- Analyzed Investing

- Posts

- The AI Chip Shortage Nobody's Pricing In—While BYD Just Buried Tesla

The AI Chip Shortage Nobody's Pricing In—While BYD Just Buried Tesla

Wall Street keeps celebrating new highs while ignoring the supply crisis quietly unraveling the AI boom's infrastructure.

This Week in Markets

Markets hit record highs this week on weak jobs data, which apparently now counts as good news. The S&P 500 and Dow notched all-time highs Wednesday after the ADP report showed just 41,000 private jobs added in December—below the already-anemic 47,000 forecast. Wall Street's logic? Weak hiring means the Fed will cut rates, so growth stocks can keep levitating.

But dig one layer deeper and the "Goldilocks" narrative starts cracking. Job openings hit a five-year low at 7.1 million, unemployment sits at 4.6%—its highest post-pandemic level—and inflation remains stubbornly above the Fed's 2% target. The official story says this is a soft landing. The bond market, quietly, is pricing something else entirely.

BYD Just Pantsed Tesla, and Wall Street's Not Even Watching

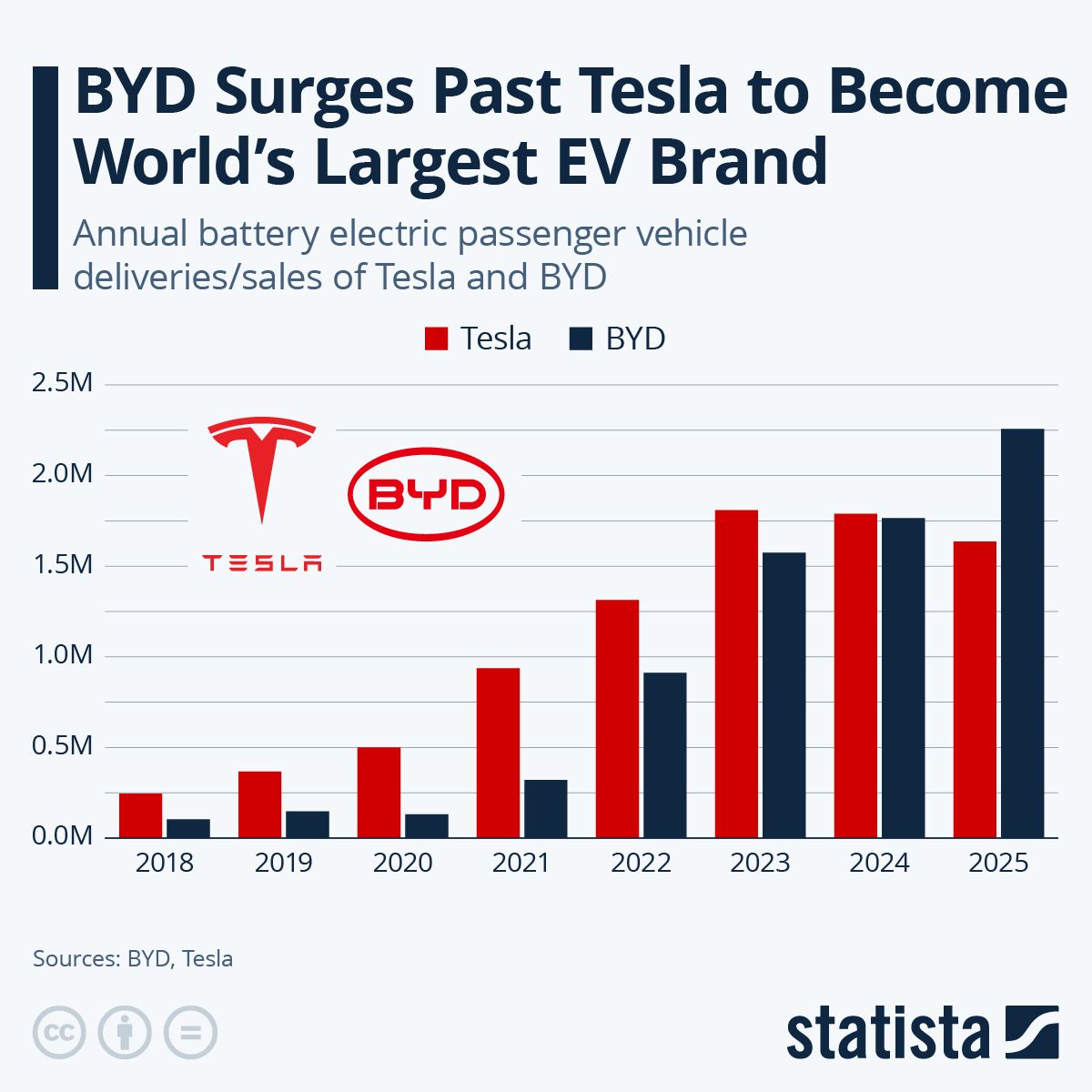

While Tesla bulls fixated on robotaxis and Elon's latest political spectacle, something seismic happened: BYD crushed Tesla in global EV sales for the first time ever. The Chinese automaker sold 2.26 million battery-electric vehicles in 2025, up 28% year-over-year, while Tesla's deliveries fell 9% to just 1.64 million—marking its second straight year of declining sales.

