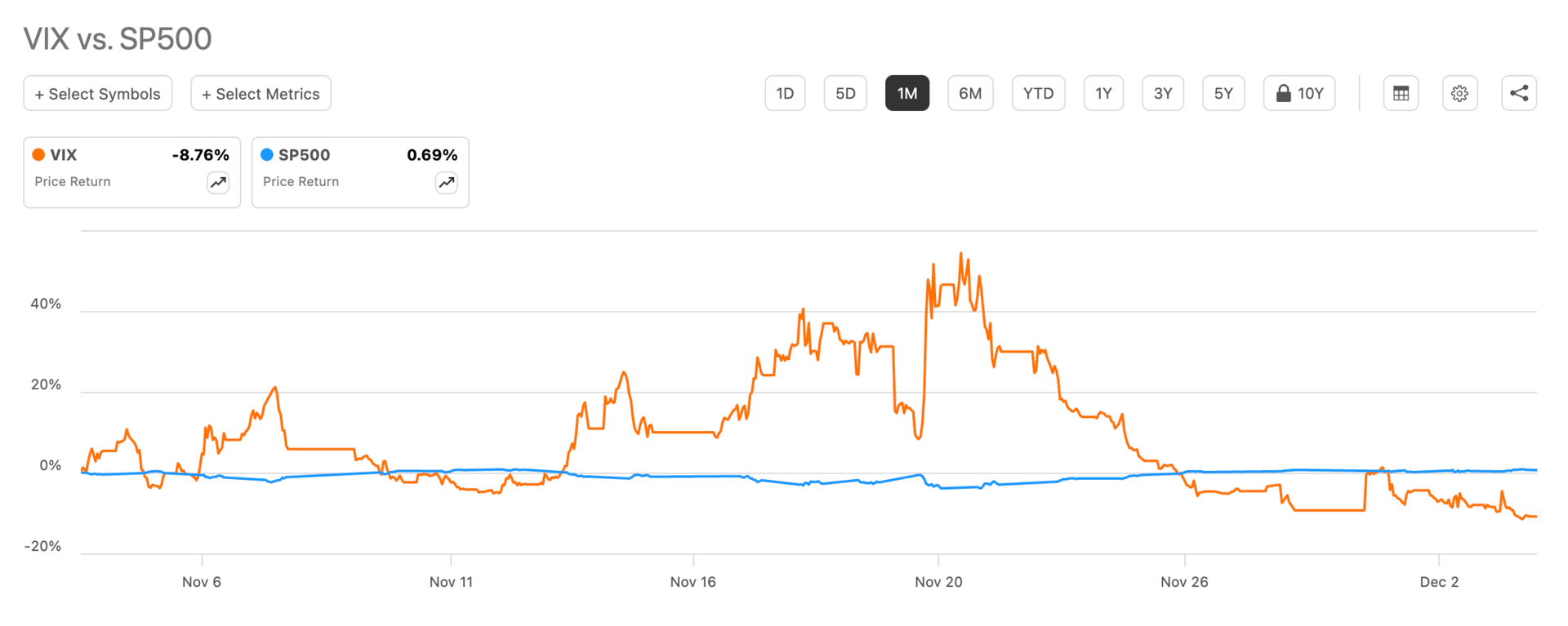

But here's the problem with staying fully invested: when Burry and Chanos are both shorting the AI trade, when VIX remains elevated despite December's traditional calm, and when the Fed is making policy decisions with a 43-day data blackout—blind optimism is how portfolios get vaporized.

The third way: algorithmic risk management that rides momentum until volatility screams danger.

Surmount's AlphaFactory Protective strategy is the unexpected answer to this week's impossible question. This systematic approach has delivered a 36.64% annual return with a Calmar ratio of 2.00—meaning it's generating twice as much return per unit of drawdown risk compared to most strategies. The 1-year return sits at 13.50%, but the real story is in how it gets there: by dynamically shifting between 10 large-cap stocks and gold based on SPY realized volatility.

The mechanics:

Low volatility → Full allocation to growth stocks (currently 50% NVDA, 50% AAPL), weighted by momentum and value

Moderate volatility → Mixed allocation between equities and GLD

High volatility spikes → Automatic defensive shift to preserve capital

Right now, the strategy is positioned exactly where you'd want it: concentrated in Nvidia and Apple during relatively calm conditions, but with the algorithmic discipline to pivot the moment volatility signals danger. It's calculated 1.39 trades per day—active enough to respond to changing conditions, but disciplined enough to avoid overtrading costs.

The S&P 500 is within 1% of all-time highs, but the VIX hasn't returned to complacency levels. When 87% of traders price in a rate cut while core PCE sits at 2.9%, when Bitcoin crashes 30% and GPU-backed debt threatens defaults—you need a strategy that can participate in upside without betting the farm.

The beauty of AlphaFactory Protective is that it doesn't require you to predict the crash. It responds to volatility in real-time, automatically de-risking when market stress appears and re-engaging when conditions stabilize. You get growth exposure during calm markets with an automatic ejection seat when volatility spikes.

This isn't market timing. It's volatility-aware exposure management—exactly what HENRYs need when the market is pricing in salvation while legends bet against the bubble.

Disclosure: This is not personalized investment advice. Past performance does not guarantee future results. Performance data is historical and based on backtested results.

Big Picture: Valuations, Velocity, and the Coming Volatility Spike

Let's zoom out. The S&P 500 is up 15% year-to-date, the Nasdaq 20%, powered almost entirely by mega-cap tech and AI plays. Meta dropped 13% in November, Nvidia fell 11%, Oracle cratered 30%. But Google surged 20%, and Apple hit all-time highs above $280. The concentration risk is extreme: roughly 40% of the S&P 500's weight is in the top 10 holdings.

When Raymond James' quant strategists warn of a "corrective phase" that could drive the S&P down 10% in three months, and when both Burry and Chanos are publicly shorting the AI trade, high earners should ask themselves: Is this the time to chase performance, or is it time to preserve capital?

History offers clarity. Every bubble follows the same script: disbelief, greed, blow-off top, denial, panic. We're somewhere between greed and denial. The question isn't if the correction comes—it's whether you'll be positioned for it.

The takeaway: December might bring a seasonal rally, or it might bring a reckoning. The smart money is hedging. The leveraged money is praying for rate cuts. And the legends who called the last two major crashes are shorting the very stocks everyone else is still buying.

Choose your side carefully.

Disclaimer: The information provided in this newsletter is for educational and informational purposes only and should not be construed as financial, investment, tax, or legal advice. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities, investments, or financial products.