- Analyzed Investing

- Posts

- Happy New Year: Three Straight Years of Double-Digit Gains—and the Red Metal That's Stealing the Show

Happy New Year: Three Straight Years of Double-Digit Gains—and the Red Metal That's Stealing the Show

Markets close 2025 with a rare three-peat of 20%+ returns. But the real story? Copper just posted its best year since 2009, and it's telling us where the smart money is headed.

Happy New Year: When the Same Trade Works Three Years Running, Pay Attention

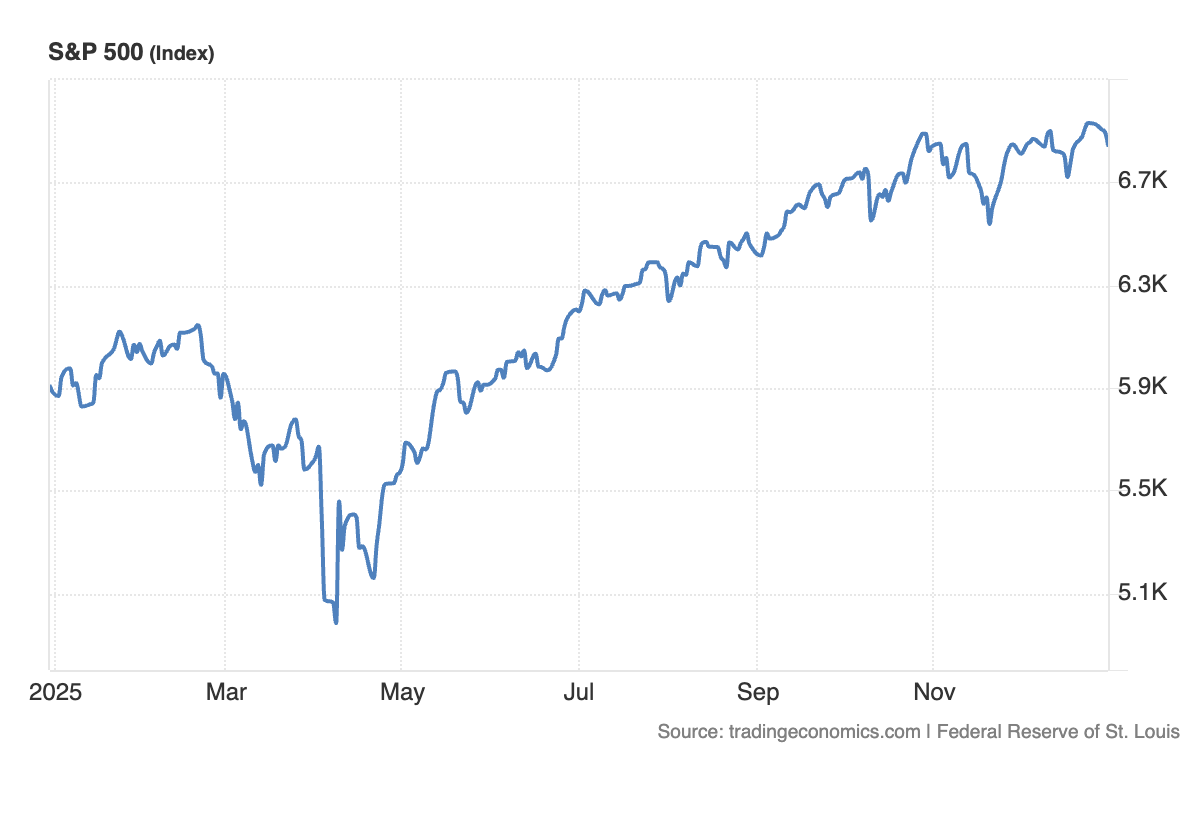

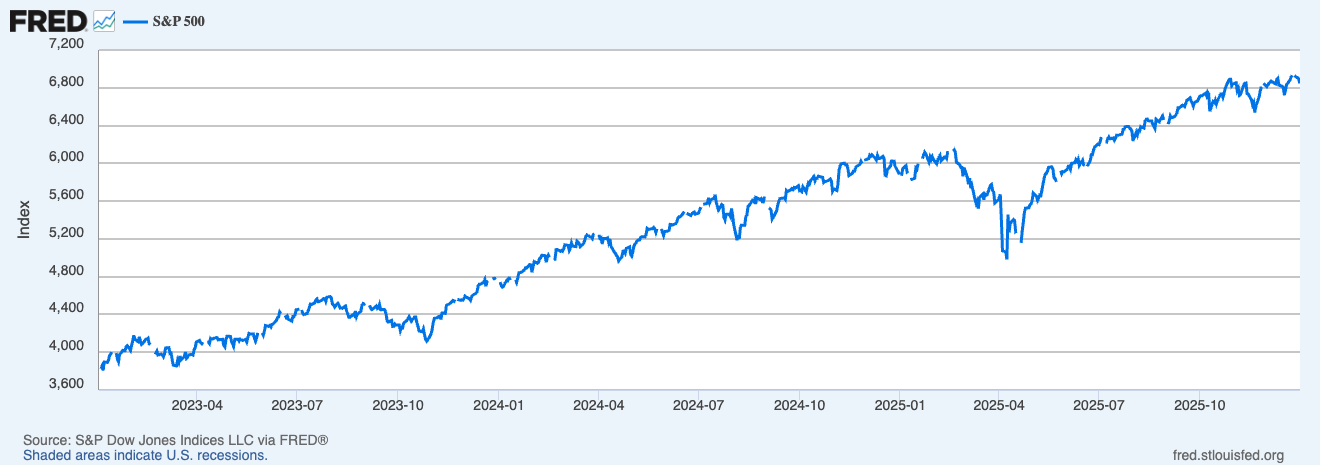

Happy New Year. While you were recovering from New Year's Eve, the S&P 500 quietly closed out 2025 with a 16.4% gain—its third consecutive year of double-digit returns. The Nasdaq surged 20%, the Dow climbed 13%, and the market hit this trifecta despite April's tariff chaos, the longest government shutdown in U.S. history, and persistent fears of an AI bubble bursting.

Three straight years of 20%+ gains? That's only happened six times since the 1940s. The 1990s delivered five consecutive years before the dot-com crash. So yes, these streaks eventually end—but they don't follow a schedule. The question isn't when this rally dies, but what happens next and where the next wealth cycle gets built.