Let that sink in: the company Elon Musk openly laughed at in 2011, dismissing their products during a Bloomberg interview, just became the world's largest EV manufacturer. Tesla's fourth-quarter deliveries plunged 15.6% year-over-year to 418,000 units, with European sales collapsing 28% amid political backlash against Musk and the expiration of the $7,500 federal tax credit that previously propped up demand.

Number of Tesla vehicles delivered worldwide from 1st quarter 2016 to 3rd quarter 2025 (in 1,000 units)

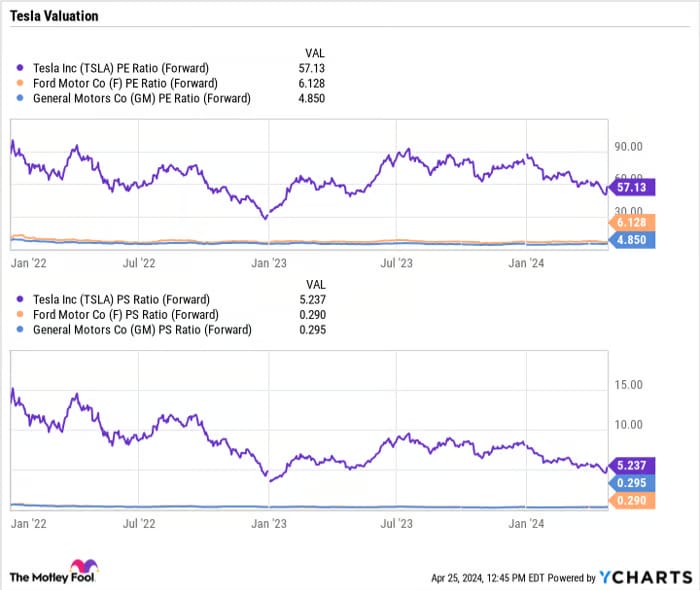

Wall Street's response? Tesla shares barely flinched. The narrative remains: "Tesla is an AI/robotics company now, not a car company." How convenient that the pivot happens right as they lose the EV crown.

The reality Wall Street's ignoring: BYD achieved this while fighting fierce domestic competition and relentless price wars in China. They did it with vertical integration, tight cost control, and a broad product portfolio spanning tiny city cars to luxury sedans—while Tesla still relies on the same two models for 95% of its volume. BYD's overseas sales surged 150%, and they're just getting started in markets where Tesla has dominated for years.

The broader shift is undeniable: China went from domestic EV champion to global pace-setter, and Western automakers—not just Tesla—are scrambling to respond. The narrative that American innovation would dominate the EV transition? It's looking increasingly obsolete.

The AI Boom's Dirty Secret: It's Running Out of Memory

Speaking of things Wall Street isn't pricing: the AI infrastructure build-out everyone's celebrating is quietly hitting a wall. There's a global memory chip shortage that's about to make gadgets significantly more expensive—and it's getting worse, not better.

Here's what happened: As AI data centers gobbled up compute capacity, memory manufacturers like Samsung, SK Hynix, and Micron redirected production capacity toward high-margin High Bandwidth Memory used in AI accelerators. The result? A structural shortage of conventional DRAM and NAND for consumer devices.

DRAM prices surged roughly 50% in 2025 and are expected to climb another 30% in Q4 2025, followed by 20% more in early 2026. SK Hynix reported that its memory capacity is "essentially sold out" for 2026. Even Samsung—which manufactures its own memory—warned that supply shortages will affect everyone, forcing the company to consider price increases across its product lineup.

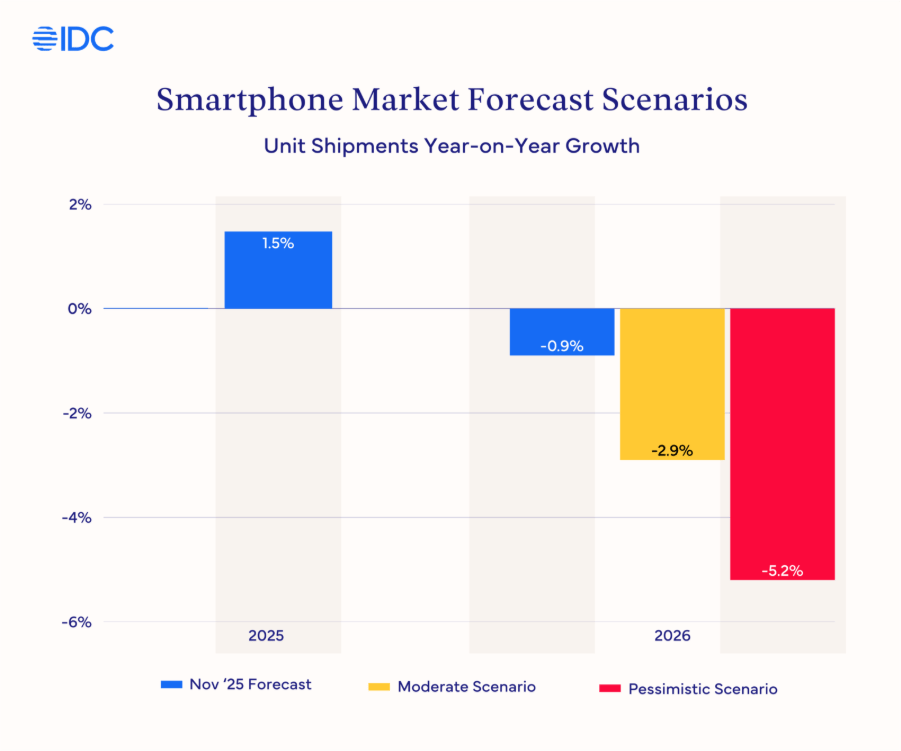

The timing couldn't be worse. Microsoft's Windows 10 end-of-life is supposed to drive a massive PC refresh cycle, except IDC warns the PC market could contract up to 9% in 2026 instead because manufacturers can't afford—or even obtain—enough RAM. Major PC vendors are signaling 15-20% price increases for H2 2026.

The smartphone market faces similar pressure. Chinese manufacturers like Xiaomi are warning of price hikes as memory costs squeeze margins, while Apple and Samsung—with their long-term supply contracts—capture market share from smaller brands that can't secure chips at any price.

And the kicker? Chipmakers aren't scaling up capacity. Micron's next new factory won't come online until 2027. By late 2026, manufacturers will have maxed out expansion in current facilities. The AI boom everyone's celebrating is cannibalizing the supply chain for everything else—and nobody's building enough capacity to fix it.

So while Wall Street celebrates trillion-dollar AI infrastructure spend, the actual bottleneck—the memory that makes it all work—is tightening by the month. Good luck building that AI future when you can't get the chips.