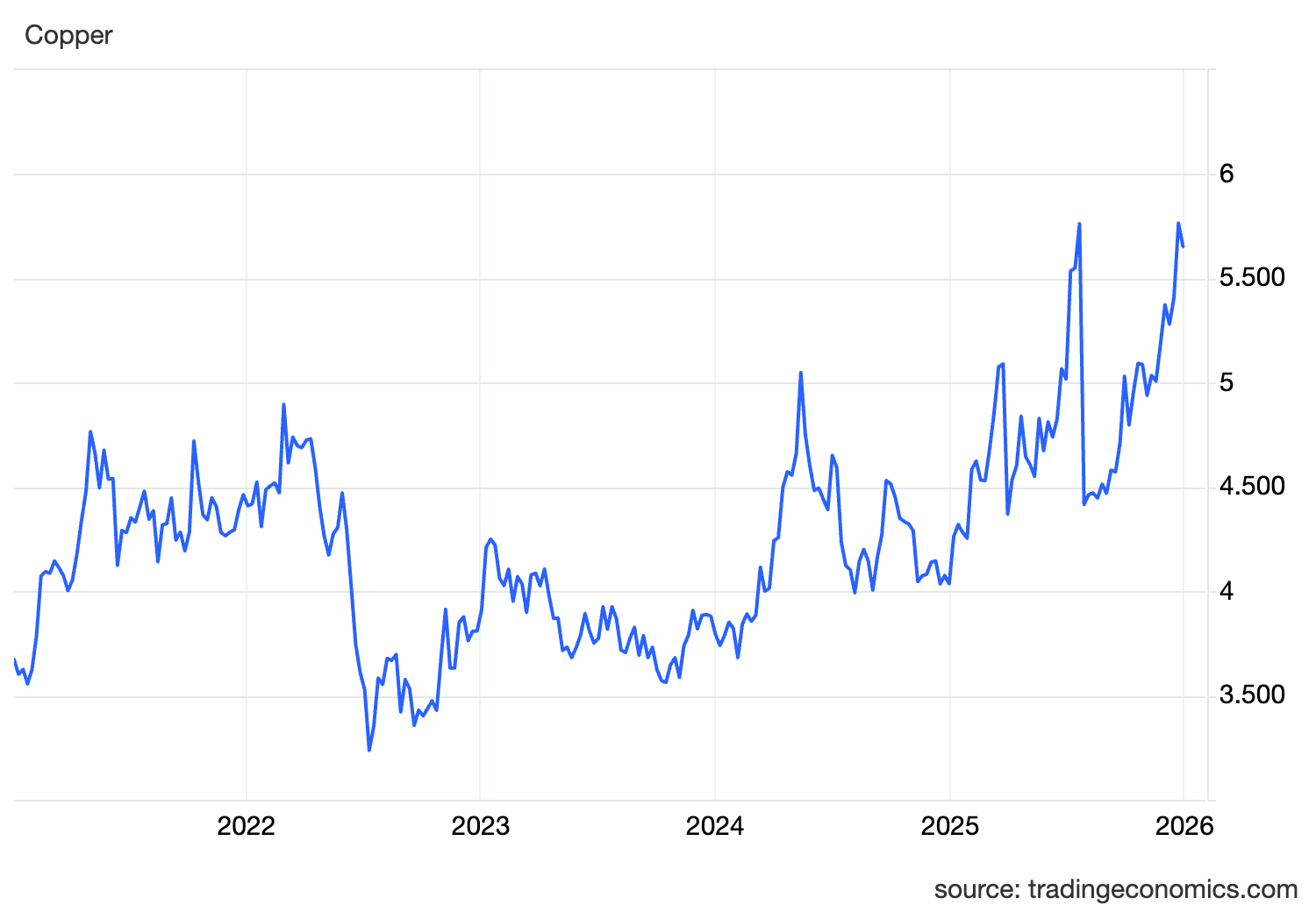

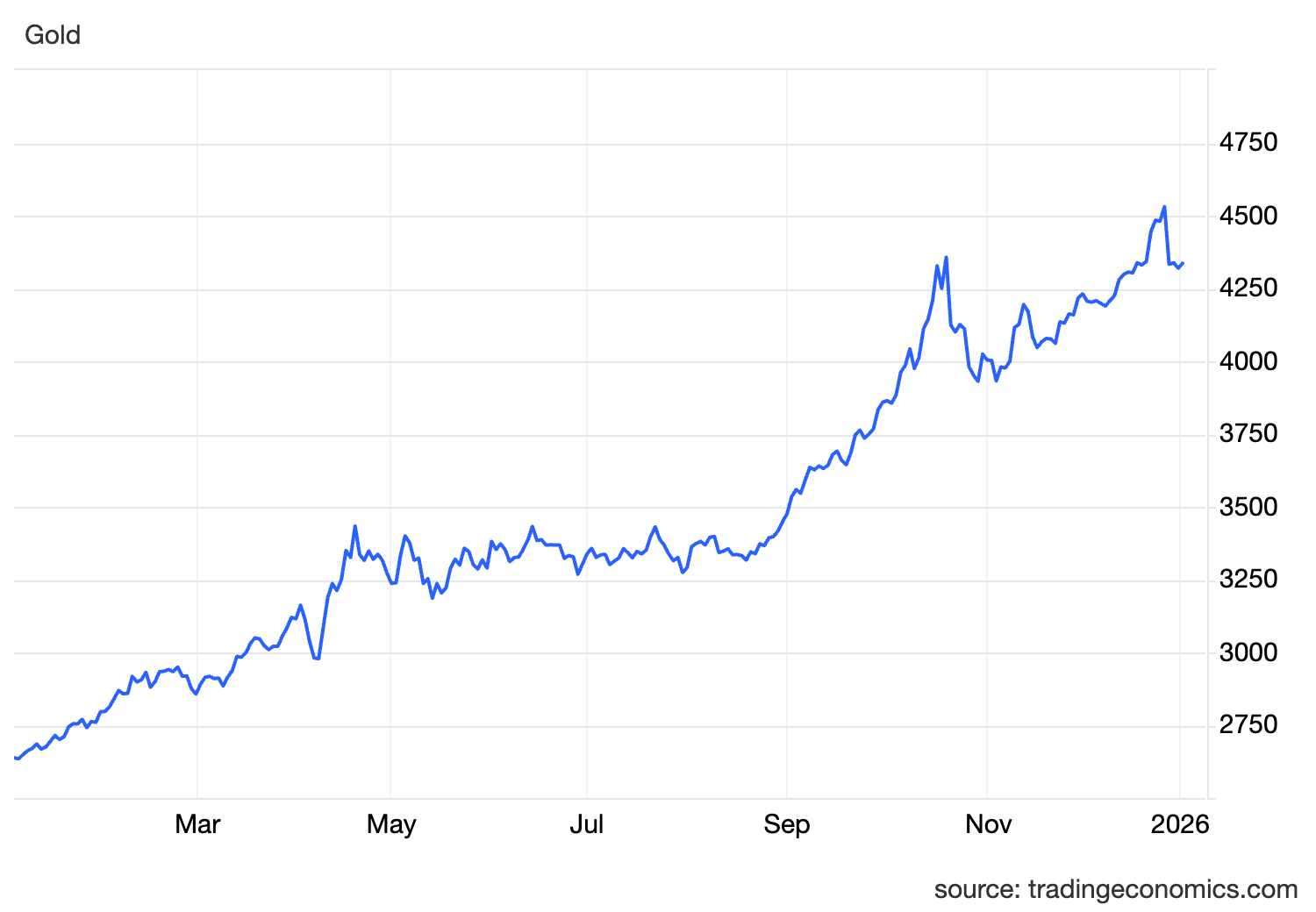

The consensus says it's all AI and mega-cap tech. Partially true. But here's what the champagne-soaked headlines missed: copper prices surged 41% in 2025, notching their best year since 2009, while precious metals had their strongest performance since 1979—gold jumped 64% and silver exploded 140%. These aren't random commodity spikes. They're signaling where institutional capital is actually flowing beneath the surface noise.

So let's talk about what actually matters as we start 2026: the trends already reshaping portfolios, the sectors getting real capital deployed at scale, and the strategies that make sense when you're building wealth for decades, not just riding the next momentum trade.

The Copper Supercycle: AI's Billion-Dollar Bottleneck

While retail investors obsessed over Nvidia's latest earnings, copper became the commodity trade of 2025. The metal hit record highs above $12,000 per metric ton in December, and here's why it matters more than another GPU launch:

Every AI data center built requires massive copper infrastructure—we're talking 27 tons of copper per megawatt of power capacity according to studies of Microsoft's Chicago facility

Traditional data centers need 5,000-15,000 tons of copper. AI-specific hyperscale facilities? Try 50,000 tons per facility—a 10x jump driven by extreme power demands and advanced cooling requirements

JPMorgan projects copper averaging $12,075 per ton through 2026, with data center demand as the primary driver, potentially rising 30% year-over-year

But here's the problem nobody wants to talk about: global copper supply is heading for a 30% deficit by 2035, according to the International Energy Agency. Mine development takes over a decade, and the industry has chronically underfunded new capacity—$76 billion invested over six years when $210 billion was needed.

Translation? The AI infrastructure boom everyone's betting on is running headfirst into a materials shortage that can't be fixed with venture capital, clever algorithms, or Elon Musk tweets. When tech giants are competing to build AI infrastructure and the physical materials can't keep pace with demand, that's not speculation—that's basic supply-demand economics driving prices higher.

This makes copper miners, infrastructure plays, and commodity-focused strategies suddenly look more interesting than another overvalued SaaS company promising "AI integration" in their Series B deck.

Precious Metals: When Safe Havens Outperform Growth Stocks

While copper tells the AI infrastructure story, precious metals told a different tale in 2025—one about currency debasement, geopolitical instability, and the limits of central bank credibility that nobody wants to say out loud.

The numbers are striking:

Gold surged 64% in 2025, topping $4,500 per ounce—its best performance since 1979 when it gained 114%

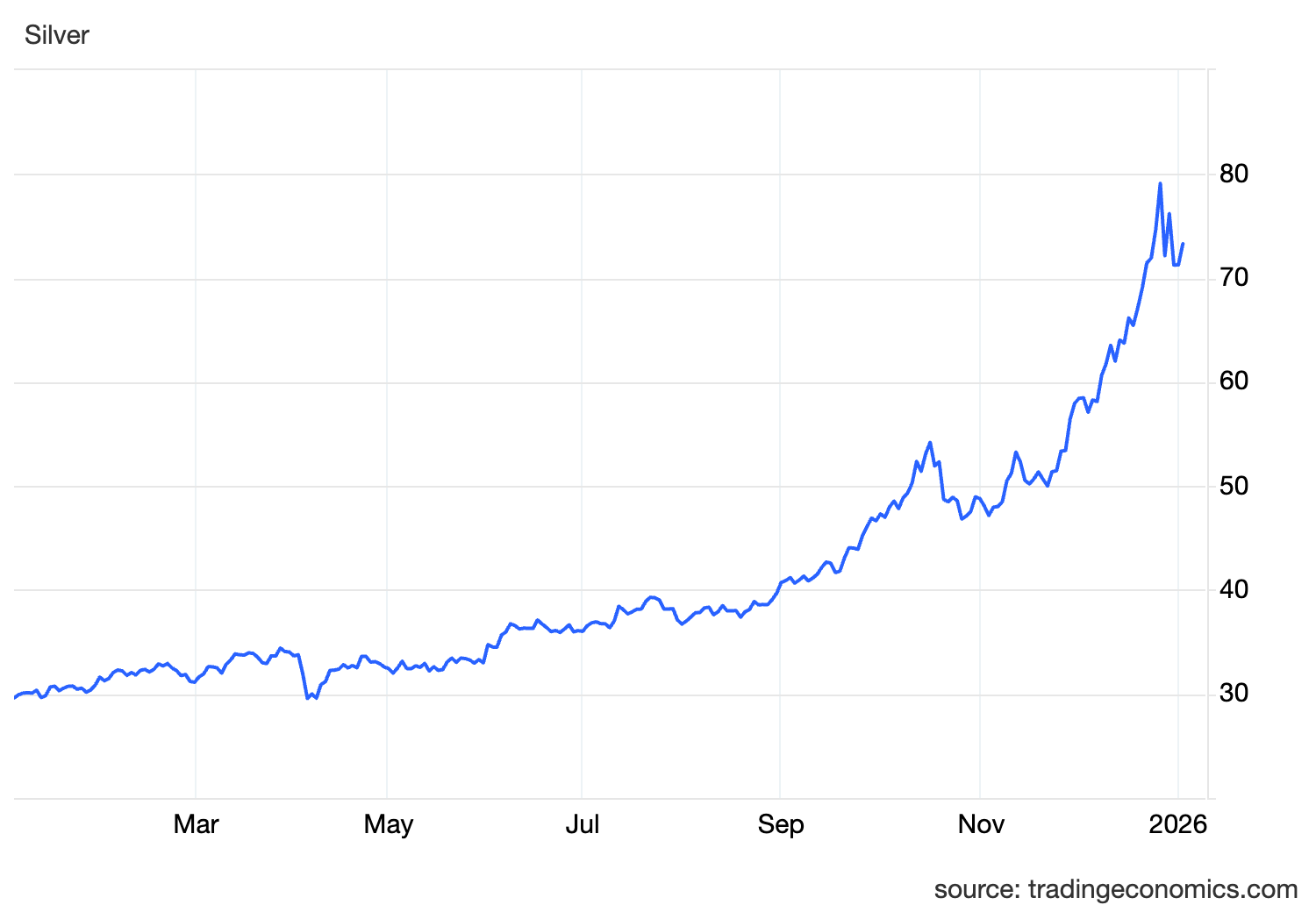

Silver more than doubled, hitting $80 per ounce before pulling back, up 140% for the year—also its best performance since 1979

Both metals outperformed the S&P 500 by significant margins while stocks were supposedly making the "everything rally" the only game in town

What's driving this? A toxic cocktail of factors: central bank buying sprees (especially from China and emerging markets), dollar weakness, geopolitical tensions from Ukraine to Venezuela, and industrial demand. Silver benefits from dual demand—it's both a monetary metal and a critical industrial input for solar panels, EVs, and electronics.