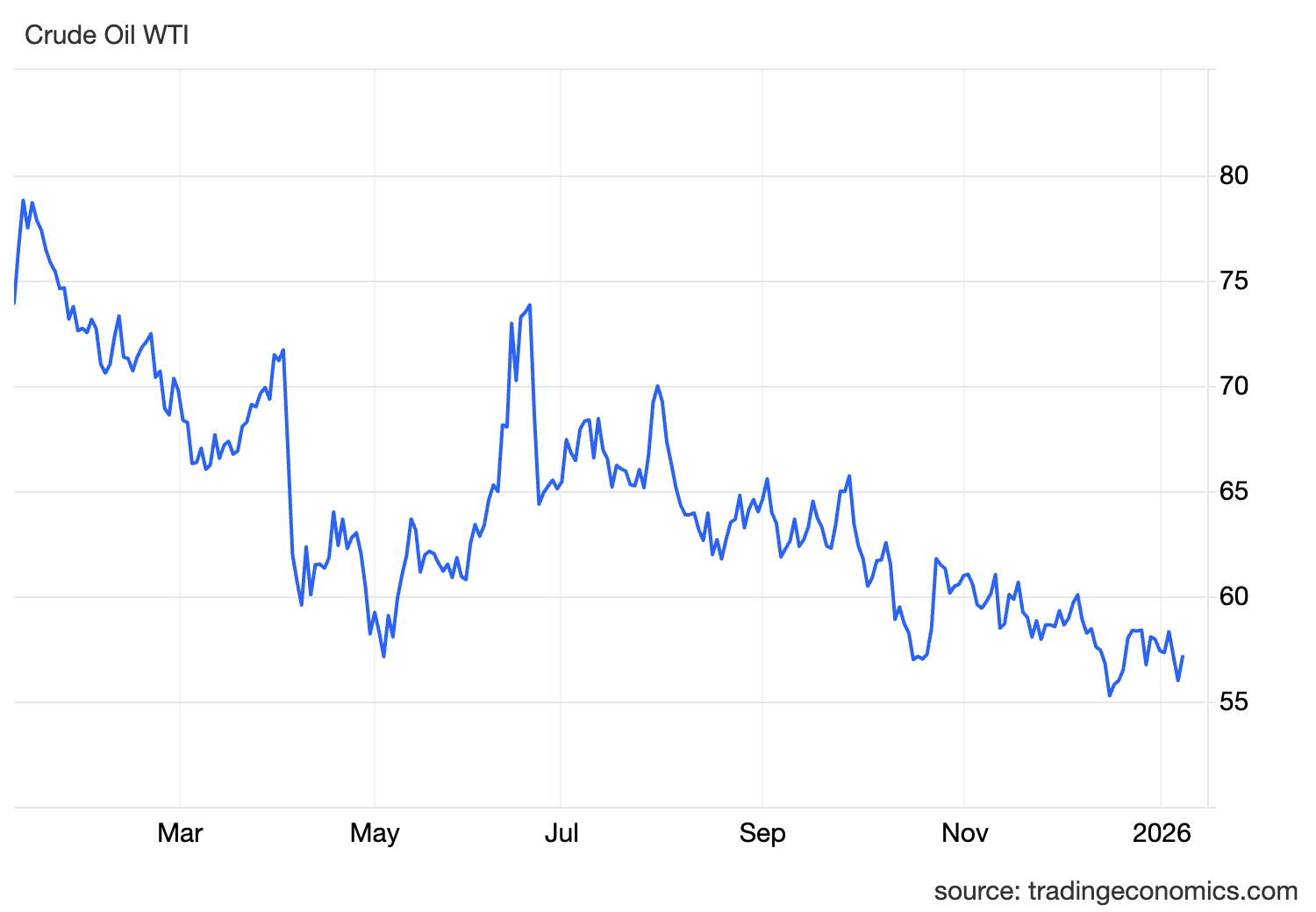

Oil's Quiet Collapse: $57 Crude in a "Booming" Economy

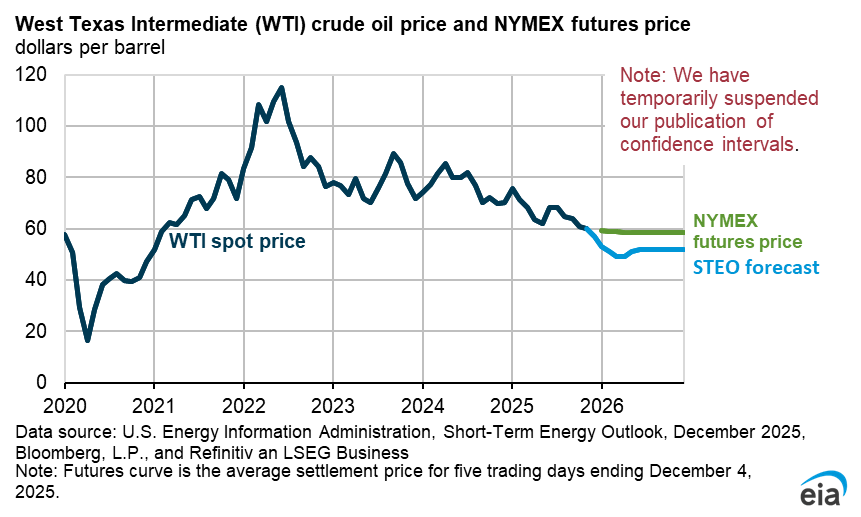

While tech stocks hit records, energy markets are telling a very different story. WTI crude closed 2025 around $57 per barrel—down nearly 20% for the year, marking oil's biggest annual loss since 2020. Brent fell about 19% over the same period.

The culprit? OPEC+ aggressively unwound production cuts throughout 2025, adding over 2.9 million barrels per day to global supply in response to Trump's persistent pressure to lower prices. The group has now paused further increases through March 2026, but the damage is done: the IEA projects supply will outstrip demand by 3.85 million barrels per day in 2026—roughly 4% of global consumption.

The EIA forecasts Brent will average around $55 per barrel through 2026, with some analysts projecting a dip to $50 by mid-year. U.S. drillers are already responding to low prices by scaling back: domestic production is expected to decline by 100,000 barrels per day to 13.5 million in 2026.

For consumers, this means average U.S. gas prices could fall below $3 per gallon for the first time since 2020—translating to $11 billion less spent at the pump compared to 2025. But for energy investors, it's carnage. The narrative was supposed to be "AI drives energy demand." Instead, oversupply is crushing prices while everyone focuses on data center buildouts.

Strategy Spotlight: Protection When Divergences Signal Danger

For investors watching bonds and stocks tell contradictory stories while supply constraints threaten the AI buildout, Surmount's AlphaFactory Protective strategy offers a systematic approach to defensive positioning. Rather than staying fully exposed to equities hitting all-time highs on weakening fundamentals, this strategy dynamically adjusts between high-conviction stocks and gold based on market volatility.