China's new export restrictions on silver, set to take effect in January 2026, added fuel to an already constrained supply situation. When Tesla CEO Elon Musk is warning about Chinese silver export controls, you know the supply chain is getting tight.

Here's what should concern you: precious metals rallied to record highs while stocks were also making records. That's not fear—that's institutional portfolio insurance against outcomes nobody wants to discuss publicly. When gold and silver hit all-time highs during a bull market in equities, it's not panic buying. It's smart money hedging against long-term monetary stability concerns.

What Actually Happened in 2025 (The Stuff That Matters)

Let's cut through the year-end cheerleading. Yes, all three major indices posted double-digit gains—S&P 500 up 16.4%, Nasdaq up 20%, Dow up 13%. The Magnificent Seven continued their dominance, with Alphabet leading the pack at +65%, Nvidia up 39%, and semiconductor stocks like Micron surging 230%.

But look at what else happened that the headlines glossed over:

International markets crushed U.S. performance—Hong Kong's Hang Seng surged 31%, Japan's Nikkei climbed 28%, and the globally-focused MSCI ACWI Ex-US index jumped 29%—the best performance since 2009

Industrial metals had their strongest year in over a decade, signaling real infrastructure capital deployment

Clean energy stocks rebounded with a 43% gain after years of underperformance

The dollar weakened significantly, making U.S. exports more competitive and foreign assets more attractive

The Fed cut rates three times in 2025, bringing the federal funds rate down to 3.5%-3.75%, but signaled a pause heading into 2026. Bond yields ended the year around 4.1% on the 10-year Treasury, roughly flat for the year. Inflation cooled but remained sticky, especially in services. The labor market stayed resilient, unemployment remained historically low, and the soft landing everyone prayed for actually materialized—at least so far.

What didn't change? Concentration risk. Valuation concerns. The reality that most of the market's gains came from a handful of mega-cap tech stocks. The difference in 2026? Alternatives are finally starting to work—commodities, international stocks, defensive sectors are all showing signs of life after years of underperformance.

Strategy Spotlight: Deep Tech Innovators

If 2025 taught us anything, it's that AI infrastructure is real, capital-intensive, and generating actual earnings—not just hype-driven valuations. The companies building the infrastructure for this transformation are seeing measurable growth. That's where Surmount's Deep Tech Innovators strategy comes in.

This isn't a "buy whatever mentions AI in the press release" momentum chase. The strategy focuses on a diversified portfolio of 30 companies across semiconductors, cloud computing, cybersecurity, and data infrastructure—the actual plumbing making AI work at scale. Monthly rebalancing based on financial strength, competitive positioning, and growth trajectory means you're not overexposed to whichever name CNBC is hyping this week.

The thesis is straightforward: AI demand is real and sustained, but it's the infrastructure layer—chips, data centers, networking equipment, security—that will see consistent capital deployment over the next decade. This provides exposure to the buildout without betting everything on a single manufacturer or hoping some Series C startup becomes the next trillion-dollar company.

This isn't about timing market tops or bottoms. It's about positioning in a secular trend with years of runway remaining, executed through a disciplined, diversified framework that manages concentration risk while capturing upside.

Looking Ahead: Build for the Next Cycle, Not the Last One

Here's the reality heading into 2026: the easy money from the past three years has been made. Three consecutive years of 20%+ returns don't extend indefinitely, and extreme concentration in mega-cap tech means downside volatility isn't a risk—it's inevitable. But that doesn't mean opportunities have dried up. They've shifted.

Copper and industrial metals are signaling massive real infrastructure spending ahead

Precious metals are signaling institutional hedging and monetary policy concerns

International markets are showing life after a decade-plus of U.S. dominance

Defensive sectors and alternative assets are starting to work again after years in the wilderness

The next cycle won't mirror the last one, and portfolios built exclusively around U.S. tech dominance are increasingly fragile. For HENRYs building long-term wealth, the playbook remains clear: maintain diversification across asset classes and geographies, lean into themes backed by real capital deployment (not just narrative momentum), and build strategies resilient enough to handle whatever market regime comes next.

The winners in 2026 won't be the ones chasing last year's returns. They'll be the ones who recognized when the cycle shifted and repositioned accordingly.

Happy New Year. Let's build something that lasts.

Until next week,

Analyzed Investing