The core logic: The strategy maintains a basket of 10 large-cap stocks selected using momentum and value scores, but incorporates a protective mechanism tied to SPY's realized volatility. In low volatility environments, it allocates fully to stocks. As volatility rises into moderate ranges, it blends stocks with gold. In high volatility regimes—the kind that often accompanies the market realizing consensus was wrong—it shifts entirely to defensive positioning.

Under current conditions, with the 10-year Treasury yield around 4.15%, job openings at five-year lows, and memory supply constraints threatening to derail the AI narrative everyone's banking on, the systematic risk management becomes particularly relevant.

This is a disciplined, rules-based approach—not a guarantee against losses. But when equity markets are celebrating record highs while bond markets price persistent inflation and supply chains show structural cracks, having systematic exposure that adapts to volatility can provide crucial protection if one of these narratives breaks badly.

What Wall Street's Missing

This week's record highs came on deteriorating labor data that bulls spun as good news for rate cuts. Meanwhile, the actual infrastructure supporting the AI boom—memory chips—is running into hard supply constraints that will ripple through consumer electronics pricing for years. The EV transition everyone assumed would be American-led just crowned a Chinese champion that's accelerating away. And energy markets are pricing in economic weakness that equity investors are blissfully ignoring.

The market's betting on a soft landing and endless AI growth. The bond market is pricing persistent inflation and a Fed that's out of ammunition. Memory manufacturers are sold out through 2026 with no new capacity coming online soon. Oil's at $57 despite geopolitical chaos that would've sent it to $100 five years ago.

One of these narratives is catastrophically wrong. The smart money isn't celebrating new highs—it's watching which story breaks first.

Until next week,

Analyzed Investing